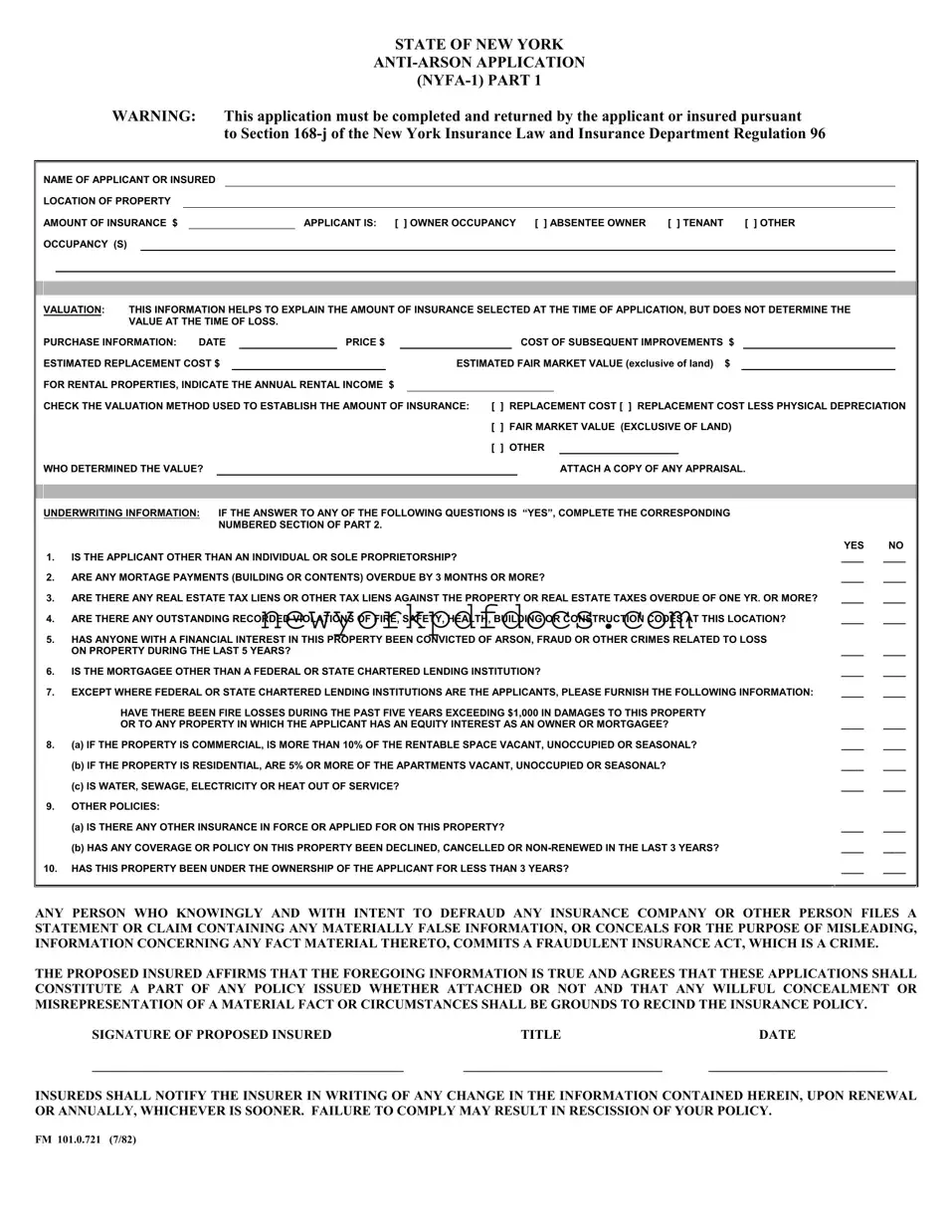

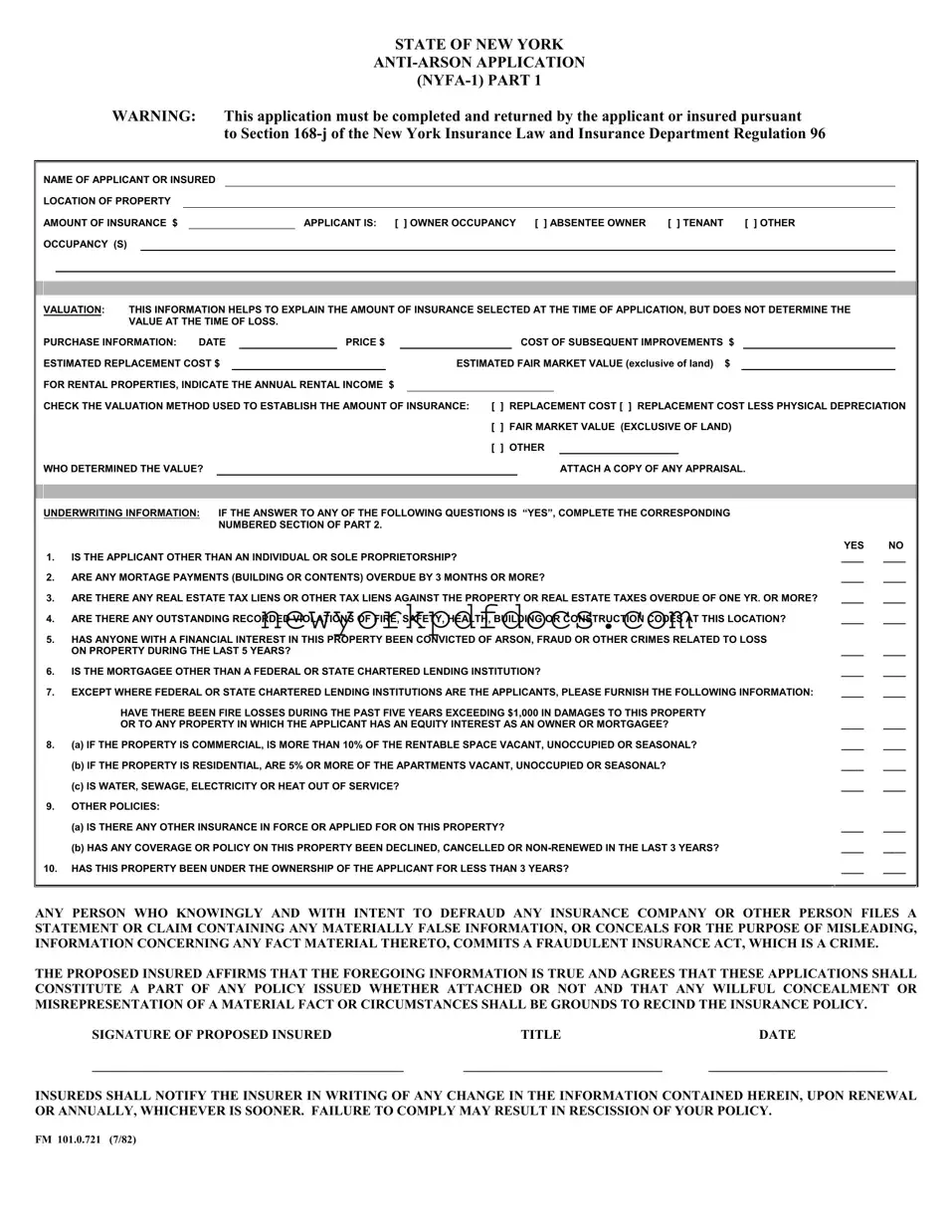

STATE OF NEW YORK

ANTI-ARSON APPLICATION

(NYFA-1) PART 1

|

|

|

|

WARNING: |

This application must be completed and returned by the applicant or insured pursuant |

|

|

|

|

|

|

|

|

|

|

|

|

|

to Section 168-j of the New York Insurance Law and Insurance Department Regulation 96 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NAME OF APPLICANT OR INSURED |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOCATION OF PROPERTY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMOUNT OF INSURANCE $ |

