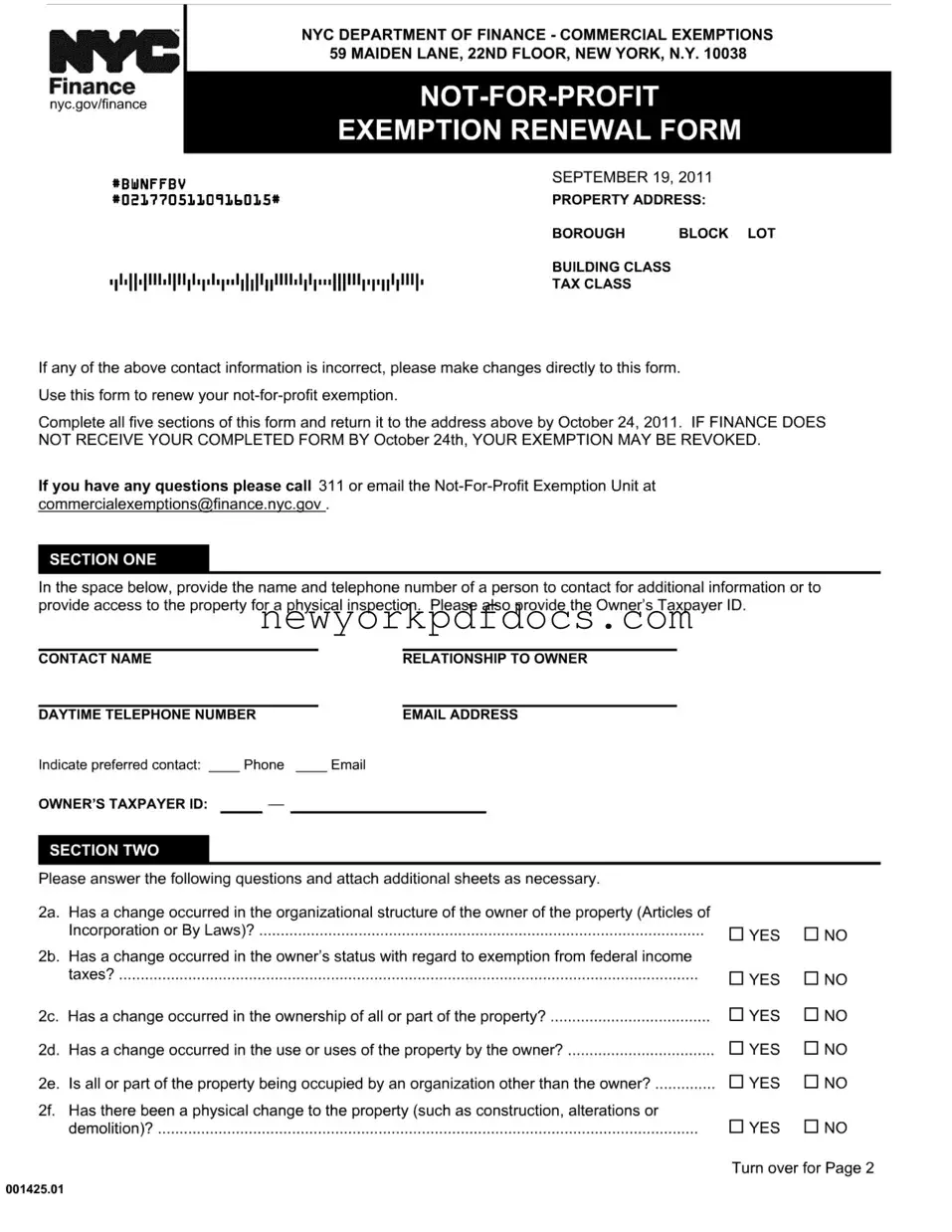

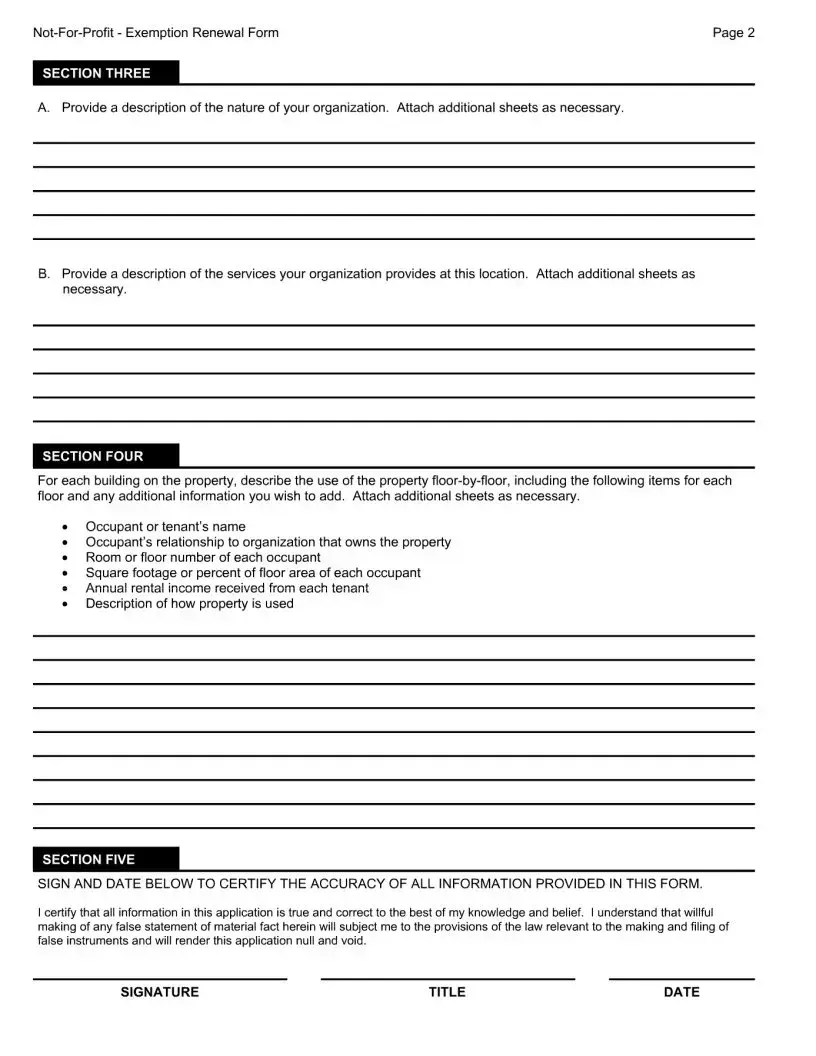

Free Non Profit Exemption Renewal Nyc Form

The Non Profit Exemption Renewal NYC form is a crucial document for organizations seeking to maintain their not-for-profit tax exemption status in New York City. This form requires detailed information about the organization and its property, ensuring compliance with local regulations. Timely submission is essential, as failure to file by the deadline may result in the loss of exemption benefits.

Open My Document Now

Free Non Profit Exemption Renewal Nyc Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Non Profit Exemption Renewal Nyc online with ease.

Open My Document Now

or

⇓ Non Profit Exemption Renewal Nyc PDF