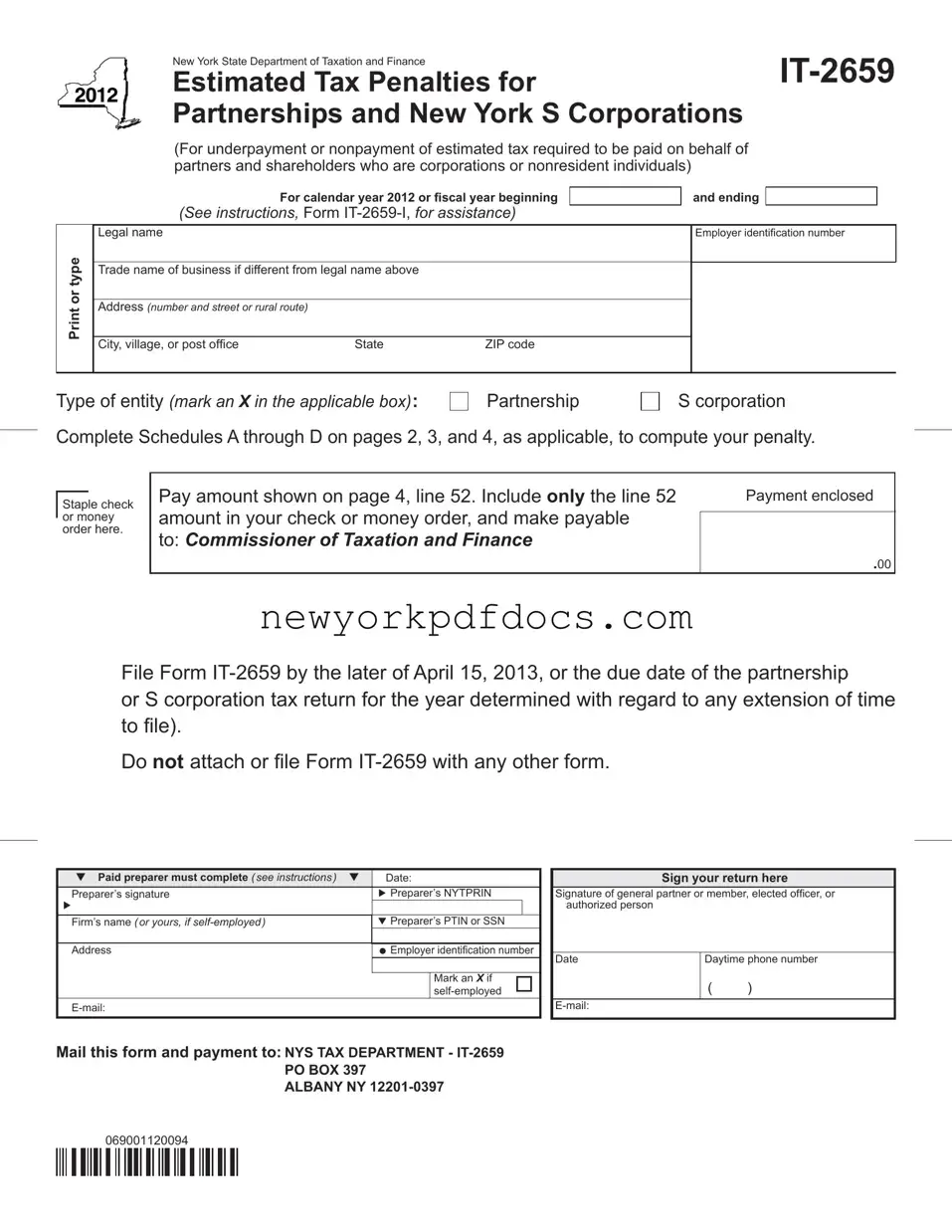

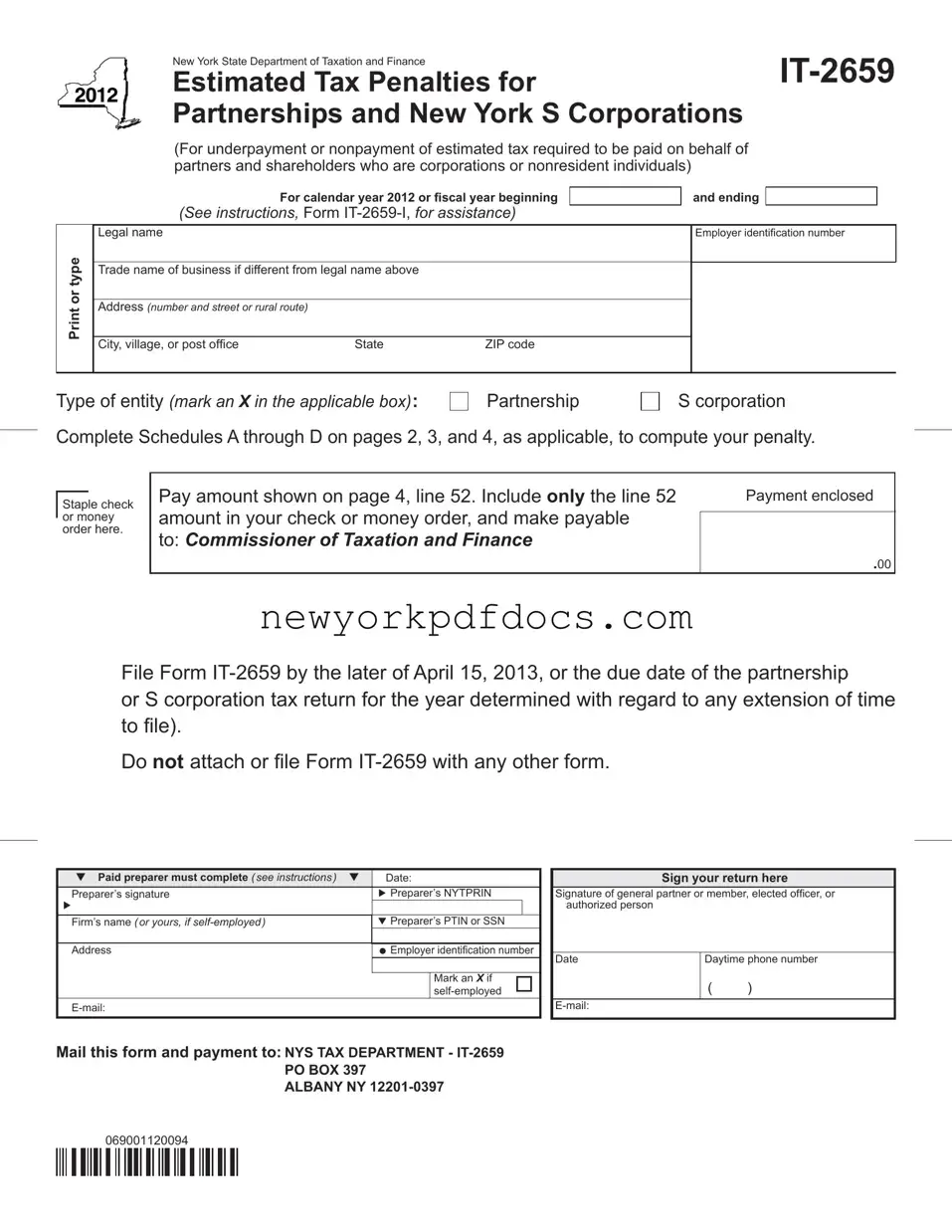

Free New York It 2659 Form

The New York IT-2659 form is used by partnerships and New York S corporations to report estimated tax penalties. This form addresses underpayment or nonpayment of estimated tax that must be paid on behalf of partners and shareholders, including corporations and nonresident individuals. Completing this form accurately ensures compliance with New York State tax requirements and helps avoid further penalties.

Open My Document Now

Free New York It 2659 Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download New York It 2659 online with ease.

Open My Document Now

or

⇓ New York It 2659 PDF