|

|

|

|

|

APPLICANT IS: |

[ ] OWNER OCCUPANCY [ ] ABSENTEE OWNER [ ] TENANT |

|

[ ] OTHER |

|

|

|

|

|

|

OCCUPANCY (S) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

VALUATION: |

|

THIS INFORMATION HELPS TO EXPLAIN THE AMOUNT OF INSURANCE SELECTED AT THE TIME OF APPLICATION, BUT DOES NOT DETERMINE THE |

|

|

|

|

|

|

|

|

VALUE AT THE TIME OF LOSS. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PURCHASE INFORMATION: DATE |

|

|

PRICE $ |

|

|

|

|

COST OF SUBSEQUENT IMPROVEMENTS $ |

|

|

|

|

|

|

|

ESTIMATED REPLACEMENT COST $ |

|

|

|

|

|

|

ESTIMATED FAIR MARKET VALUE (EXCLUSIVE OF LAND) |

$ |

|

|

|

|

|

|

|

FOR RENTAL PROPERTIES, INDICATE THE ANNUAL RENTAL INCOME $ |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CHECK THE VALUATION METHOD USED TO ESTABLISH THE AMOUNT OF INSURANCE: [ ] REPLACEMENT COST [ ] REPLACEMENT COST LESS PHYSICAL DEPRECIATION |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ ] FAIR MARKET VALUE (EXCLUSIVE OF LAND) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

[ ] OTHER |

|

|

|

|

|

|

|

|

|

|

WHO DETERMINED THE VALUE? |

|

|

|

|

|

|

|

|

|

|

|

|

|

ATTACH A COPY OF ANY APPRAISAL. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

UNDERWRITING INFORMATION: |

IF THE ANSWER TO ANY OF THE FOLLOWING QUESTIONS IS “YES”, COMPLETE THE CORRESPONDING |

|

|

|

|

|

|

|

|

|

|

|

|

|

NUMBERED SECTION OF PART 2. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

|

|

|

1. IS THE APPLICANT OTHER THAN AN INDIVIDUAL OR SOLE PROPRIETORSHIP? |

|

|

____ |

____ |

|

|

|

2. ARE ANY MORTAGE PAYMENTS (BUILDING OR CONTENTS) OVERDUE BY 3 MONTHS OR MORE? |

|

|

____ |

____ |

|

|

|

3. ARE THERE ANY REAL ESTATE TAX LIENS OR OTHER TAX LIENS AGAINST THE PROPERTY OR REAL ESTATE TAXES OVERDUE OF ONE YR. OR MORE? |

____ |

____ |

|

|

|

4. ARE THERE ANY OUTSTANDING RECORDED VIOLATIONS OF FIRE, SAFETY, HEALTH, BUILDING OR CONSTRUCTION CODES AT THIS LOCATION? |

____ |

____ |

|

5.HAS ANYONE WITH A FINANCIAL INTEREST IN THIS PROPERTY BEEN CONVICTED OF ARSON, FRAUD OR OTHER CRIMES RELATED TO LOSS

|

ON PROPERTY DURING THE LAST 5 YEARS? |

____ |

____ |

6. |

IS THE MORTGAGEE OTHER THAN A FEDERAL OR STATE CHARTERED LENDING INSTITUTION? |

____ |

____ |

7. |

EXCEPT WHERE FEDERAL OR STATE CHARTERED LENDING INSTITUTIONS ARE THE APPLICANTS, PLEASE FURNISH THE FOLLOWING INFORMATION: |

