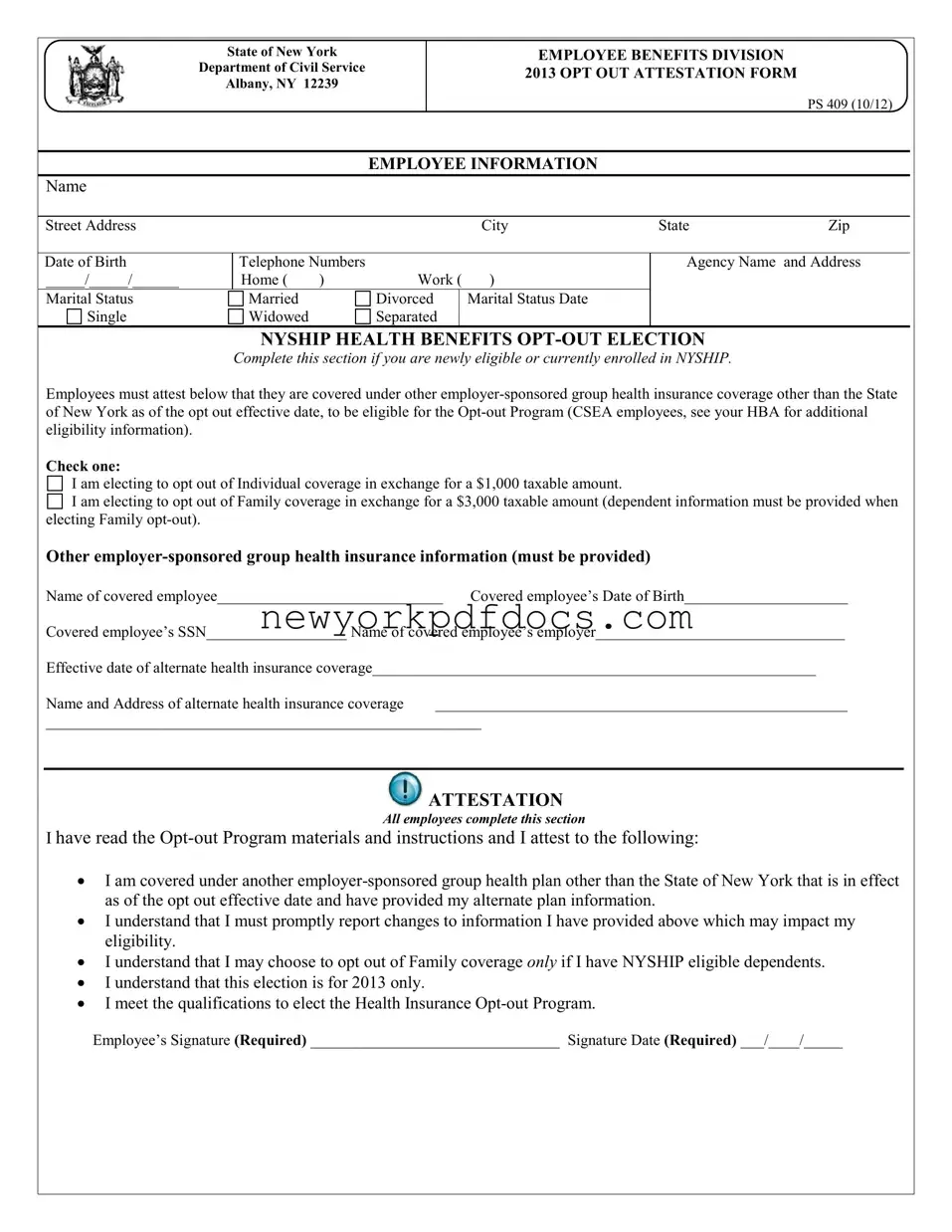

State of New York

Department of Civil Service

Albany, NY 12239

EMPLOYEE BENEFITS DIVISION 2013 OPT OUT ATTESTATION FORM

PS 409 (10/12)

EMPLOYEE INFORMATION

Name

Street Address |

City |

State |

Zip |

Date of Birth |

Telephone Numbers |

|

|

|

_____/_____/______ |

Home ( |

) |

Work ( |

) |

Marital Status |

Married |

|

Divorced |

|

Marital Status Date |

Single |

Widowed |

|

Separated |

|

|

|

|

|

|

|

|

NYSHIP HEALTH BENEFITS OPT-OUT ELECTION

Complete this section if you are newly eligible or currently enrolled in NYSHIP.

