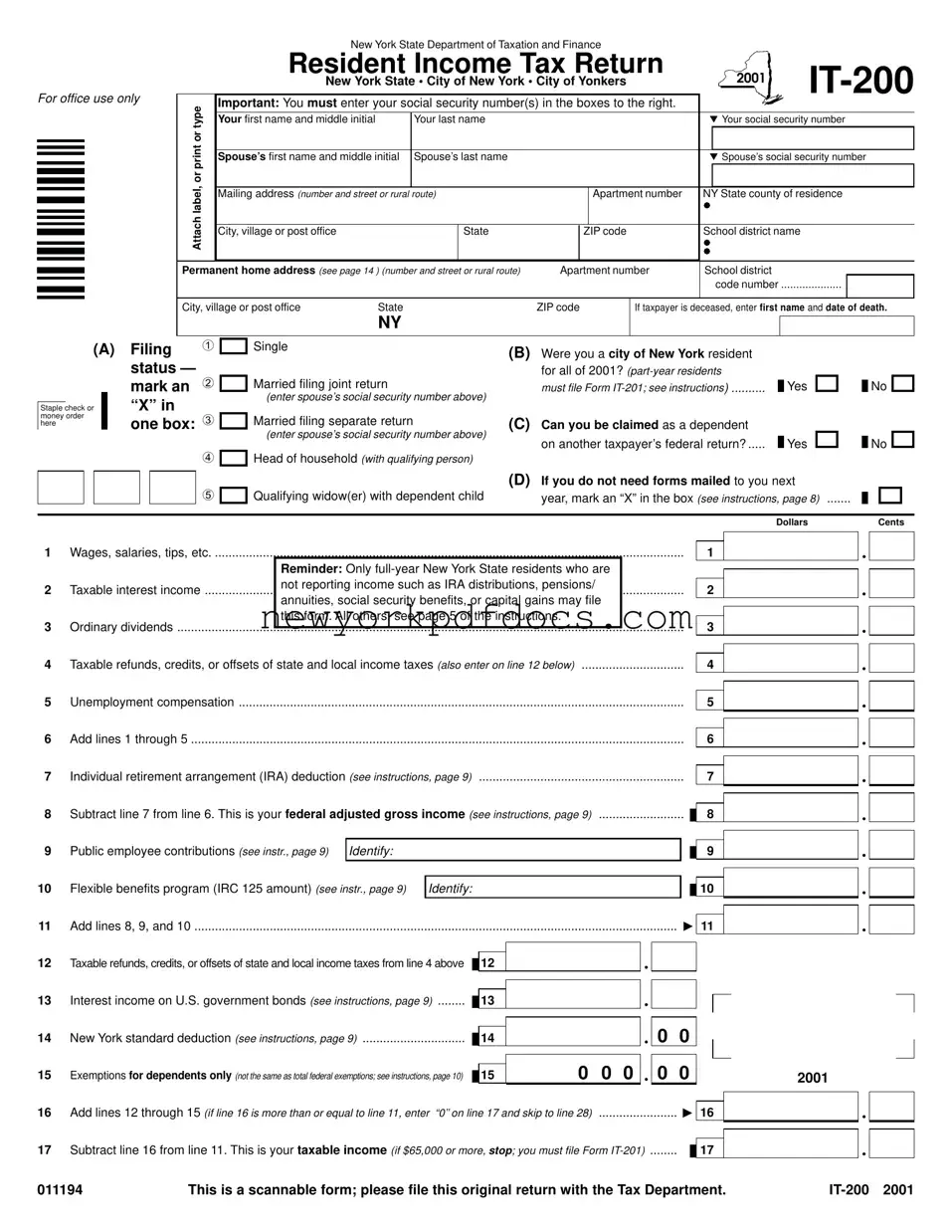

Filling out the New York IT-200 form can be a straightforward process, but many individuals make common mistakes that can lead to delays or issues with their tax returns. One frequent error is failing to include social security numbers for both the taxpayer and their spouse. This information is crucial and must be entered accurately in the designated boxes. Without it, the form may be rejected or delayed.

Another mistake involves incorrect filing status selection. Taxpayers often overlook the importance of marking the correct box for their filing status, such as "Single," "Married filing joint," or "Head of household." An incorrect selection can affect tax calculations and eligibility for certain credits or deductions. It is essential to review the options carefully and ensure the correct status is marked with an "X."

Many individuals also neglect to check their residency status. The form asks whether the taxpayer was a resident of New York City for the entire year. Part-year residents must use a different form, specifically Form IT-201. Failing to answer this question accurately can lead to complications in tax processing and potential penalties.

Another common oversight is not reporting all sources of income. Taxpayers sometimes forget to include taxable interest, dividends, or unemployment compensation. It is vital to review all income sources and ensure they are reported correctly on the form. Missing income can result in underreporting, which may lead to audits or additional taxes owed.

Many people also misunderstand the exemption calculations. Taxpayers often confuse the exemptions for dependents with total federal exemptions. It is important to follow the instructions carefully to determine the correct number of exemptions to claim, as this can significantly impact the overall tax liability.

In addition, some individuals fail to attach necessary documentation. The IT-200 form requires taxpayers to staple their wage and tax statements to the return. Omitting these documents can delay processing and refunds. Always ensure that all required attachments are included before mailing the return.

Another frequent error involves not signing the return. Both the taxpayer and spouse, if applicable, must sign the form. A missing signature can result in the return being considered invalid, leading to further complications. It is a simple step that is often overlooked.

Lastly, taxpayers sometimes forget to double-check their math. Errors in calculations can lead to incorrect tax amounts owed or refunds due. Taking the time to review all calculations carefully can prevent these mistakes and ensure a smoother filing process.

By being aware of these common mistakes, individuals can take steps to avoid them and ensure their New York IT-200 form is completed accurately and efficiently.

status — mark an

status — mark an  “X” in

“X” in

10

10

No

No