|

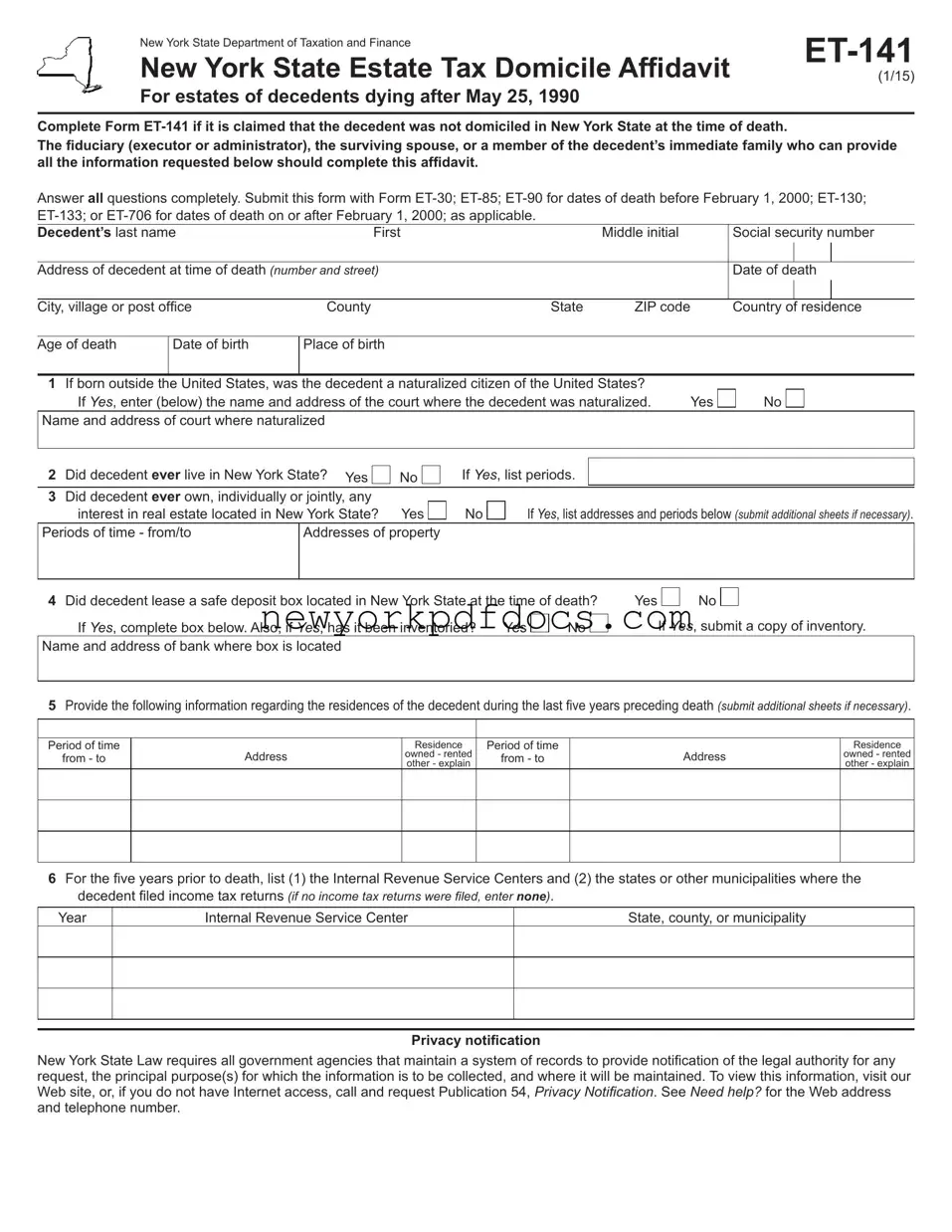

New York State Department of Taxation and Finance |

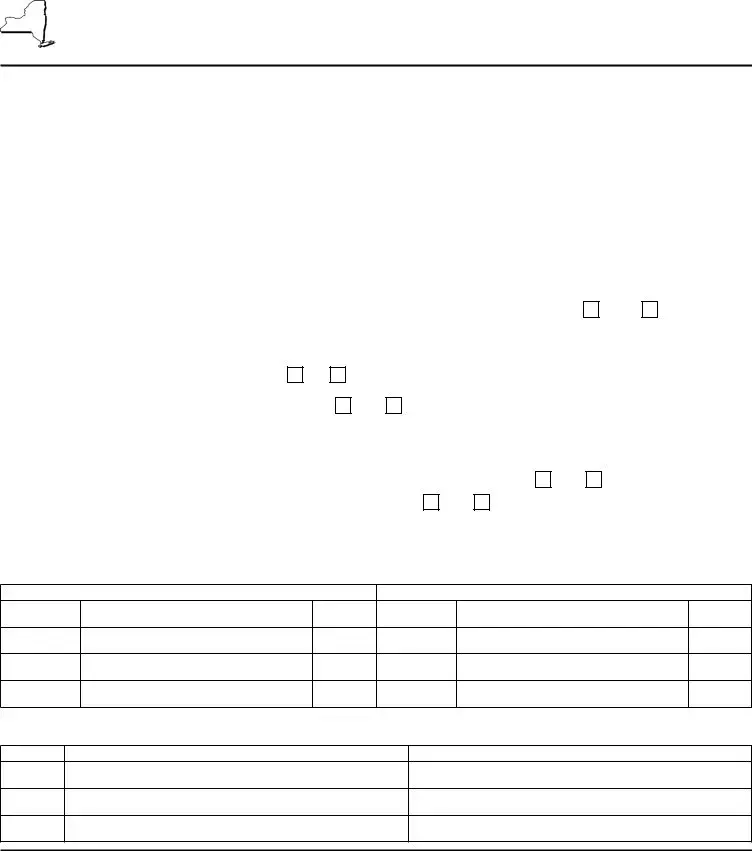

ET-141 |

|

New York State Estate Tax Domicile Afidavit |

|

(1/15) |

For estates of decedents dying after May 25, 1990

Complete Form ET-141 if it is claimed that the decedent was not domiciled in New York State at the time of death.

The iduciary (executor or administrator), the surviving spouse, or a member of the decedent’s immediate family who can provide all the information requested below should complete this afidavit.

Answer all questions completely. Submit this form with Form ET-30; ET-85; ET-90 for dates of death before February 1, 2000; ET-130; ET-133; or ET-706 for dates of death on or after February 1, 2000; as applicable.

Decedent’s last name |

First |

|

|

|

|

Middle initial |

|

Social security number |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Address of decedent at time of death (number and street) |

|

|

|

|

|

|

|

Date of death |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

City, village or post ofice |

County |

|

|

|

State |

ZIP code |

|

Country of residence |

|

|

|

|

|

|

|

|

|

|

|

|

|

Age of death |

Date of birth |

Place of birth |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 |

If born outside the United States, was the decedent a naturalized citizen of the United States? |

|

|

|

|

|

If Yes, enter (below) the name and address of the court where the decedent was naturalized. |

Yes |

No |

Name and address of court where naturalized |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Did decedent ever live in New York State? Yes |

|

|

|

|

|

|

|

|

2 |

No |

