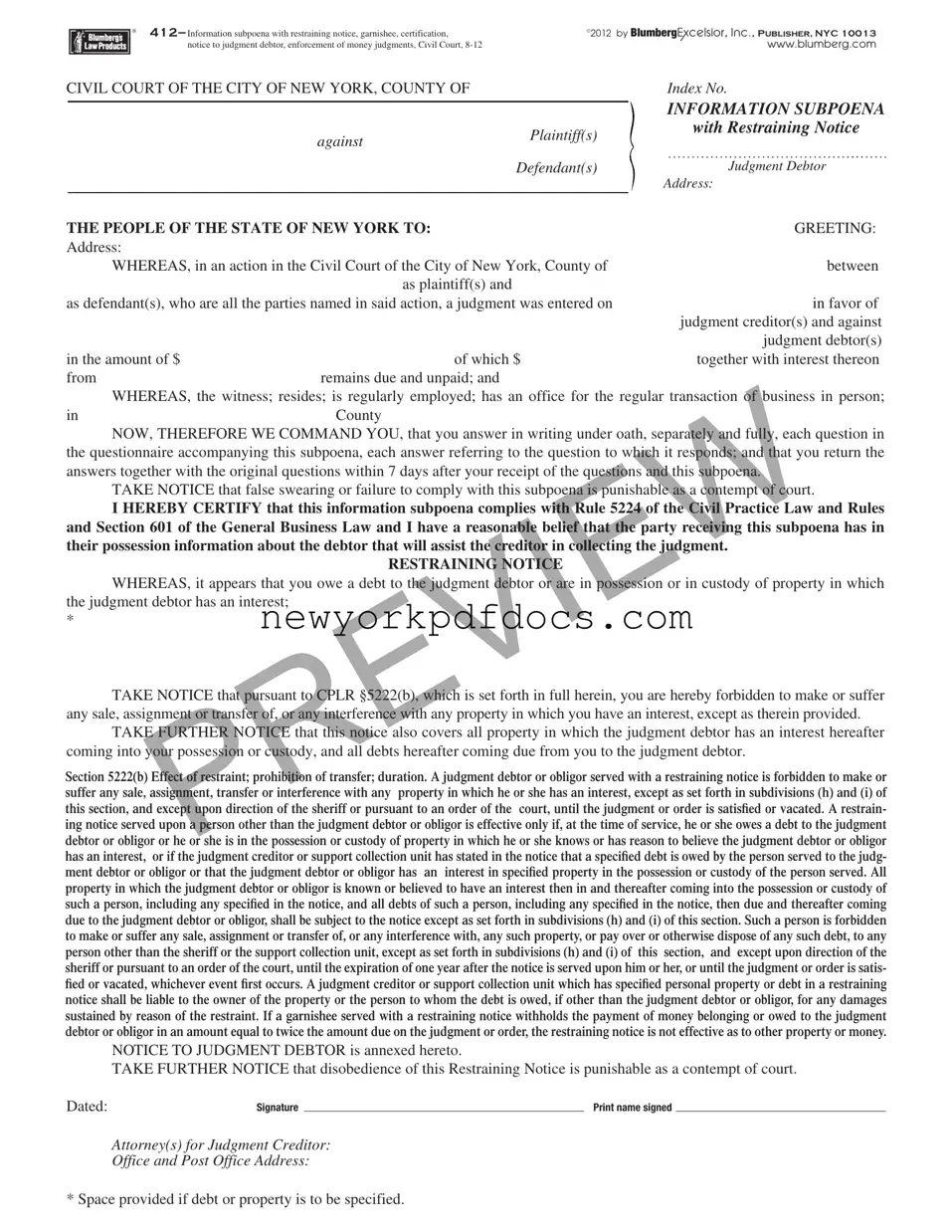

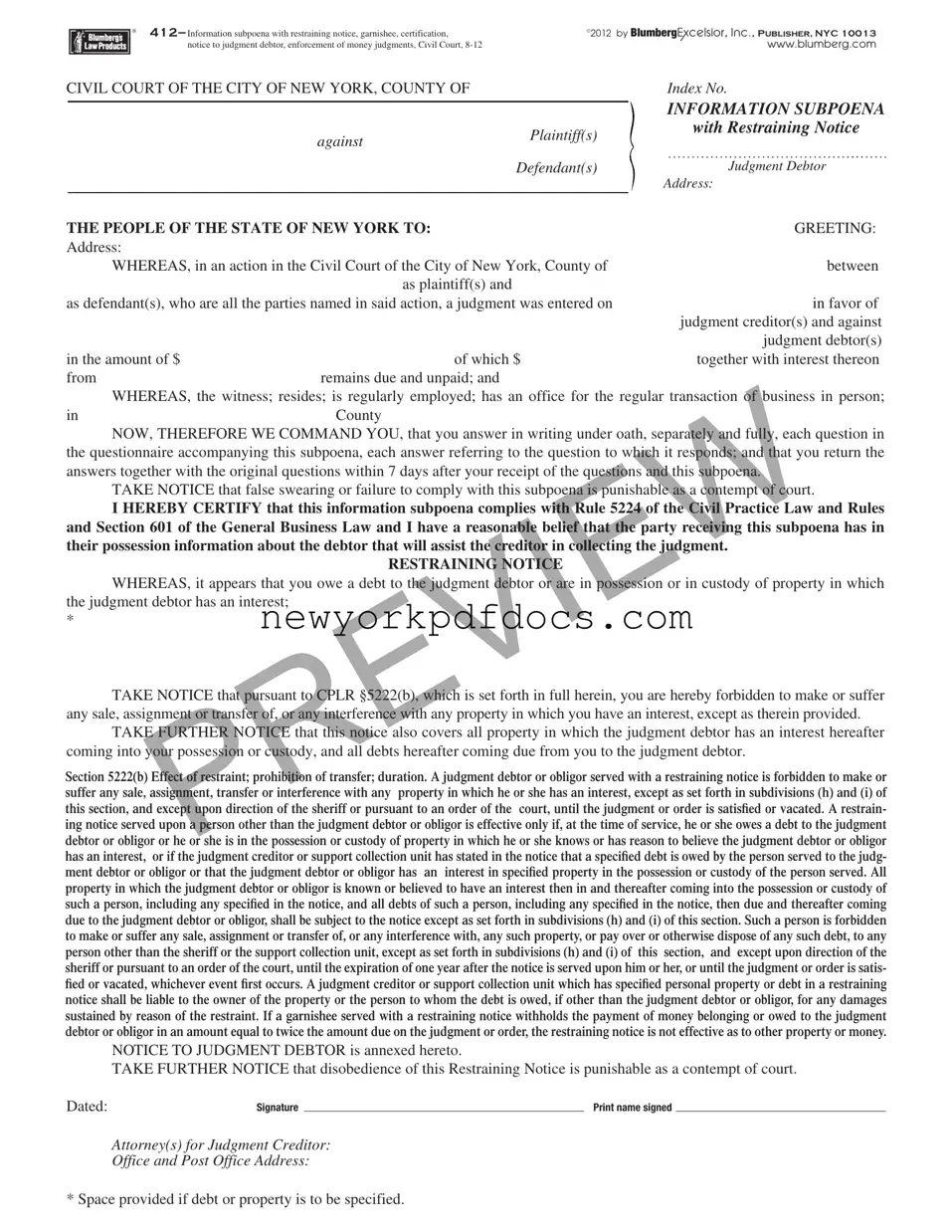

412– Information subpoena with restraining notice, garnishee, certification, |

©2012 by BlumbergExcelsior, Inc., PUBLISHER, NYC 10013 |

notice to judgment debtor, enforcement of money judgments, Civil Court, 8-12 |

|

www.blumberg.com |

CIVIL COURT OF THE CITY OF NEW YORK, COUNTY OF |

|

Index No. |

|

|

INFORMATION SUBPOENA |

|

|

against |

Plaintiff(s) |

with Restraining Notice |

|

|

|

|

Defendant(s) |

Judgment Debtor |

|

|

Address: |

|

|

|

THE PEOPLE OF THE STATE OF NEW YORK TO: |

GREETING: |

Address: |

|

|

WHEREAS, in an action in the Civil Court of the City of New York, County of |

between |

|

as plaintiff(s) and |

|

as defendant(s), who are all the parties named in said action, a judgment was entered on |

