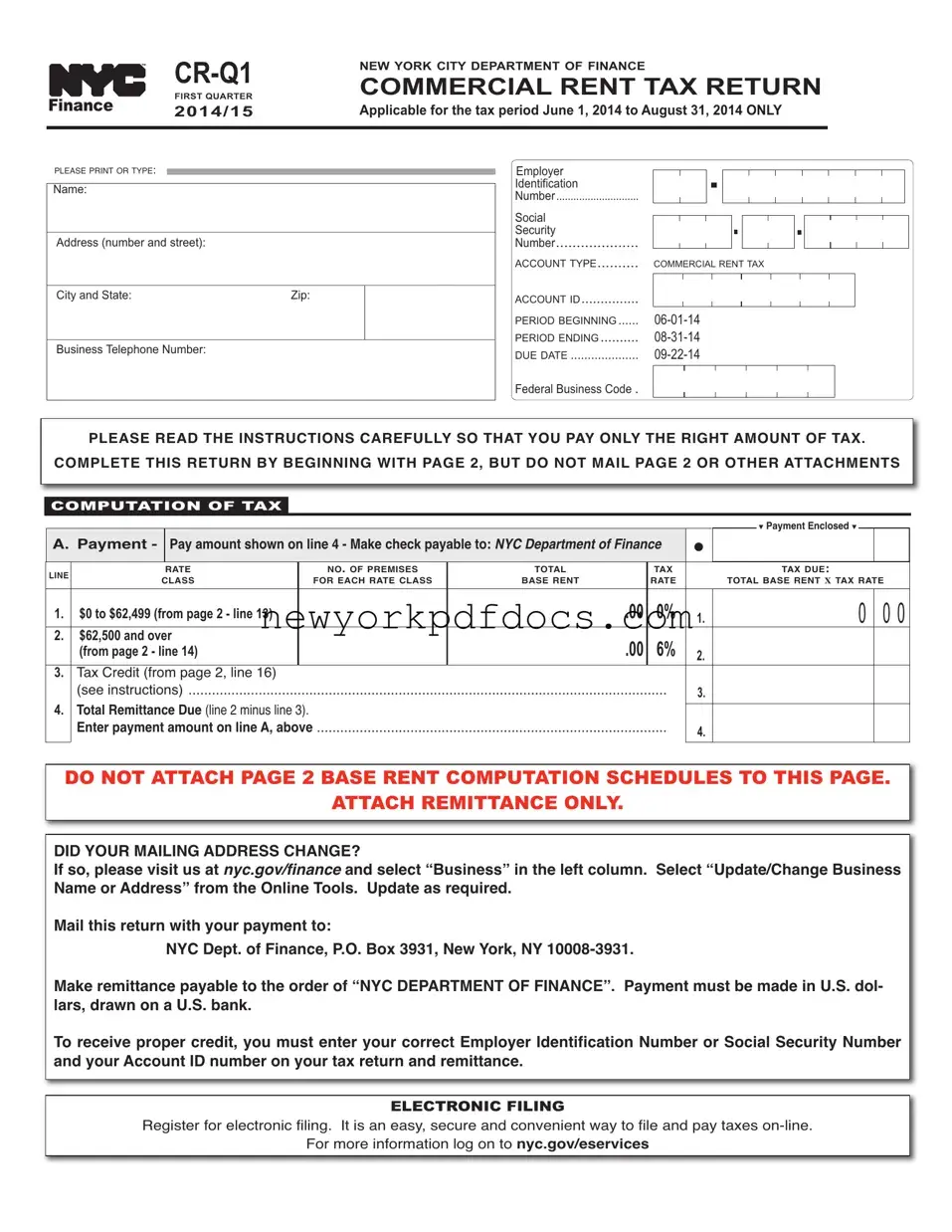

Form CR-Q1 for the tax period June 1, 2014 toAugust 31, 2014 ONLY |

Page 2 |

USE THIS

PAGE IF

PAGE IF YOU HAVE

YOU HAVE

THREE

THREE

OR LESS

OR LESS

PREMISES/SUBTENANTS OR, MAKE COPIES OF THIS

PREMISES/SUBTENANTS OR, MAKE COPIES OF THIS

PAGE TO REPORT ADDITIONAL PREMISES/SUBTENANTS. IF YOU REPORT MORE THAN

PAGE TO REPORT ADDITIONAL PREMISES/SUBTENANTS. IF YOU REPORT MORE THAN

THREE

THREE

PREMISES OR SUBTENANTS, AND CHOOSE TO

PREMISES OR SUBTENANTS, AND CHOOSE TO

USE A SPREADSHEET, YOU MUST USE THE

USE A SPREADSHEET, YOU MUST USE THE

CRQ FINANCE

CRQ FINANCE

SUP- PLEMENTAL SPREADSHEET, WHICH YOU CAN DOWNLOAD FROM

SUP- PLEMENTAL SPREADSHEET, WHICH YOU CAN DOWNLOAD FROM

OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

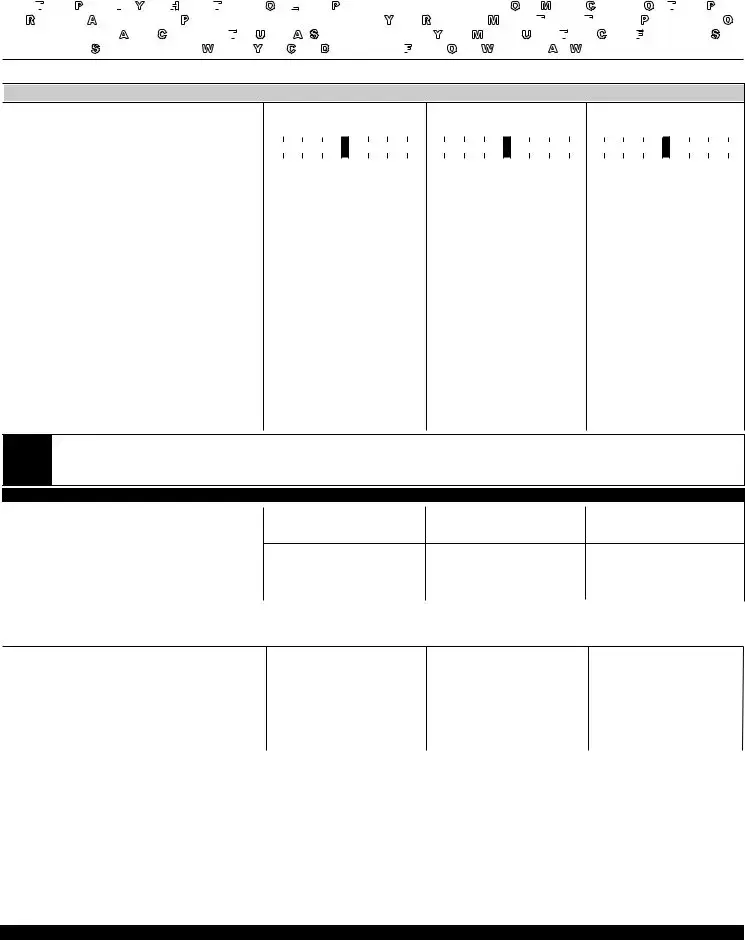

EACH LINE MUST BEACCURATELYCOMPLETED. YOUR DEDUCTION WILLBE DISALLOWED IF INACCURATE INFORMATION IS SUBMITTED.

LINE |

DESCRIPTION |

PREMISES 1 |

PREMISES 2 |

PREMISES 3 |

● 1a. |

Street Address ......................................................... 1a. |

|

|

|

|

|

|

1b. Zip Code ..................................................................1b. |

________________________________________________________________________________________ |

1c. |

Block and 1d. Lot Number...................................1c/1d. ________________________________________________________________________________________ |

|

|

|

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

1c. BLOCK |

1d. LOT |

● 2. |

Gross Rent Paid (see instructions) |

2. |

________________________________________________________________________________________ |

3. |

Rent Applied to Residential Use |

3. |

________________________________________________________________________________________ |

|

............................................. |

4a. |

________________________________________________________________________________________ |

●4b. Employer Identification Number (EIN) forKEEP THIS PAGE partnerships or corporations .....................................4b. ● 4b. EIN _____________________ ● 4b. EIN_____________________ ● 4b. EIN ____________________4a. SUBTENANT'S NAME

4c. Social Security Number for individuals |

4c. |

● 4c. SSN_____________________ ● 4c. SSN ____________________ ● 4c. SSN ____________________ |

