Filling out the New York IT-203 form can be a complex process, and mistakes can lead to delays or issues with tax returns. Here are nine common errors that individuals often make when completing this form.

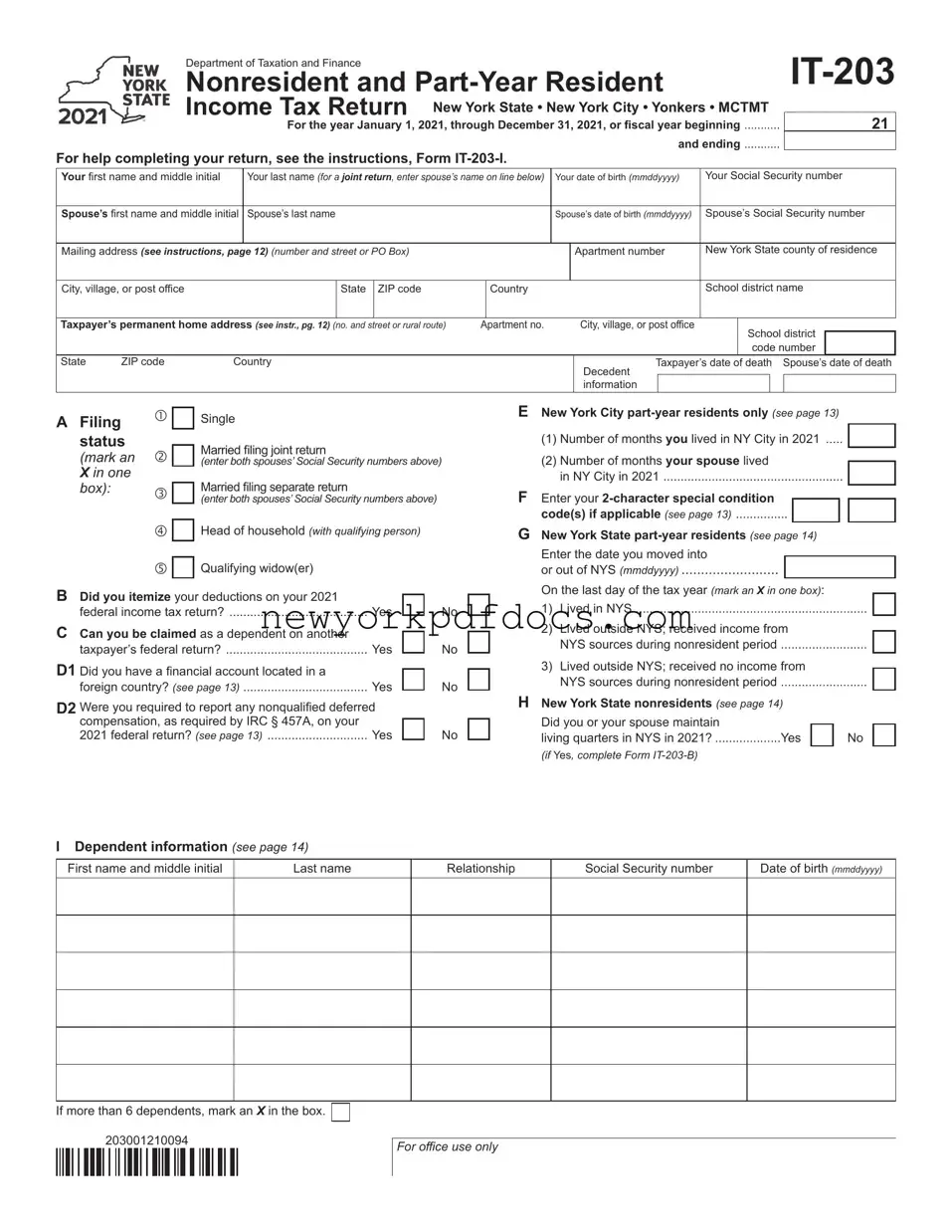

One frequent mistake is failing to include all required personal information. This includes not only the taxpayer's name and Social Security number but also the spouse's details in the case of a joint return. Omitting any of this information can result in processing delays.

Another common error involves the selection of filing status. Taxpayers sometimes choose the wrong category, such as marking “Single” when they should have selected “Married Filing Jointly.” This misclassification can significantly impact the tax calculation and credits available.

