|

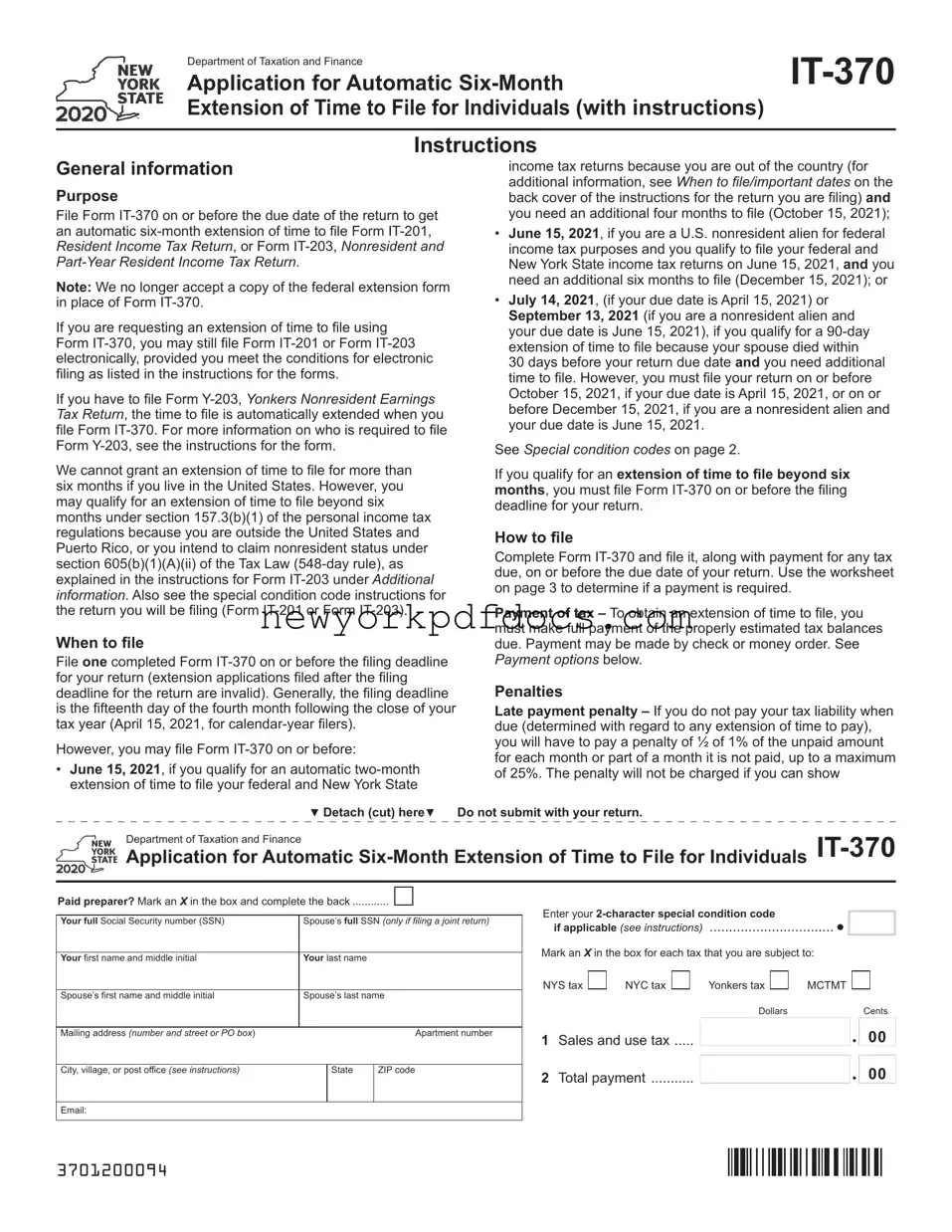

Department of Taxation and Finance |

|

IT-370 |

|

Application for Automatic Six-Month |

|

Extension of Time to File for Individuals (with instructions) |

|

|

|

|

|

Instructions |

|

|

General information |

income tax returns because you are out of the country (for |

|

Purpose |

additional information, see When to file/important dates on the |

|

back cover of the instructions for the return you are filing) and |

|

File Form IT-370 on or before the due date of the return to get |

you need an additional four months to file (October 15, 2021); |

|

an automatic six-month extension of time to file Form IT‑201, |

• June 15, 2021, if you are a U.S. nonresident alien for federal |

|

Resident Income Tax Return, or Form IT-203, Nonresident and |

income tax purposes and you qualify to file your federal and |

|

Part-Year Resident Income Tax Return. |

New York State income tax returns on June 15, 2021, and you |

|

Note: We no longer accept a copy of the federal extension form |

need an additional six months to file (December 15, 2021); or |

|

• July 14, 2021, (if your due date is April 15, 2021) or |

|

in place of Form IT-370. |

|

If you are requesting an extension of time to file using |

September 13, 2021 (if you are a nonresident alien and |

|

your due date is June 15, 2021), if you qualify for a 90-day |

|

Form IT-370, you may still file Form IT-201 or Form IT-203 |

extension of time to file because your spouse died within |

|

electronically, provided you meet the conditions for electronic |

30 days before your return due date and you need additional |

|

filing as listed in the instructions for the forms. |

time to file. However, you must file your return on or before |

|

If you have to file Form Y-203, Yonkers Nonresident Earnings |

October 15, 2021, if your due date is April 15, 2021, or on or |

|

before December 15, 2021, if you are a nonresident alien and |

|

Tax Return, the time to file is automatically extended when you |

|

your due date is June 15, 2021. |

|

|

file Form IT-370. For more information on who is required to file |

|

|

Form Y-203, see the instructions for the form. |

See Special condition codes on page 2. |

|

