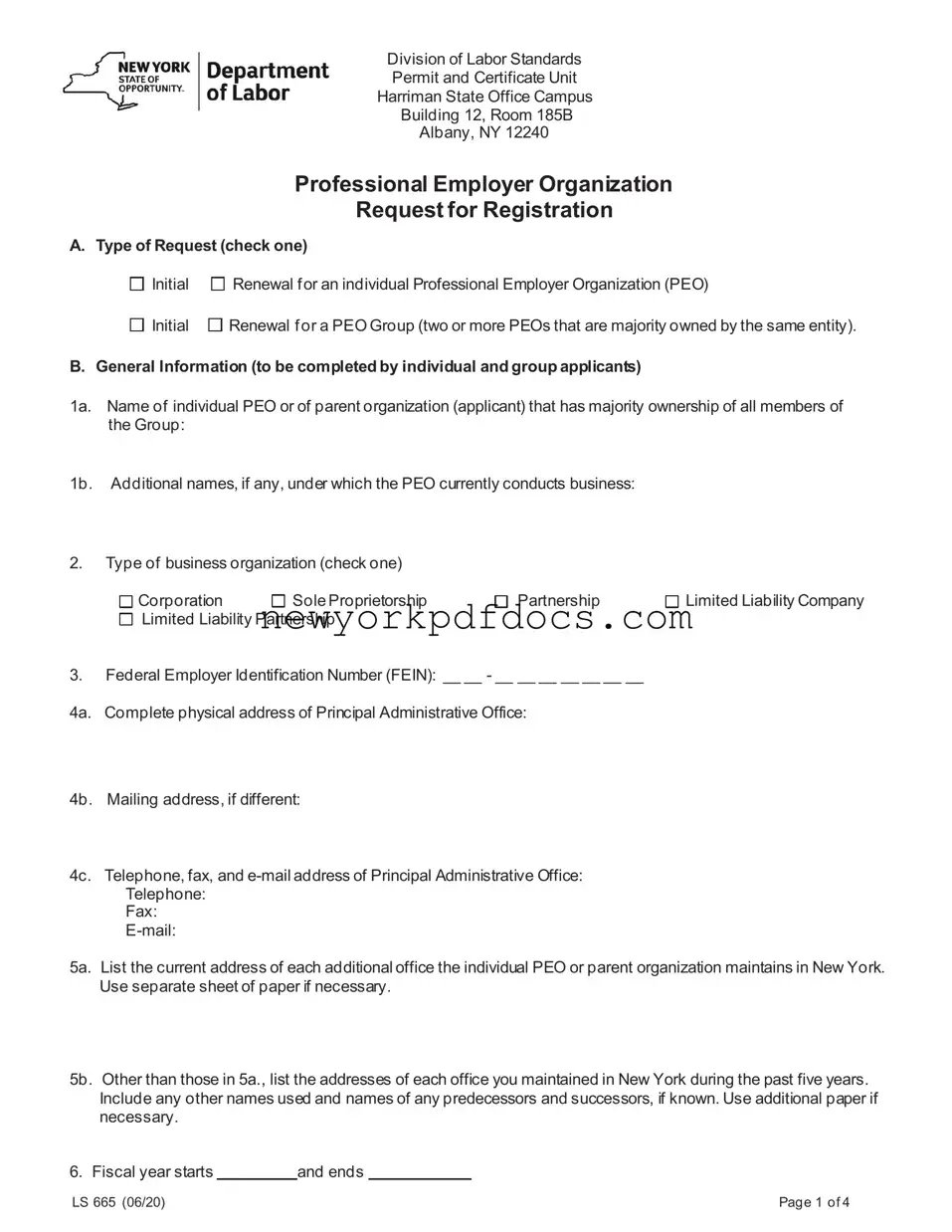

E. Submission Instructions (applicable to individual and group applicants)

•For any questions, email PEOinfo.LS@labor.ny.gov or call (518) 457-1942.

•The initial PEO registration application must be submitted prior to operating in New York State. Renewal registration application(s) must be submitted no later than 180 days after the end of the PEO’s fiscal year.

•Make sure you have marked on the first page whether this is an initial or renewal request by an individual PEO or a PEO Group, and the Declaration and Group Guaranty, if applicable, on the next page are completed.

•With an initial request, submit a copy of the corporate filing receipt and/or authorization to do business in New York State from the New York State Secretary of State for each incorporated individual PEO, parent organization and PEO group member.

•Attach a blank client contract incorporating the requirements of Article 31 of the New York Labor Law and a sample written notice to worksite employees.

•Attach a list of all New York clients including the name, address, FEIN, type of business, name of the New York State Workers’ Compensation and Disability Insurance policyholders, and number of employees for each client. This list will be kept confidential. Attach a reviewed or audited financial statement of the PEO’s most recent fiscal year;

o The statement must have been prepared within 180 days prior to the submission by an independent certified public accountant (CPA) using generally accepted accounting principles (GAAP) and must show a minimum net worth of $75,000.

o The statement must be accompanied by a cover letter, signed by the independent CPA, certifying that (1) the statement fairly represents the financial position of the firm in accordance with GAAP and (2) there is reasonable assurance that the firm has timely paid all applicable federal and state payroll taxes on all New York employees (for example: office, worksite, etc.) for that fiscal year and explaining the basis for these certifications.

o A PEO Group may submit combined or consolidated audited or reviewed financial statements.

o Where the Group or the Group’s parent submit a combined or consolidated statement, supplemental consolidated or combined schedules covering each professional employer organization registered under the group must be included.

o If a bond or security is to be submitted in place of financial statements, email or call us for submission information.

•Attach proof of New York Workers’ Compensation and Disability Insurance:

oIf you have office and internal employees in New York, provide evidence of coverage for New York State Workers’ Compensation and

Disability Insurance by attaching copies of Form C-105.2 and DB-120.1 (Certificate of Insurance) that are available from your carrier(s).

oIf you have no office or internal employees in New York, attach Form CE-200. Information on and copies of this form are available from any District Office of the New York State Workers’ Compensation Board or from their website at www.wcb.ny.gov. Click on “WC/DB Exemptions”. Then click “Request for WC/DB Exemptions.”

•If a corporation, the request must be signed by an officer of the corporation authorized to bind the entity.

•If a partnership, proprietorship or LLC, the request must be signed by a partner, owner or member authorized to bind the entity.

•Mail the completed request with all attachments to:

New York State Department of Labor

Division of Labor Standards

Permit and Certificate Unit

State Office Campus

Building 12, Room 185B

Albany, NY 12240

F. Responsibilities (applicable to individual and group applicants)

•Within 60 days of the end of each calendar quarter, the PEO must submit a statement, signed by an independent CPA, certifying that there

is reasonable assurance that the firm has timely paid all applicable federal and state payroll taxes on all New York employees (for example: office, worksite, etc.) for that quarter and explaining the basis for this certification.

•Within 60 days of the end of each calendar quarter, a client list must be submitted, showing all changes since the last list submitted. Include the name and address, FEIN, type of business, and name of New York State Workers’ Compensation and Disability Insurance policyholders for each new client. The list should be signed by an officer, partner, owner or member, certifying the list is complete, current and accurate.

•Upon ending a contract, the client must be advised to contact the Unemployment Insurance (UI) Division concerning its UI liability. Inquiries can be directed to Liability and Determination Section, Unemployment Insurance Division, Department of Labor, State Campus, Albany, NY 12240. The telephone number is (518) 457-2635.