If Yes, list periods. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3 |

Did decedent ever own, individually or jointly, any |

|

|

|

If Yes, list addresses and periods below (submit additional sheets if necessary). |

|

interest in real estate located in New York State? |

Yes |

No |

|

Periods of time - from/to |

Addresses of property |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

4 |

Did decedent lease a safe deposit box located in New York State at the time of death? |

Yes |

No |

|

|

|

|

If Yes, complete box below. Also, if Yes, has it been inventoried? |

Yes |

No |

If Yes, submit a copy of inventory. |

Name and address of bank where box is located |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

5Provide the following information regarding the residences of the decedent during the last ive years preceding death (submit additional sheets if necessary).

Residence

owned - rented other - explain

Residence

owned - rented other - explain

6For the ive years prior to death, list (1) the Internal Revenue Service Centers and (2) the states or other municipalities where the decedent iled income tax returns (if no income tax returns were iled, enter NONE).

Internal Revenue Service Center

State, county, or municipality

Privacy notiication

New York State Law requires all government agencies that maintain a system of records to provide notiication of the legal authority for any

request, the principal purpose(s) for which the information is to be collected, and where it will be maintained. To view this information, visit our Web site, or, if you do not have Internet access, call and request Publication 54, Privacy Notiication. See Need help? for the Web address

and telephone number.