____ |

____ |

|

HAVE THERE BEEN FIRE LOSSES DURING THE PAST FIVE YEARS EXCEEDING $1,000 IN DAMAGES TO THIS PROPERTY |

|

|

|

OR TO ANY PROPERTY IN WHICH THE APPLICANT HAS AN EQUITY INTEREST AS AN OWNER OR MORTGAGEE? |

____ |

____ |

8. |

(A) IF THE PROPERTY IS COMMERCIAL, IS MORE THAN 10% OF THE RENTABLE SPACE VACANT, UNOCCUPIED OR SEASONAL? |

____ |

____ |

|

(B) IF THE PROPERTY IS RESIDENTIAL, ARE 5% OR MORE OF THE APARTMENTS VACANT, UNOCCUPIED OR SEASONAL? |

____ |

____ |

|

(C) IS WATER, SEWAGE, ELECTRICITY OR HEAT OUT OF SERVICE? |

____ |

____ |

9. |

OTHER POLICIES: |

|

|

|

(A) IS THERE ANY OTHER INSURANCE IN FORCE OR APPLIED FOR ON THIS PROPERTY? |

____ |

____ |

|

(B) HAS ANY COVERAGE OR POLICY ON THIS PROPERTY BEEN DECLINED, CANCELLED OR NON-RENEWED IN THE LAST 3 YEARS? |

____ |

____ |

10. |

HAS THIS PROPERTY BEEN UNDER THE OWNERSHIP OF THE APPLICANT FOR LESS THAN 3 YEARS? |

____ |

____ |

|

|

|

|

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES A STATEMENT OR CLAIM CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME.

THE PROPOSED INSURED AFFIRMS THAT THE FOREGOING INFORMATION IS TRUE AND AGREES THAT THESE APPLICATIONS SHALL CONSTITUTE A PART OF ANY POLICY ISSUED WHETHER ATTACHED OR NOT AND THAT ANY WILLFUL CONCEALMENT OR MISREPRESENTATION OF A MATERIAL FACT OR CIRCUMSTANCES SHALL BE GROUNDS TO RECIND THE INSURANCE POLICY.

SIGNATURE OF PROPOSED INSURED |

TITLE |

DATE |

_______________________________________________ |

______________________________ |

___________________________ |

INSUREDS SHALL NOTIFY THE INSURER IN WRITING OF ANY CHANGE IN THE INFORMATION CONTAINED HEREIN, UPON RENEWAL OR ANNUALLY, WHICHEVER IS SOONER. FAILURE TO COMPLY MAY RESULT IN RESCISSION OF YOUR POLICY.

FM 101.0.721 (7/82)

STATE OF NEW YORK

ANTI-ARSON APPLICATION

(NYFA-1) PART 2

OWNERSHIP INFORMATION: |

|

|

|

|

|

|

1. |

LIST THE NAMES AND ADDRESS OF: |

SHAREHOLDERS OF A CORPORATION |

PARTNERS, INCLUDING LIMITED PARTNERS |

TRUSTEES AND BENEFICIARIES |

|

NOTE: LIST ONLY THOSE POSSESSING AN OWNERSHIP INTEREST OF 25% OR MORE, EXCEPT FOR CLOSE CORPORATION BENEFICIARIES WHERE ALL |

|

OWNERS SHOULD BE LISTED. |

|

|

|

|

|

|

NAME |

ADDRESS |

POSITION |

INTEREST % |

|

|

|

|

|

|

|

|

|

|

|

|

2. |

MORTGAGE PAYMENTS |

MORTGAGE _______________________________ |

DATE DUE_______________________ |

AMOUNT DUE ____________________________ |

|

LIST ANY OTHER ENCUMBRANCES: |

|

|

|

|

|

3. |

UNPAID TAXES OR UNPAID LIENS: |

TYPE _________________________ |

DATE DUE_______________________ |

AMOUNT DUE ____________________________ |

4. |

CODE VIOLATIONS: |

DATE _______________________________________ |

DESCRIBE ________________________________________________________________ |

|

|

|

|

5. |

CONVICTIONS: DATE ____________________________________________ |

DESCRIBE ________________________________________________________________ |

|

_________________________________________________________________ |

NAME OF PERSON _________________________________________________________ |

6.NAME(S) OF UNCHARTERED MORTGAGEES:

7. |

LOSSES: LOCATION |

_________________________________ |

DATE |

_____________ |

AMOUNT |

____________ |

DESCRIPTION _______________________ |

|

_______________________________________________________ |

_____________________ |

_______________________ |

______________________________________ |

|

_______________________________________________________ |

_____________________ |

_______________________ |

______________________________________ |

|

_______________________________________________________ |

_____________________ |

_______________________ |

______________________________________ |

8.VACANCY AND/OR UNOCCUPANCY:

