Free Ny Tr 579 It Form

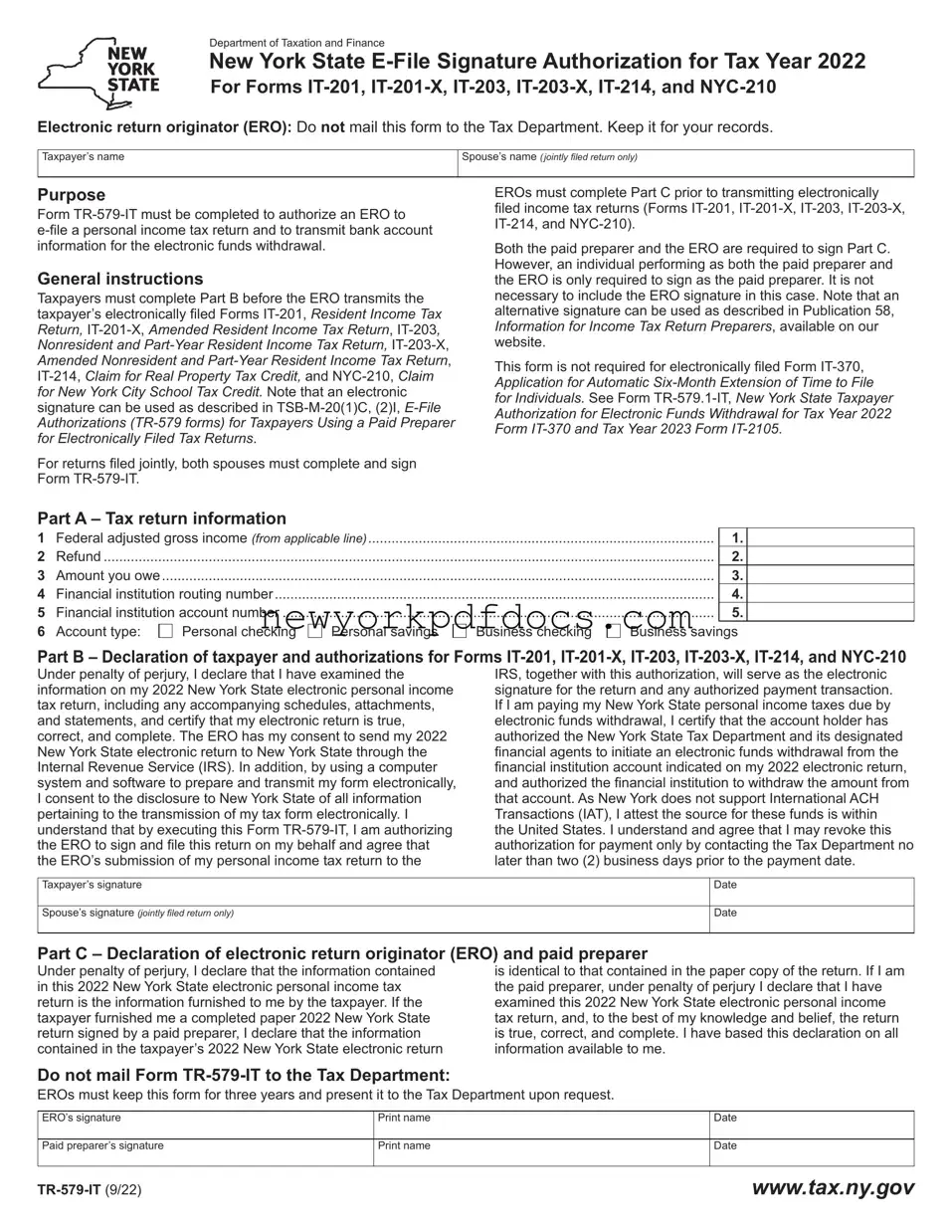

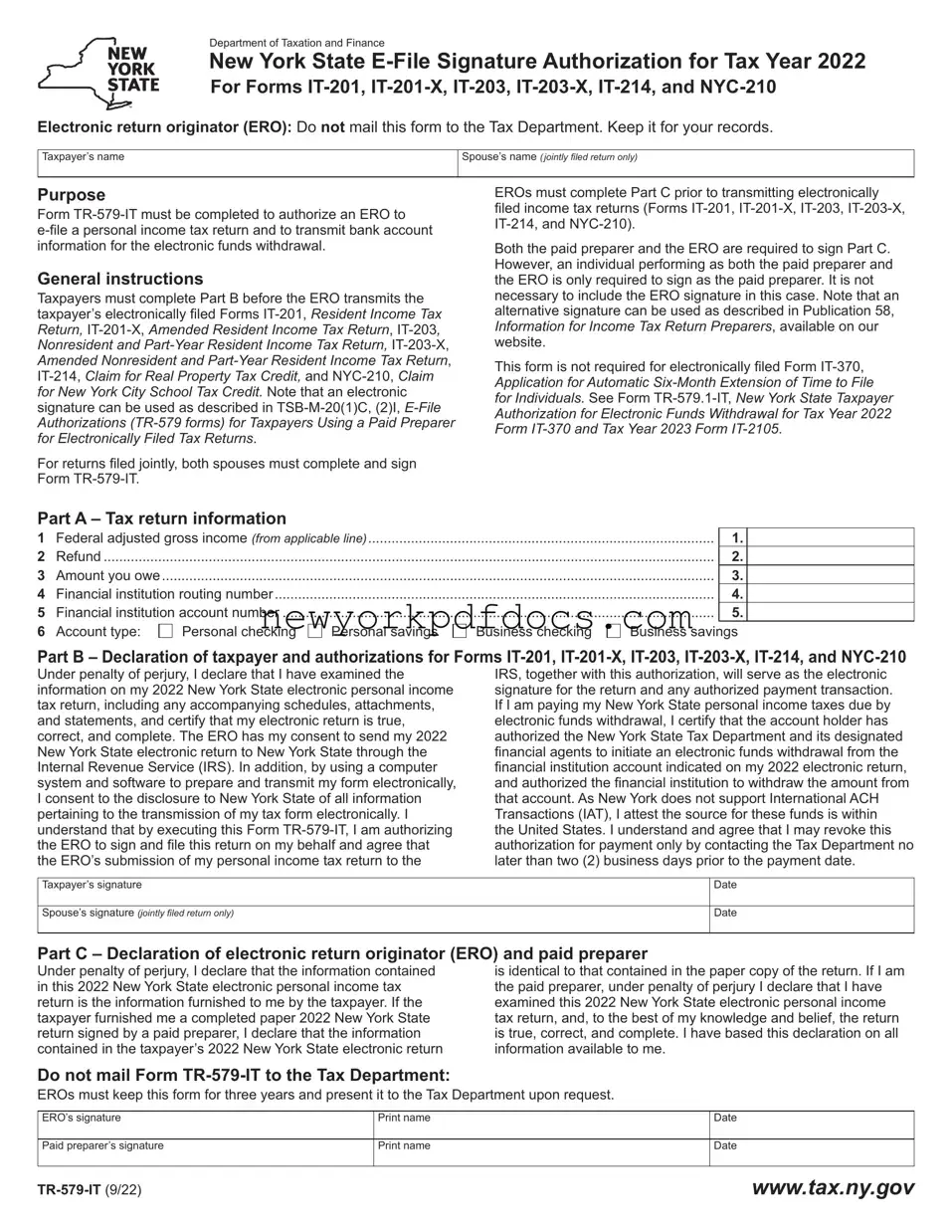

The NY TR-579-IT form is a crucial document used in New York State for electronic filing of personal income tax returns. This form authorizes an Electronic Return Originator (ERO) to e-file various tax forms on behalf of the taxpayer. It also facilitates the electronic funds withdrawal process for any taxes owed.

Open My Document Now

Free Ny Tr 579 It Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Ny Tr 579 It online with ease.

Open My Document Now

or

⇓ Ny Tr 579 It PDF