in favor of |

|

|

judgment creditor(s) and against |

|

|

judgment debtor(s) |

in the amount of $ |

of which $ |

together with interest thereon |

from |

remains due and unpaid; and |

|

WHEREAS, the witness; resides; is regularly employed; has an office for the regular transaction of business in person; |

in |

County |

|

NOW, THEREFORE WE COMMAND YOU, that you answer in writing under oath, separately and fully, each question in the questionnaire accompanying this subpoena, each answer referring to the question to which it responds; and that you return the answers together with the original questions within 7 days after your receipt of the questions and this subpoena.

TAKE NOTICE that false swearing or failure to comply with this subpoena is punishable as a contempt of court.

I HEREBY CERTIFY that this information subpoena complies with Rule 5224 of the Civil Practice Law and Rules and Section 601 of the General Business Law and I have a reasonable belief that the party receiving this subpoena has in their possession information about the debtor that will assist the creditor in collecting the judgment.

RESTRAINING NOTICE

WHEREAS, it appears that you owe a debt to the judgment debtor or are in possession or in custody of property in which the judgment debtor has an interest;

*

TAKE NOTICE that pursuant to CPLR §5222(b), which is set forth in full herein, you are hereby forbidden to make or suffer any sale, assignment or transfer of, or any interference with any property in which you have an interest, except as therein provided.

TAKE FURTHER NOTICE that this notice also covers all property in which the judgment debtor has an interest hereafter coming into your possession or custody, and all debts hereafter coming due from you to the judgment debtor.

Section 5222(b) Effect of restraint; prohibition of transfer; duration. A judgment debtor or obligor served with a restraining notice is forbidden to make or suffer any sale, assignment, transfer or interference with any property in which he or she has an interest, except as set forth in subdivisions (h) and (i) of this section, and except upon direction of the sheriff or pursuant to an order of the court, until the judgment or order is satisfied or vacated. A restrain- ing notice served upon a person other than the judgment debtor or obligor is effective only if, at the time of service, he or she owes a debt to the judgment debtor or obligor or he or she is in the possession or custody of property in which he or she knows or has reason to believe the judgment debtor or obligor has an interest, or if the judgment creditor or support collection unit has stated in the notice that a specified debt is owed by the person served to the judg- ment debtor or obligor or that the judgment debtor or obligor has an interest in specified property in the possession or custody of the person served. All property in which the judgment debtor or obligor is known or believed to have an interest then in and thereafter coming into the possession or custody of such a person, including any specified in the notice, and all debts of such a person, including any specified in the notice, then due and thereafter coming due to the judgment debtor or obligor, shall be subject to the notice except as set forth in subdivisions (h) and (i) of this section. Such a person is forbidden to make or suffer any sale, assignment or transfer of, or any interference with, any such property, or pay over or otherwise dispose of any such debt, to any person other than the sheriff or the support collection unit, except as set forth in subdivisions (h) and (i) of this section, and except upon direction of the sheriff or pursuant to an order of the court, until the expiration of one year after the notice is served upon him or her, or until the judgment or order is satis- fied or vacated, whichever event first occurs. A judgment creditor or support collection unit which has specified personal property or debt in a restraining notice shall be liable to the owner of the property or the person to whom the debt is owed, if other than the judgment debtor or obligor, for any damages sustained by reason of the restraint. If a garnishee served with a restraining notice withholds the payment of money belonging or owed to the judgment debtor or obligor in an amount equal to twice the amount due on the judgment or order, the restraining notice is not effective as to other property or money.