Employees must attest below that they are covered under other employer-sponsored group health insurance coverage other than the State of New York as of the opt out effective date, to be eligible for the Opt-out Program (CSEA employees, see your HBA for additional eligibility information).

Check one:

I am electing to opt out of Individual coverage in exchange for a $1,000 taxable amount.

I am electing to opt out of Family coverage in exchange for a $3,000 taxable amount (dependent information must be provided when electing Family opt-out).

I am electing to opt out of Family coverage in exchange for a $3,000 taxable amount (dependent information must be provided when electing Family opt-out).

Other employer-sponsored group health insurance information (must be provided)

Name of covered employee_____________________________ Covered employee’s Date of Birth_____________________

Covered employee’s SSN__________________ Name of covered employee’s employer________________________________

Effective date of alternate health insurance coverage_________________________________________________________

Name and Address of alternate health insurance coverage _____________________________________________________

________________________________________________________

ATTESTATION

ATTESTATION

All employees complete this section

I have read the Opt-out Program materials and instructions and I attest to the following:

•I am covered under another employer-sponsored group health plan other than the State of New York that is in effect as of the opt out effective date and have provided my alternate plan information.

•I understand that I must promptly report changes to information I have provided above which may impact my eligibility.

•I understand that I may choose to opt out of Family coverage only if I have NYSHIP eligible dependents.

•I understand that this election is for 2013 only.

•I meet the qualifications to elect the Health Insurance Opt-out Program.

Employee’s Signature (Required) ________________________________ Signature Date (Required) ___/____/_____

NYS Department of Civil Service |

Opt-out |

Attestation Form |

Albany, NY 12239 |

Page 2 |

– PS 409 (10/12) |

Employees who can demonstrate and attest to having other employer-sponsored group health insurance may elect to opt out of NYSHIP’s Empire Plan or Health Maintenance Organizations. Employees who elect to opt out of NYSHIP will receive $1,000 for waiving Individual coverage or $3,000 for waiving Family coverage. This amount will be credited to bi-weekly paychecks as taxable income over the plan year. Unless newly eligible to enroll, employees must be enrolled in NYSHIP Individual or Family coverage prior to April 1st of the previous plan year to be eligible to opt out of that coverage. This enrollment cannot have been subject to late enrollment. In order to participate, employees must have other employer-sponsored group health insurance.

There are two circumstances when employees may elect to opt out of coverage; as newly eligible for the Opt-out Program, and, for currently enrolled employees, during the Annual Option Transfer Period. Only employees who experience a qualifying event will be allowed to withdraw their Opt-out election and enroll in a health insurance plan mid-year. See instructions below.

INSTRUCTIONS:

Newly eligible employees: Employees may enroll in the Opt-out Program no later than their first date of NYSHIP eligibility. Employees must sign the PS-409 Opt-out Attestation Form and complete a PS-404 Enrollment Form.

Current enrollees: Eligible enrollees may elect the Opt-out Program during the Annual Option Transfer Period for each plan year. Employees must sign the PS-409 Opt-out Attestation Form and complete a PS-404 Enrollment Form.

During mid-year: Employees who experience a Qualifying Event (QE) must notify their personnel office within thirty (30) days of the QE date in order to enroll in a health insurance plan without a waiting period. Employees must complete a PS404 Enrollment Form.

By signing the Opt-out Attestation, you elect to receive $3,000 (Family coverage waived), or $1,000 (Individual coverage waived); this amount will be credited to your bi-weekly paycheck as taxable income over the plan year.

The information you provide on this application is requested in accordance with Section 163 of New York State Civil Service Law for the principal purpose of enabling the Department of Civil Service to process your request concerning health insurance coverage. This information will be used in accordance with Section 96

(1)of the Personal Privacy Protection Law, particularly subdivisions (b), (e) and (f). Failure to provide the information requested may interfere with our ability to comply with your request. This information will be maintained by the Director of the Employee Benefits Division, NYS Department of Civil Service, Albany, NY 12239. For information concerning the Personal Protection Law, call (518) 457-9375. For information related to the Health Insurance Program, contact your Agency Health Benefits Administrator. If, after calling your Agency Health Benefits Administrator, you need more information, please call (518) 457-5754

or 1-800-833-4344 between the hours of 9:00 a.m. and 4:00 p.m.

This form is invalid if it is not signed and submitted along with a completed PS 404.

I am electing to opt out of Family coverage in exchange for a $3,000 taxable amount (dependent information must be provided when electing Family

I am electing to opt out of Family coverage in exchange for a $3,000 taxable amount (dependent information must be provided when electing Family  ATTESTATION

ATTESTATION