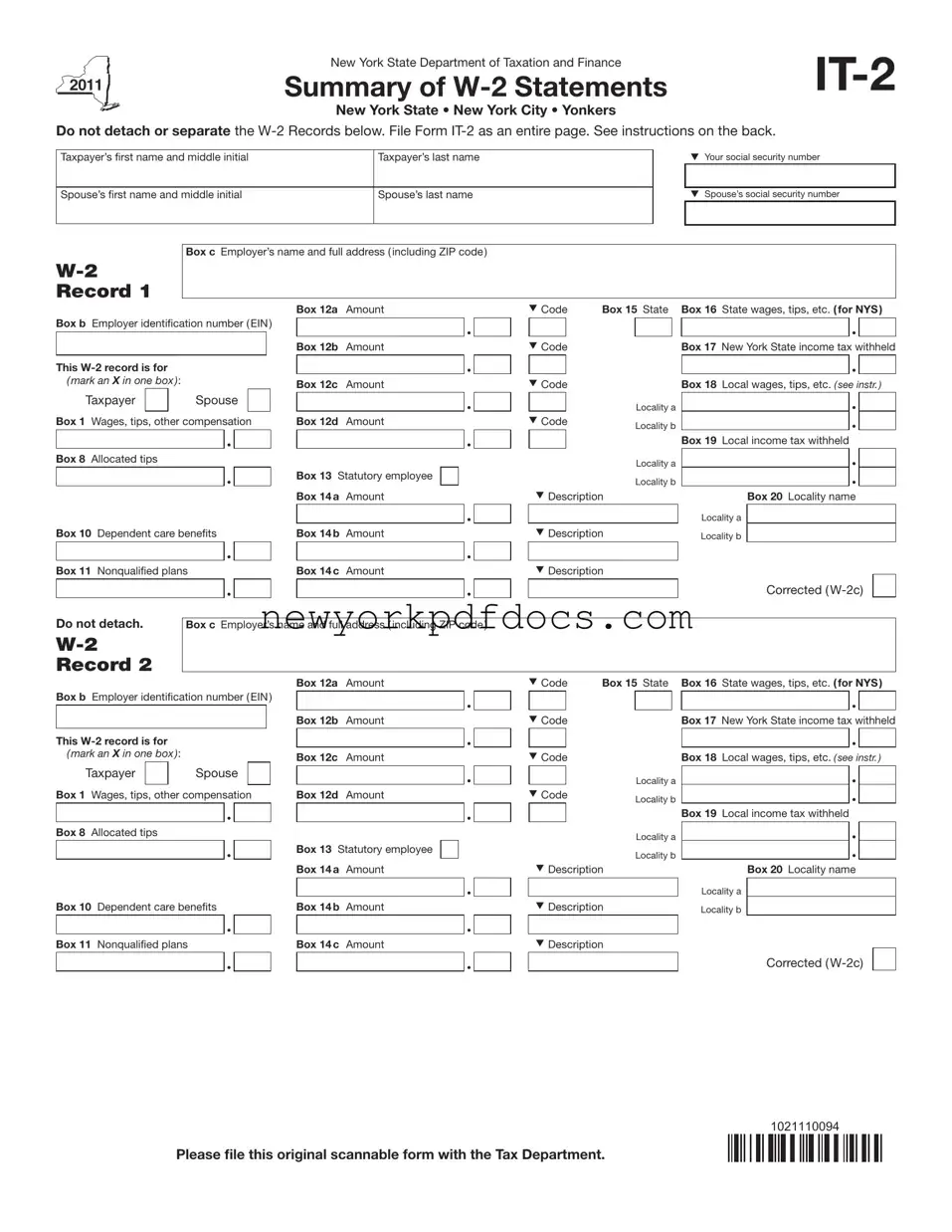

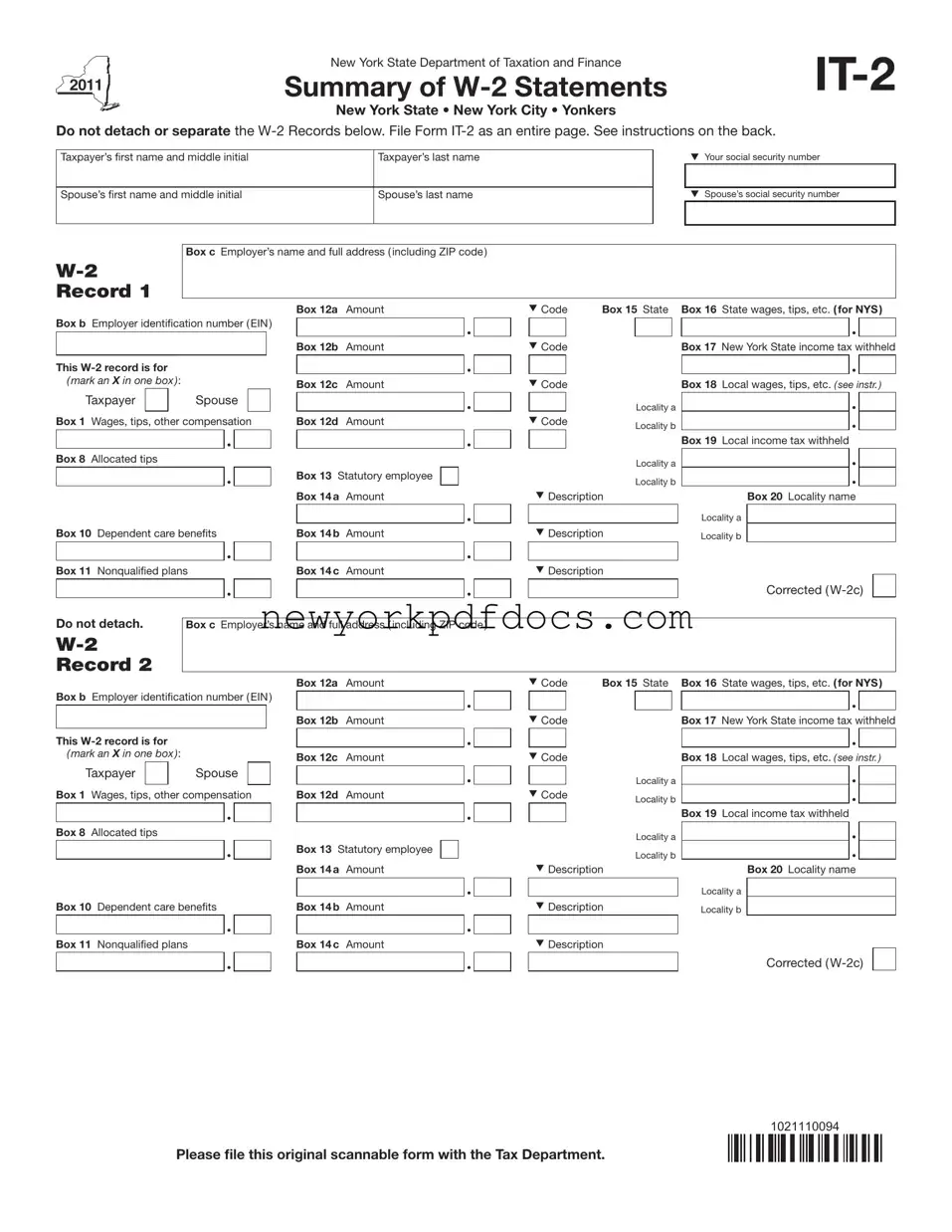

Filling out the New York IT-2 form can be straightforward, but many people make common mistakes that can lead to delays or issues with their tax filings. Awareness of these pitfalls can help ensure a smoother process.

One frequent error is not including the full names of both the taxpayer and spouse. It’s essential to provide the first name, middle initial, and last name accurately. Omitting any part of the name can create confusion and may result in processing delays.

Another mistake involves the social security numbers. Ensure that both the taxpayer's and spouse's social security numbers are correct. A simple typo can lead to significant complications with the tax authority.

Many individuals overlook the importance of marking the correct box for the W-2 record. It’s crucial to indicate whether the record is for the taxpayer or the spouse. Failing to do so can cause the tax department to misallocate income and withholdings.

Completing the employer information accurately is also vital. This includes the employer's name, full address, and employer identification number (EIN). Missing or incorrect details can lead to delays in processing your return.

Inaccurate wage reporting is another common error. Make sure the amounts in Box 1 (wages, tips, other compensation) and Box 16 (state wages, tips, etc.) match the figures on the W-2 forms. Discrepancies can trigger audits or additional inquiries.

Another mistake is neglecting to include all W-2 records if there are multiple forms. Each W-2 should be listed on the IT-2 form without detaching or separating them. This ensures that all income is accounted for properly.

People often forget to check the local income tax information. If local wages or taxes apply, ensure that these amounts are filled out correctly. Missing this information can lead to underreporting income and potential penalties.

It’s also important to review any codes in the boxes, especially in Boxes 12 and 18. Misunderstanding or incorrectly entering these codes can lead to errors in tax calculations.

Lastly, not following the instructions on the back of the form can lead to oversights. Always refer to the guidelines provided to ensure that every section is completed correctly. Taking the time to double-check your work can save you from future headaches.