NOTICE TO JUDGMENT DEBTOR is annexed hereto.

TAKE FURTHER NOTICE that disobedience of this Restraining Notice is punishable as a contempt of court.

Dated: |

Signature |

|

Print name signed |

Attorney(s) for Judgment Creditor:

Office and Post Office Address:

* Space provided if debt or property is to be specified.

412—P. 2 Notice to judgment debtors, CPLR 5222; 1-09 |

©2009 BY BlumbergExcelsior, Inc., PUBLISHER, NYC 10013 |

|

www.blumberg.com |

NOTICE TO JUDGMENT DEBTOR OR OBLIGOR

Money or property belonging to you may have been taken or held in order to satisfy a judgment or order which has been entered against you. Read this carefully.

YOU MAY BE ABLE TO GET YOUR MONEY BACK

State and federal laws prevent certain money or property from being taken to satisfy judgments or orders. Such money or property is said to be “exempt”. The following is a partial list of money which may be exempt:

1.Supplemental security income (SSI);

2.Social security;

3.Public assistance (welfare);

4.Spousal support, maintenance (alimony) or child support;

5.Unemployment benefits;

6.Disability benefits;

7.Workers’ compensation benefits;

8.Public or private pensions;

9.Veterans benefits;

10.Ninety percent of your wages or salary earned in the last sixty days;

11.Twenty-five hundred dollars of any bank account containing statutorily exempt payments that were deposited electronically or by direct deposit within the last forty-five days, including, but not limited to, your social security, supplemental security income, veterans benefits, public assistance, workers’ compensation, unemployment insurance, public or private pensions, railroad retirement benefits, black lung benefits, or child support payments;

12.Railroad retirement; and

13.Black lung benefits.

If you think that any of your money that has been taken or held is exempt, you must act promptly because the money may be applied to the judgment or order. If you claim that any of your money that has been taken or held is exempt, you may contact the person sending this notice.

Also, YOU MAY CONSULT AN ATTORNEY, INCLUDING ANY FREE/LEGAL SERVICES ORGANIZATION IF YOU QUALIFY. You can also go to court without an attorney to get your money back. Bring this notice with you when you go. You are allowed to try to prove to a judge that your money is exempt from collection under New York CPLRsections 5222(a), 5239 and 5240. If you do not have a lawyer, the clerk of the court may give you forms to help you prove your account contains exempt money that the creditor cannot collect. The law (New York CPLR Art. 4 and sections 5239 and 5240) provides a procedure for determination of a claim to an exemption.

