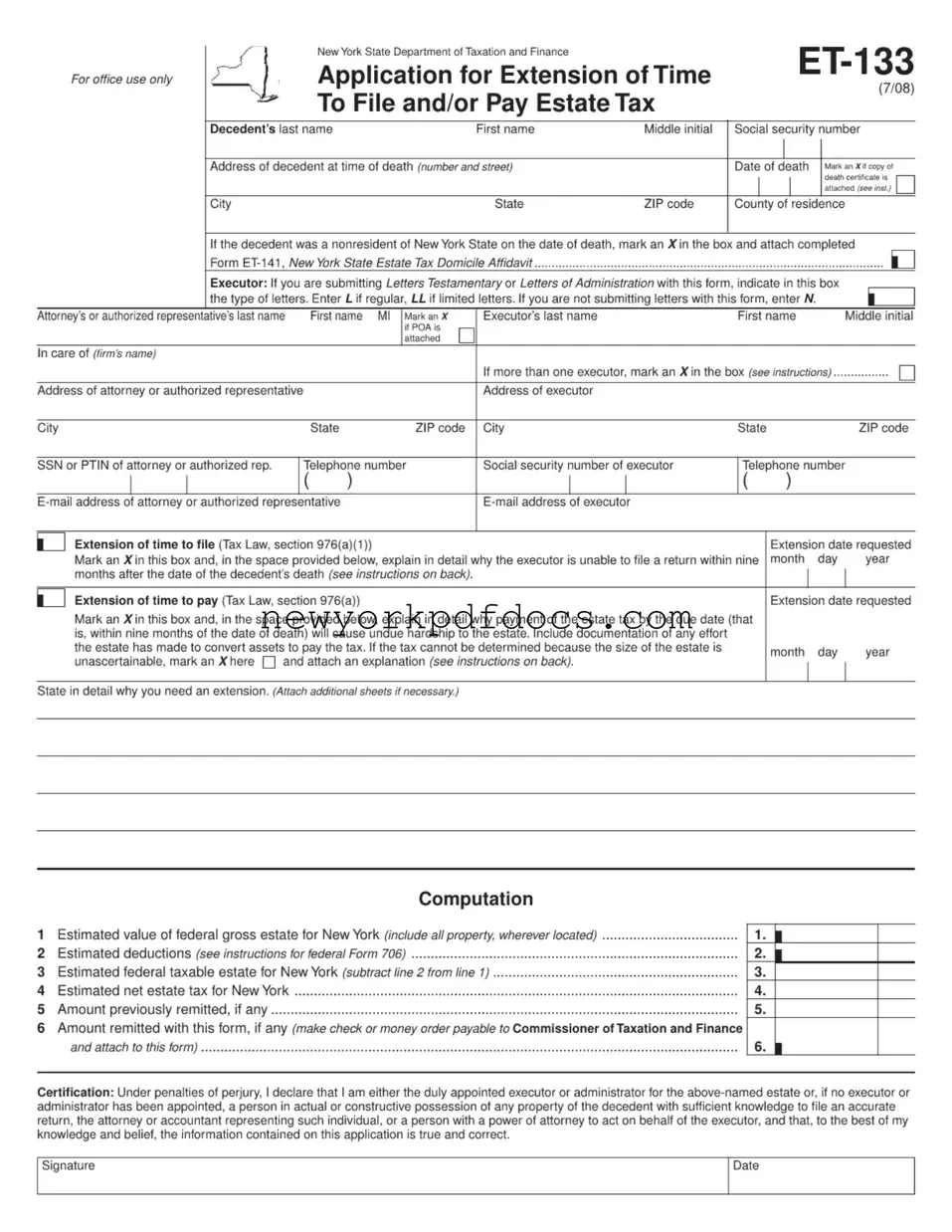

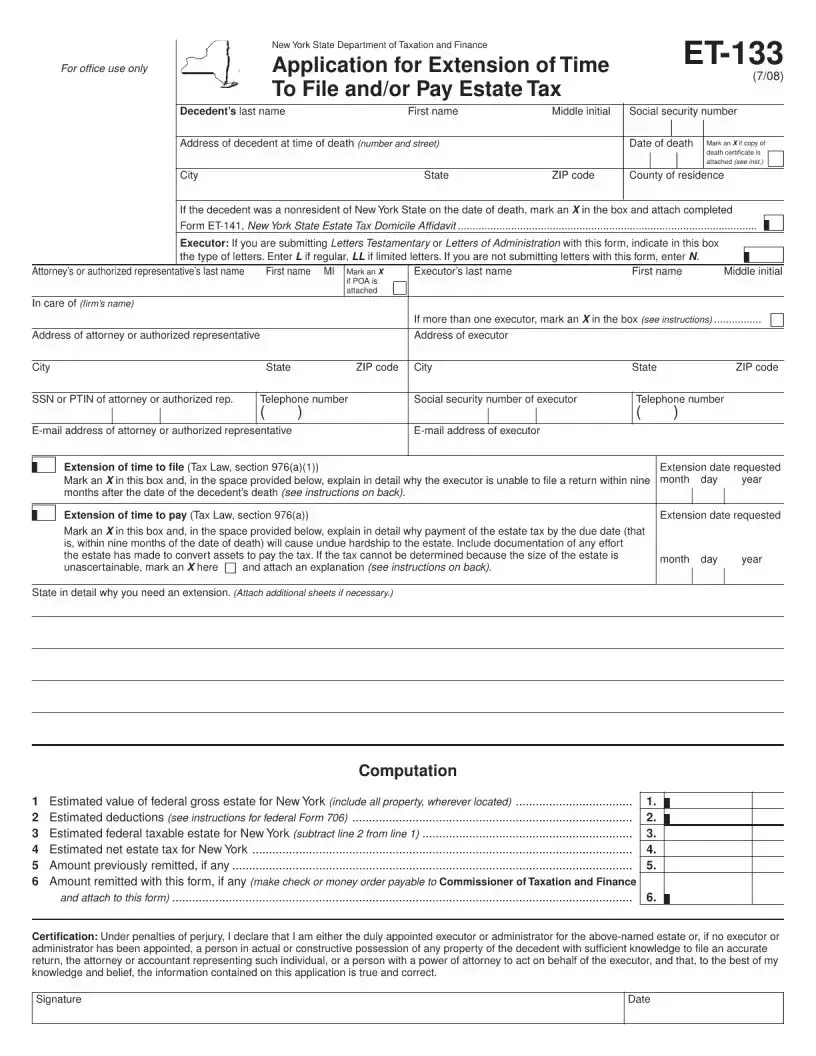

