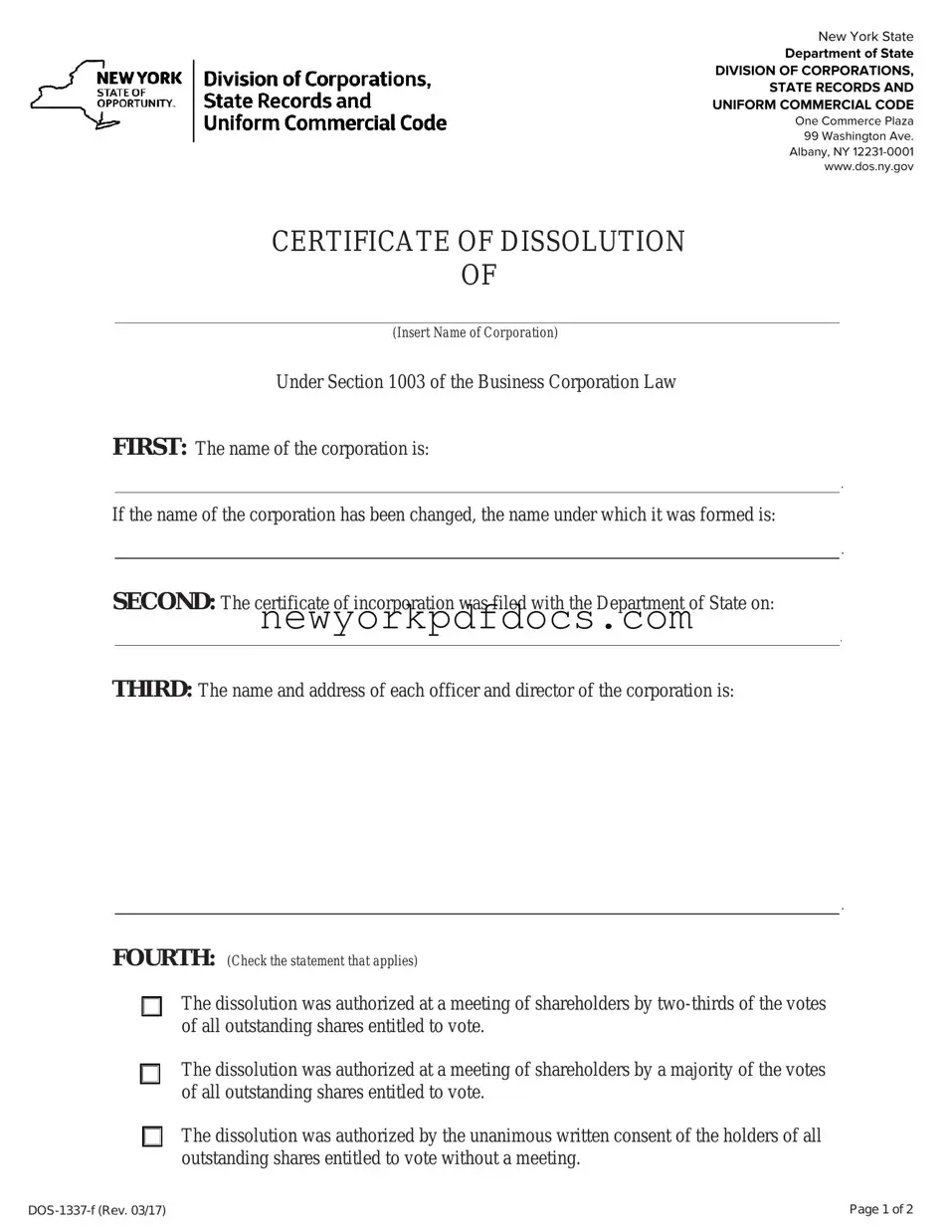

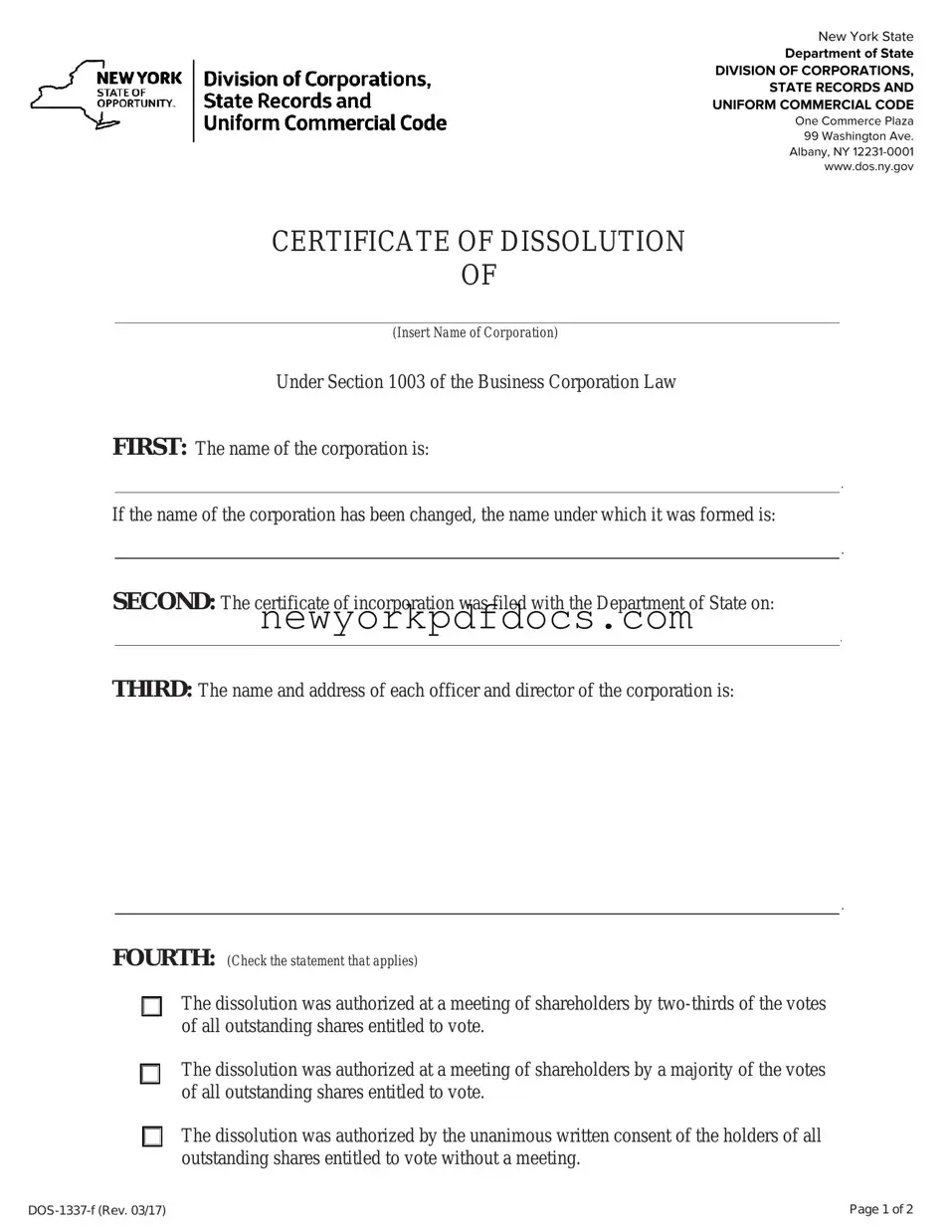

Free Ny Dissolution Certificate Form

The New York Dissolution Certificate form is a legal document that officially terminates a corporation's existence in the state of New York. This form is essential for corporations seeking to dissolve their business operations and must be filed with the New York State Department of State. Proper completion and submission of this certificate ensure compliance with the state's Business Corporation Law.

Open My Document Now

Free Ny Dissolution Certificate Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Ny Dissolution Certificate online with ease.

Open My Document Now

or

⇓ Ny Dissolution Certificate PDF