STATE OF NEW YORK, COUNTY OF |

ss.: |

The undersigned, being duly sworn, deposes and says; deponent |

is not a party herein, is over 18 years of age and resides at |

|

|

That on |

at |

M., at |

|

deponent served the within subponea on |

|

|

(judgment debtor) (witness) therein named. |

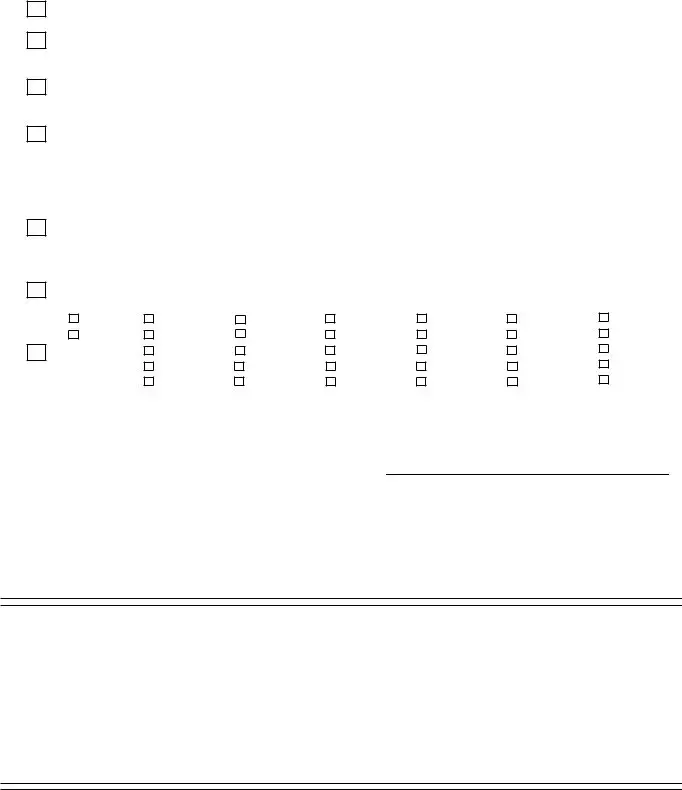

INDIVIDUAL

1.

CORPORATION

2.

SUITABLE AGE PERSON

3.

AFFIXING TO DOOR, ETC.

4.

MAILING TO

RESIDENCE

USE WITH 3 OR 4

5A.

MAILING TO

BUSINESS

USE WITH 3 OR 4

5B.

DESCRIPTION

USE WITH

1,2,OR 3

by delivering a true copy to said person personally; deponent knew the person so served to be the (judgment debtor) (witness) therein.

acorporation, by delivering thereat a true copy to

personally, deponent knew said corporation so served to be the corporation described in said subponea as said (judgment debtor) (witness) and knew

said individual to be |

thereof. |

|

|

by delivering thereat a true copy to |

|

a person of suitable |

age and discretion. Said premises is (judgment debtor's) (witness')---actual place of business |

---dwelling place---usual place of abode--- |

within the state. |

by affixing a true copy to the door of said premises, which is (judgment debtor's) (witness')--- |

actual place of business---dwelling place--- |

usual place of |

abode---within the state. Deponent was unable, with due diligence to find (judgment debtor) (witness) or a person of suitable age and discretion thereat, having called there S

Within 20 days of such delivery or affixing, deponent enclosed a copy of same in a postpaid envelope properly addressed to (judgment debtor) (witness) at (judgment debtor's) (witness') last known residence, and deposited said envelope in an official depository under the exclusive care and custody of the U.S. Postal Service within New York State.

Within 20 days of such delivery or affixing, deponent enclosed a copy of same in a first class postpaid envelope properly addressed to (judgment debtor) (witness) at (judgment debtor's) (witness') actual place of business, at

in an official depository under the exclusive care and custody of the U.S. Postal Service within New York State. The envelope bore the legend "Personal and Confidential" and did not indicate on the outside thereof, by return address or otherwise, that the communication was from an attorney or concerned an action against the (judgment debtor) (witness).

Male |

White Skin |

Black Hair |

White Hair |

14-20 Yrs. |

Under 5' |

Under 100 Lbs. |

Female |

Black Skin |

Brown Hair |

Balding |

21-35 Yrs. |

5'0"-5'3" |

100-130 Lbs. |

|

Yellow Skin |

Blonde Hair |

Mustache |

36-50 Yrs. |

5'4"-5'8" |

131-160 Lbs. |

|

Brown Skin |

Gray Hair |

Beard |

51-65 Yrs. |

5'9"-6'0" |

161-200 Lbs. |

|

Red Skin |

Red Hair |

Glasses |

Over 65 Yrs. |

Over 6' |

Over 200 Lbs. |

Other identifying features:

That the copy so delivered was accompanied by a copy and original questions, and a prepaid, addressed return envelope, and that at the same time the authorized fee of 50 cents was paid (or tendered) to said witness.

Sworn to before me on

Print name beneath signature

LICENSE NO.:__________________________

Index No. |

Civil Court of the City of New York |

COUNTY OF |

|

|

|

|

|

|

Information Subpoena

LAW OFFICES OF

Plaintiff

against

Attorney(s) for

Office and Post Office Address