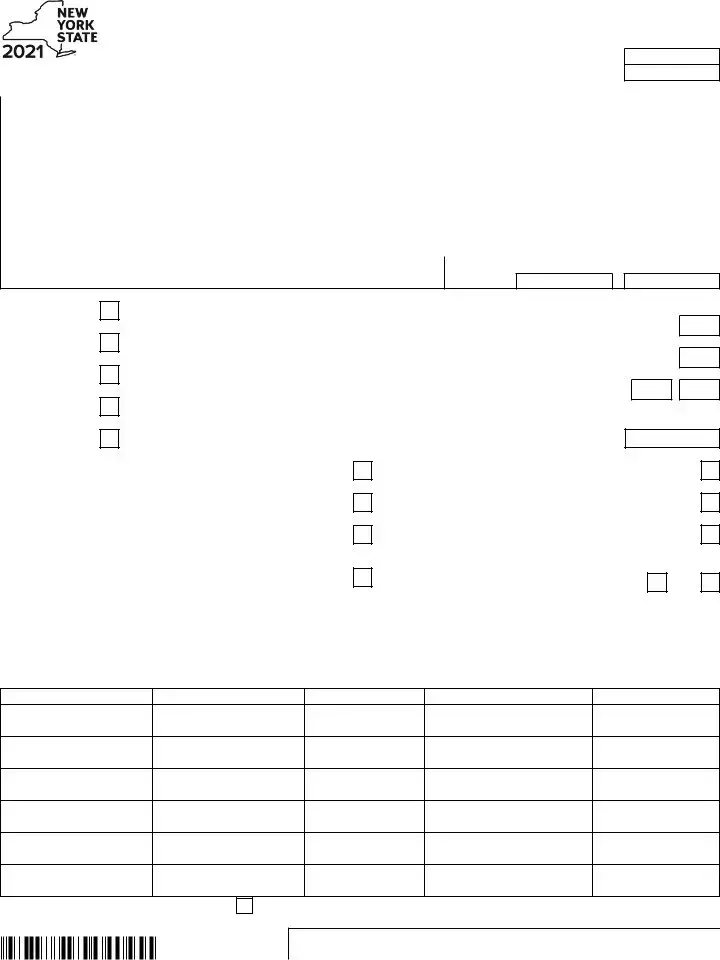

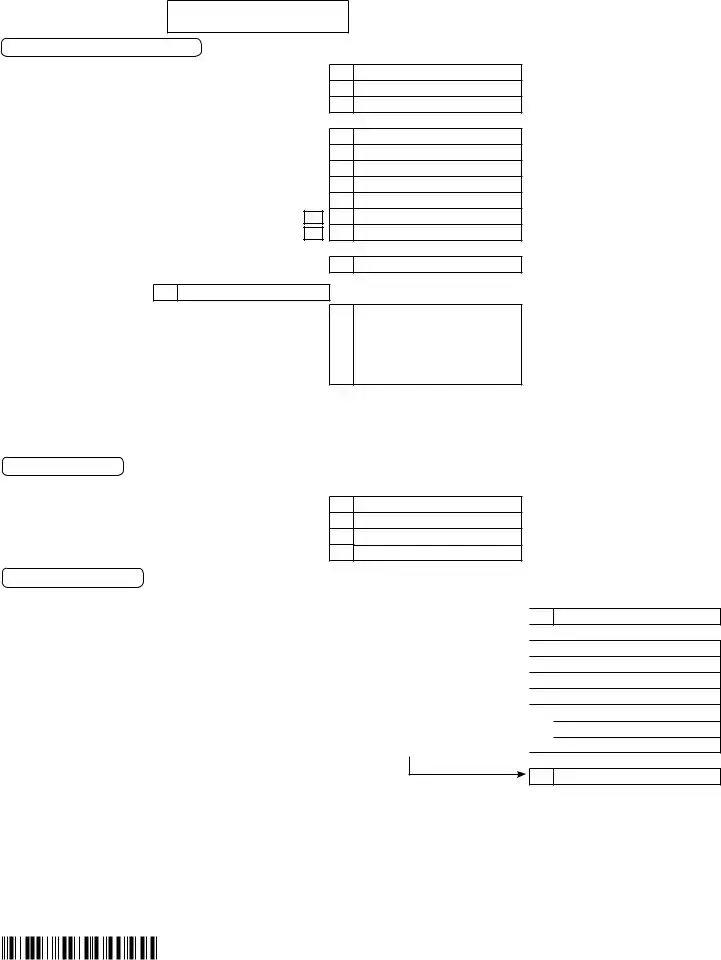

Inaccurate reporting of income is also a prevalent issue. Taxpayers may forget to include all sources of income or misreport amounts. For example, failing to report taxable interest or business income can lead to penalties and interest on unpaid taxes.

Additionally, many individuals overlook the importance of checking the residency status. Part-year residents must accurately report the number of months lived in New York City. Inaccuracies here can lead to incorrect tax calculations.

Taxpayers often neglect to sign the form. A missing signature can result in the return being considered incomplete. It is essential to ensure that both the taxpayer and spouse sign, if applicable.

Another mistake is failing to claim all eligible deductions and credits. For instance, not taking advantage of the standard deduction or itemized deductions can lead to a higher tax liability than necessary. Taxpayers should review all available options to maximize their deductions.

Many individuals also forget to include their dependents correctly. This includes not only listing their names but also ensuring that the relationship and Social Security numbers are accurate. Errors in this section can affect eligibility for certain credits.

Another common error is not keeping copies of submitted documents. While it may seem trivial, having a record of what was submitted can be invaluable in case of future inquiries or audits by the tax authorities.

Finally, failing to review the instructions thoroughly can lead to various mistakes. Each year, tax laws may change, and new instructions are issued. Taxpayers should take the time to read through the guidelines provided with the form to ensure compliance.

No

No