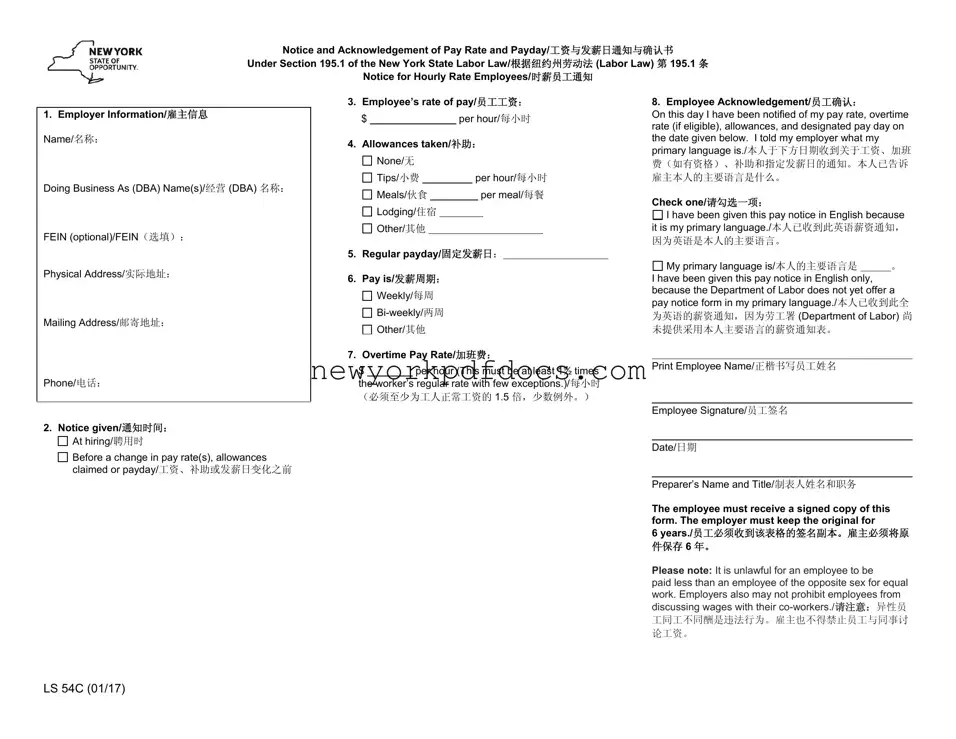

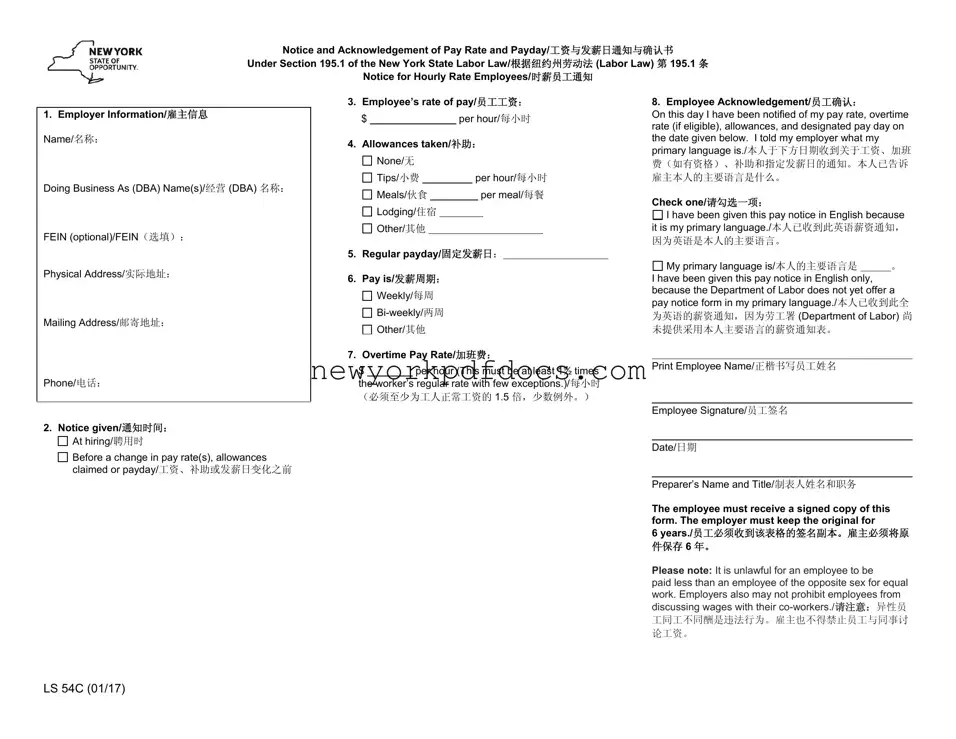

Free Ny Notice And Acknowledgement Of Pay Rate Form

The NY Notice and Acknowledgement of Pay Rate form is a crucial document that employers in New York must provide to their employees. This form outlines essential information regarding pay rates, overtime, allowances, and paydays, ensuring transparency in the employer-employee relationship. Understanding this form is vital for both employees and employers to comply with New York State Labor Law and to foster a fair workplace environment.

Open My Document Now

Free Ny Notice And Acknowledgement Of Pay Rate Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Ny Notice And Acknowledgement Of Pay Rate online with ease.

Open My Document Now

or

⇓ Ny Notice And Acknowledgement Of Pay Rate PDF

At hiring/聘用时

At hiring/聘用时

Before a change in pay rate(s), allowances claimed or payday/工资、补助或发薪日变化之前

Before a change in pay rate(s), allowances claimed or payday/工资、补助或发薪日变化之前

I have been given this pay notice in English because it is my primary language./本人已收到此英语薪资通知, 因为英语是本人的主要语言。

I have been given this pay notice in English because it is my primary language./本人已收到此英语薪资通知, 因为英语是本人的主要语言。

My primary language is/本人的主要语言是 。

My primary language is/本人的主要语言是 。