|

We cannot grant an extension of time to file for more than |

If you qualify for an extension of time to file beyond six |

|

six months if you live in the United States. However, you |

months, you must file Form IT-370 on or before the filing |

|

may qualify for an extension of time to file beyond six |

deadline for your return. |

|

|

months under section 157.3(b)(1) of the personal income tax |

How to file |

|

|

regulations because you are outside the United States and |

|

|

Puerto Rico, or you intend to claim nonresident status under |

Complete Form IT-370 and file it, along with payment for any tax |

|

section 605(b)(1)(A)(ii) of the Tax Law (548-day rule), as |

|

due, on or before the due date of your return. Use the worksheet |

|

explained in the instructions for Form IT-203 under Additional |

|

on page 3 to determine if a payment is required. |

|

information. Also see the special condition code instructions for |

|

|

|

|

the return you will be filing (Form IT-201 or Form IT-203). |

Payment of tax – To obtain an extension of time to file, you |

|

When to file |

must make full payment of the properly estimated tax balances |

|

due. Payment may be made by check or money order. See |

|

File one completed Form IT-370 on or before the filing deadline |

Payment options below. |

|

|

for your return (extension applications filed after the filing |

Penalties |

|

|

deadline for the return are invalid). Generally, the filing deadline |

|

|

is the fifteenth day of the fourth month following the close of your |

Late payment penalty – If you do not pay your tax liability when |

|

tax year (April 15, 2021, for calendar-year filers). |

due (determined with regard to any extension of time to pay), |

|

However, you may file Form IT-370 on or before: |

you will have to pay a penalty of ½ of 1% of the unpaid amount |

|

for each month or part of a month it is not paid, up to a maximum |

|

• June 15, 2021, if you qualify for an automatic two-month |

|

of 25%. The penalty will not be charged if you can show |

|

extension of time to file your federal and New York State |

|

|

|

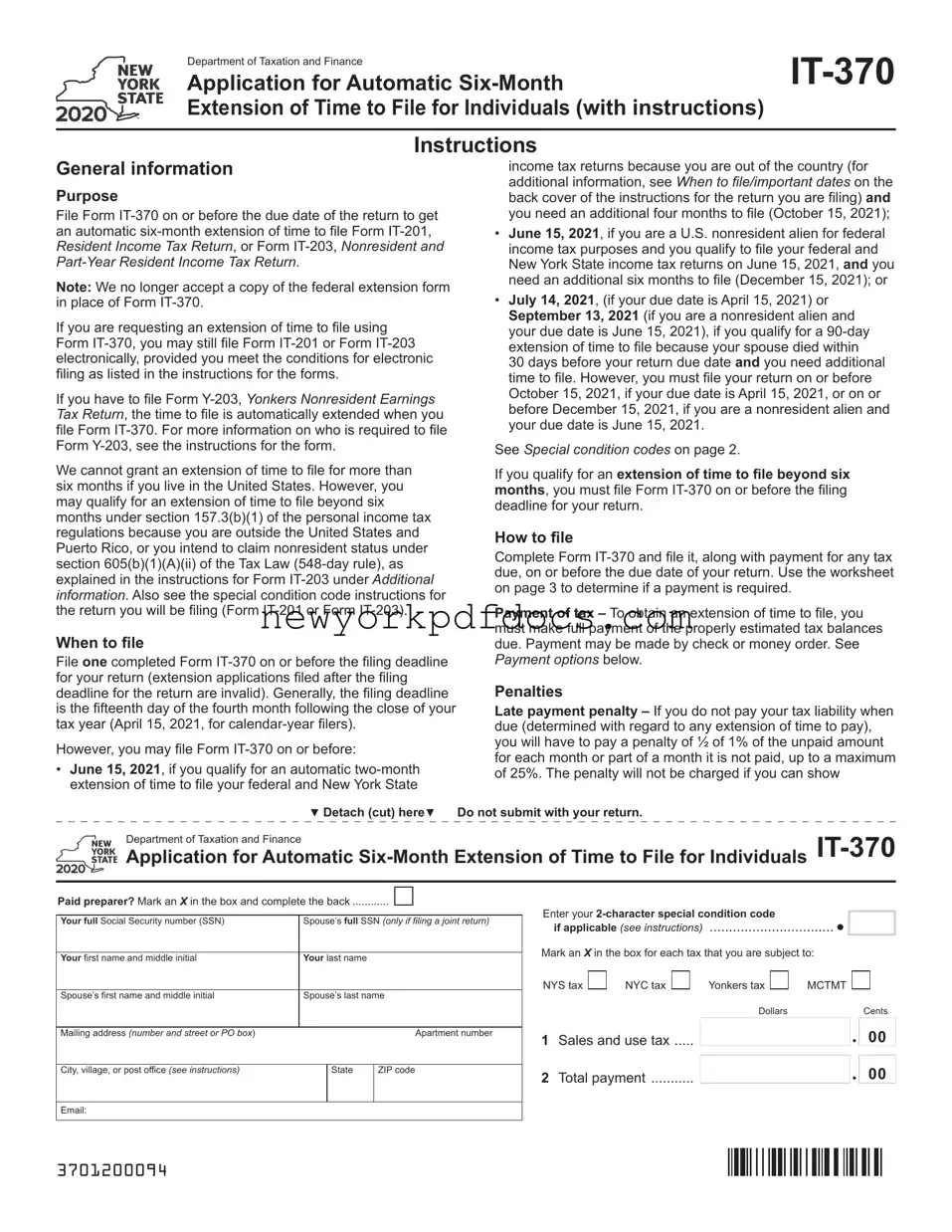

▼ Detach (cut) here▼ |

Do not submit with your return. |

|