4d. RENT RECEIVED FROM SUBTENANT |

|

|

|

(see instructions if more than one subtenant) |

4d. ___________________________________________________________________________________________________ |

5b. |

Commercial RevitalizationFORProgram |

YOUR RECORDS. |

5a. |

Other Deductions (attach schedule) |

5a. |

________________________________________________________________________________________ |

|

special reduction (see instructions) |

5b. |

________________________________________________________________________________________ |

6. |

Total Deductions (add lines 3, 4d, 5a and 5b) |

6. |

________________________________________________________________________________________ |

7.Base Rent Before Rent Reduction (line 2 minus line 6) ....7DO. ________________________________________________________________________________________NOT FILE

8.35% Rent Reduction (35% X line 7) ...........................8. ________________________________________________________________________________________

9. Base Rent Subject to Tax (line 7 minus line 8) ...........9. ________________________________________________________________________________________

If the line 7 amount represents rent for less than the full 3 month period, proceed to line 10a, or

NOTE If the line 7 amount plus the line 5b amount is $62,499 or less and represents rent for a full 3 month period, transfer line 9 to line 13, or If the line 7 amount plus the line 5b amount is $62,500 or more and represents rent for a full 3 month period, transfer line 9 to line 14

COMPLETE LINES 10 - 12 ONLY IF YOU RENTED PREMISES FOR LESS THAN THE FULL THREE-MONTH PERIOD

........10a. Number of Months at Premises during the tax period |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

10a. # of months |

10b. From: |

|

|

10c. To: |

|

10c. To: |

|

|

10c. To: |

11.Monthly Base Rent before rent reduction

(line 7 plus line 5b divided by line 10a) |

11. ________________________________________________________________________________________ |

12.Quarterly Base Rent before rent reduction

(line 11 X 3 months) |

12. ________________________________________________________________________________________ |

■If the line 12 amount is $62,499 or less, transfer the line 9 amount (NOT THE LINE 12AMOUNT) to line 13

■If the line 12 amount is $62,500 or more, transfer the line 9 amount (NOT THE LINE 12AMOUNT) to line 14

|

RATE CLASS |

TAX RATE |

|

|

|

13. |

($0 - 62,499) |

0% |

13. |

_______________________________________________________________________________________ |

14. |

($62,500 or more) |

6% |

14. |

_______________________________________________________________________________________ |

15.Tax Due before credit

(line 14 multiplied by 6%) |

15. |

|

16. Tax Credit (see worksheet below) |

16. |

_______________________________________________________________________________________ |

Note: The tax credit only applies if line 7 plus line 5b (or line 12, if applicable) is at least $62,500, but is less than $75,000. All others enter zero.

Tax Credit Computation Worksheet

■If the line 7 amount represents rent for the full 3 month period, your credit is calculated as follows:

Amount on line 15 X ($75,000 minus the sum of lines 7 and 5b) = _____________ = your credit

$12,500

■If the line 7 amount represents rent for less than the full 3 month period, your credit is calculated as follows:

Amount on line 15 X ($75,000$12,500minus line 12) = _____________ = your credit

TRANSFER THE AMOUNTS FROM LINES 13, 14 AND 16 TO THE CORRESPONDING LINES ON PAGE 1

PAGE IF

PAGE IF YOU HAVE

YOU HAVE

THREE

THREE

OR LESS

OR LESS

PREMISES/SUBTENANTS OR, MAKE COPIES OF THIS

PREMISES/SUBTENANTS OR, MAKE COPIES OF THIS

PAGE TO REPORT ADDITIONAL PREMISES/SUBTENANTS. IF YOU REPORT MORE THAN

PAGE TO REPORT ADDITIONAL PREMISES/SUBTENANTS. IF YOU REPORT MORE THAN

THREE

THREE

PREMISES OR SUBTENANTS, AND CHOOSE TO

PREMISES OR SUBTENANTS, AND CHOOSE TO

USE A SPREADSHEET, YOU MUST USE THE

USE A SPREADSHEET, YOU MUST USE THE

CRQ FINANCE

CRQ FINANCE

SUP- PLEMENTAL SPREADSHEET, WHICH YOU CAN DOWNLOAD FROM

SUP- PLEMENTAL SPREADSHEET, WHICH YOU CAN DOWNLOAD FROM

OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.

OUR WEBSITE AT WWW.NYC.GOV/CRTINFO.