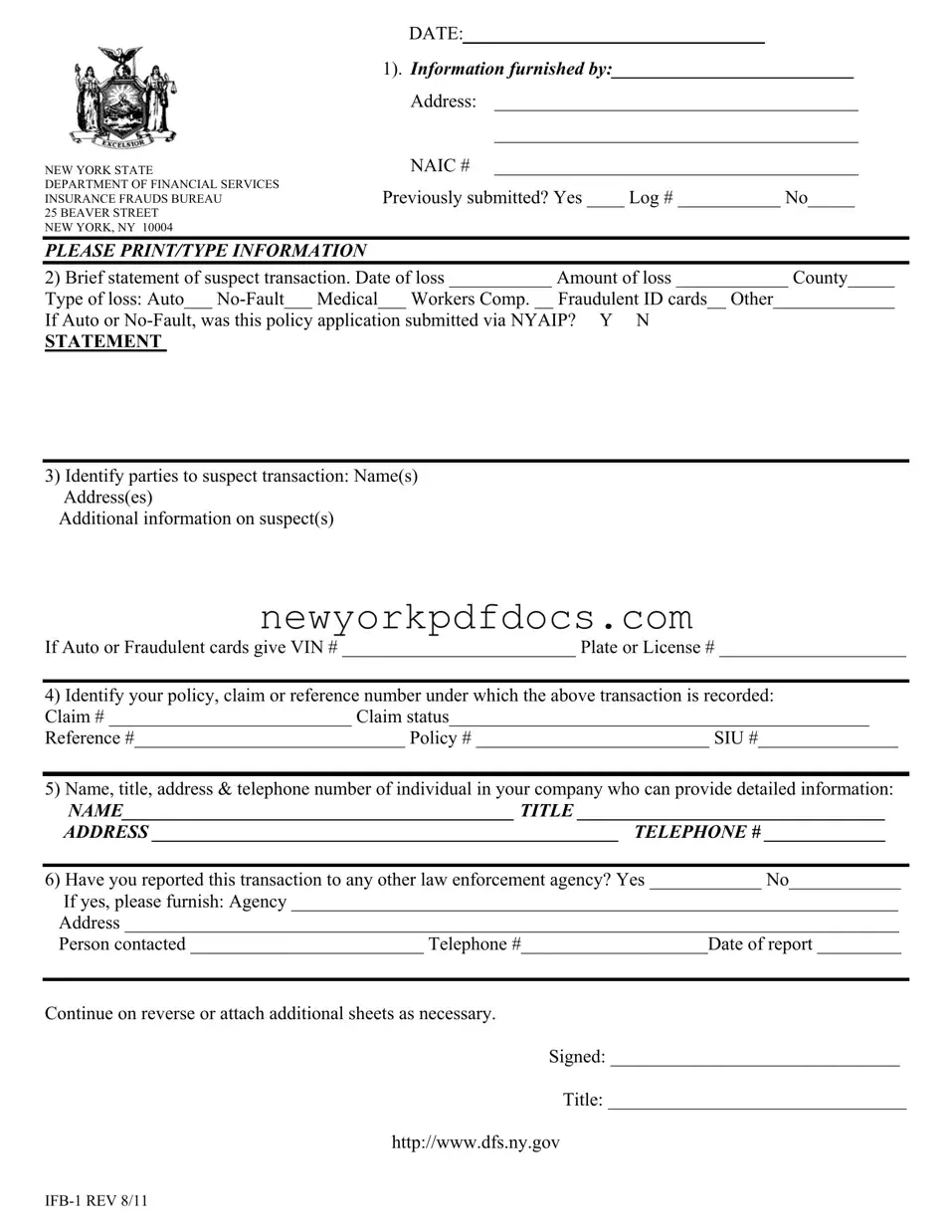

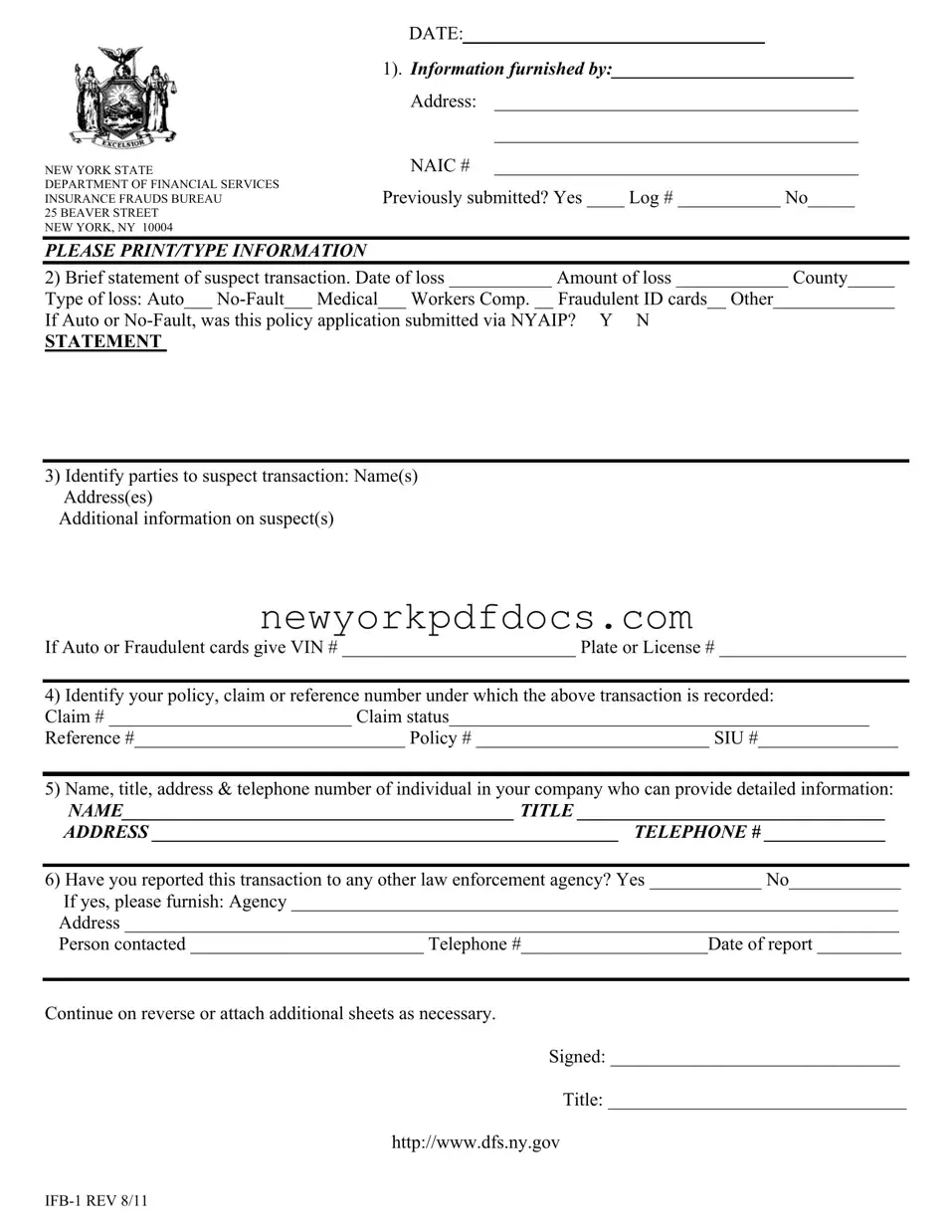

Free New York Ifb 1 Form

The New York Ifb 1 form is a crucial document used to report suspected insurance fraud to the New York State Department of Financial Services' Insurance Frauds Bureau. This form captures essential details about the fraudulent activity, including the nature of the transaction and the involved parties. Completing the Ifb 1 form accurately is vital for initiating an investigation and protecting the integrity of the insurance system.

Open My Document Now

Free New York Ifb 1 Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download New York Ifb 1 online with ease.

Open My Document Now

or

⇓ New York Ifb 1 PDF