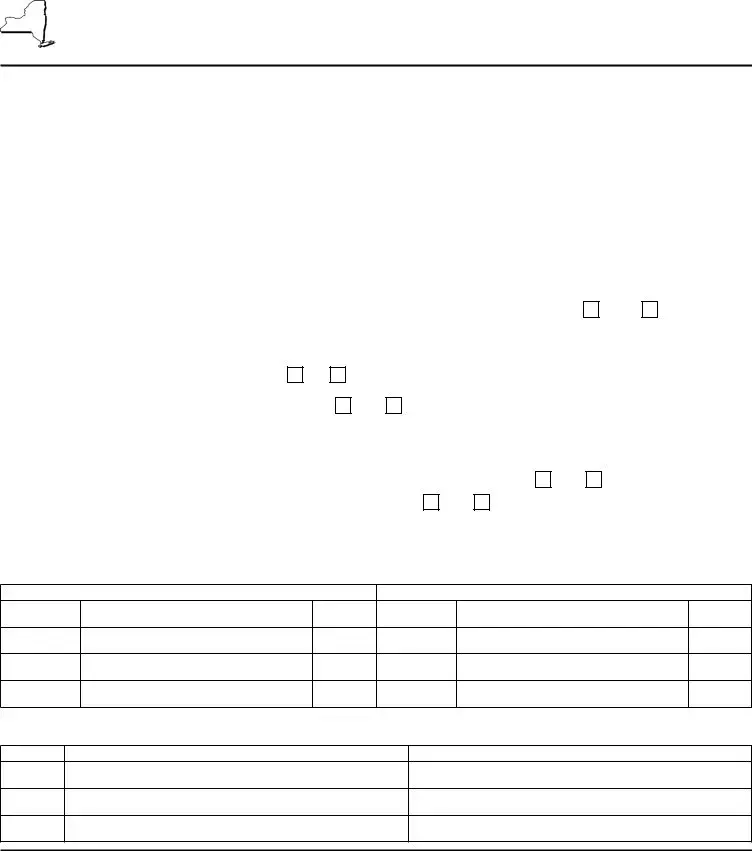

ET-141 (1/15) (back)

7List the states where the decedent was registered to vote during the last ive years preceding death (list latest year irst).

Years |

|

State |

|

|

|

|

From |

|

To |

|

|

|

|

|

|

|

Date of Death |

|

|

|

|

|

|

|

|

|

|

|

|

|

If decedent did not vote in those ive years, when did he or she last vote? |

|

Where? |

|

|

|

8List employment or business activities (if any) engaged in by the decedent during the ive years preceding the date of death.

|

|

|

In New York State |

|

|

|

|

|

Outside New York State |

|

Period of time |

|

Nature of employment or business activities |

Period of time |

|

Nature of employment or business activities |

|

from - to |

|

from - to |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

9 |

Was decedent a party to any legal proceedings in New York State during the last ive years? |

Yes |

No |

If Yes, list courts, dates, |

and types of action. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10 |

Did decedent have a license to operate a business, profession, motor vehicle, airplane, or boat? |

Yes |

No |

If Yes, list below. |

|

License number |

|

Type of license |

Date of issuance |

|

|

|

Name and location of issuing ofice |

|

|

|

|

|

|

|

|

|

11 |

Did decedent execute any trust indentures, deeds, mortgages, or any other documents |

|

|

|

|

|

describing his or her residence during the last ive years preceding death? |

|

|

|

Yes |

No |

If Yes, submit a copy. |

12 |

Was the decedent a member of any church, club, or organization? |

Yes |

No |

|

|

|

|

If Yes, give name, address, and other details. (Submit additional sheets if necessary.)

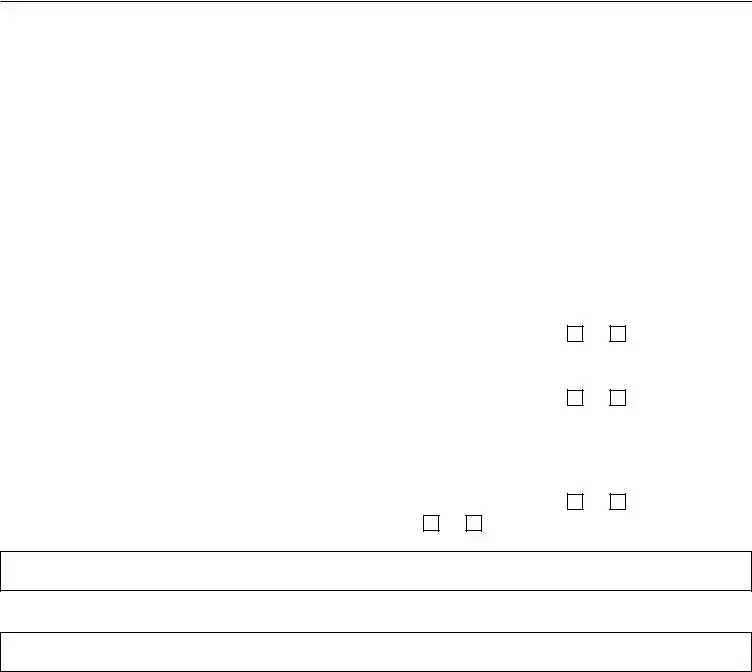

13What other information do you wish to submit in support of the contention that the decedent was not domiciled in New York State at the time of death? (Submit additional sheets if necessary.)

Applicant’s last name |

First name |

Middle initial |

Relationship to decedent |

|

|

|

|

Address (number and street) |

|

|

Connection with estate |

|

|

|

|

City, village, or post ofice |

State |

ZIP code |

Country of residence |

|

|

|

|

The undersigned states that this afidavit is made to induce the Commissioner of the Department of Taxation and Finance of the State of New York to determine

domicile, and that the answers herein contained to the foregoing questions are each and every one of them true in every particular.

|

|

|

|

|

|

|

Signature of Notary Public, Commissioner of Deeds or Authorized New York State |

Signature of applicant |

|

|

|

|

|

Department of Taxation and Finance employee (no seal required) |

Sworn before me this |

|

|

day of |

|

20 |

|

|

|

|

|

|

|

|

|

|

Signature |