INDICATE SEASONAL PERIOD (IF ANY) WHEN BUILDING IS UNUSED:

FOR APARTMENT BUILDINGS, INDICATE: |

TOTAL UNITS __________________________ |

UNOCCUPIED UNITS |

_________________________________________ |

FOR OTHER BUILDINGS INDICATE: |

VACANCY ___________________________________ |

% UNOCCUPANCY |

____________________________________________ |

FOR ALL BUILDINGS INDICATE THE FOLLOWING: |

|

|

|

|

|

|

REASON FOR VACANCY/UNOCCUPANCY: |

|

|

|

|

|

|

|

ANTICIPATED DATE OF OCCUPANCY: |

|

|

|

|

|

|

|

IF THE BUILDING IS VACANT OR UNOCCUPIED, INDICATE HOW IT IS PROTECTED FROM UNAUTHORIZED ENTRY |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

YES |

NO |

IS THERE A GOVERNMENTAL ORDER TO VACATE OR DESTROY THE BUILDING OR HAS THE BUILDING BEEN CLASSIFIED AS UNINHABITABLE |

|

|

OR STRUCTURALLY UNSAFE? |

|

|

|

|

|

|

|

|

_____ |

_____ |

IF WATER, SEWAGE, ELECTRICITY OR HEAT IS OUT OF SERVICE, EXPLAIN CIRCUMSTANCES: __________________________________________ |

|

|

|

|

|

|

IS THERE UNREPAIRED DAMAGE OR HAVE ITEMS BEEN STRIPPED FROM THE BUILDING? IF YES, DESCRIBE: ___________________________ |

_____ |

_____ |

|

|

|

|

|

|

|

IS THE BUILDING FOR SALE? IF YES, DATE PUT UP FOR SALE: ____________________________ |

|

|

|

|

_____ |

_____ |

9.OTHER POLICIES: INDICATE STATUS: (IN FORCE, APPLIED FOR, DECLINED, CANCELLED OR NONRENEWED)

STATUS |

DATE |

AMOUNT OF INSURANCE |

CARRIER |

POLICY# |

________________________________________ |

_______________________ |

___________________________________ |

__________________________________________________________________ |

________________ |

_______________________________________ |

______________________ |

___________________________________ |

__________________________________________________________________ |

________________ |

_______________________________________ |

______________________ |

___________________________________ |

__________________________________________________________________ |

________________ |

10.LIST ALL REAL ESTATE TRANSACTIONS DURING THE LAST 3 YEARS INVOLVING THIS PROPERTY.

DATE |

SELLING PRICE |

NAME OF SELLER |

AMOUNT OF MORTGAGE |

MORTGAGEE |

__________________________ |

_________________________________ |

_______________________________________________ |

________________________________________ |

________________________________ |

__________________________ |

_________________________________ |

_______________________________________________ |

________________________________________ |

________________________________ |

|

|

|

|

|

ANY PERSON WHO KNOWINGLY AND WITH INTENT TO DEFRAUD ANY INSURANCE COMPANY OR OTHER PERSON FILES A STATEMENT OR CLAIM CONTAINING ANY MATERIALLY FALSE INFORMATION, OR CONCEALS FOR THE PURPOSE OF MISLEADING, INFORMATION CONCERNING ANY FACT MATERIAL THERETO, COMMITS A FRAUDULENT INSURANCE ACT, WHICH IS A CRIME.

THE PROPOSED INSURED AFFIRMS THAT THE FOREGOING INFORMATION IS TRUE AND AGREES THAT THESE APPLICATIONS SHALL CONSTITUTE A PART OF ANY POLICY ISSUED WHETHER ATTACHED OR NOT AND THAT ANY WILLFUL CONCEALMENT OR MISREPRESENTATION OF A MATERIAL FACT OR CIRCUMSTANCES SHALL BE GROUNDS TO RECIND THE INSURANCE POLICY.

SIGNATURE OF PROPOSED INSURED |

TITLE |

DATE |

_______________________________________________ |

______________________________ |

___________________________ |