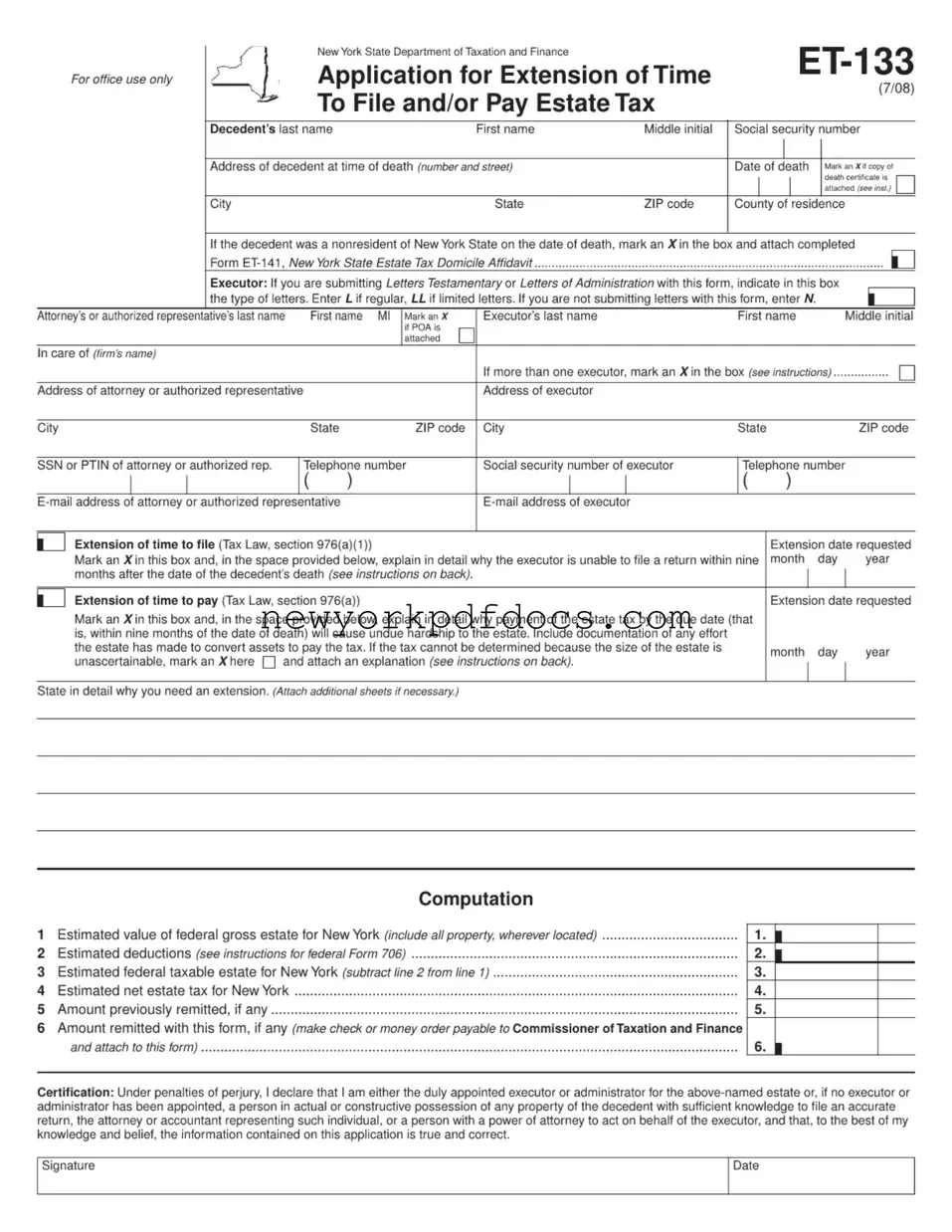

Free New York Et 133 Form

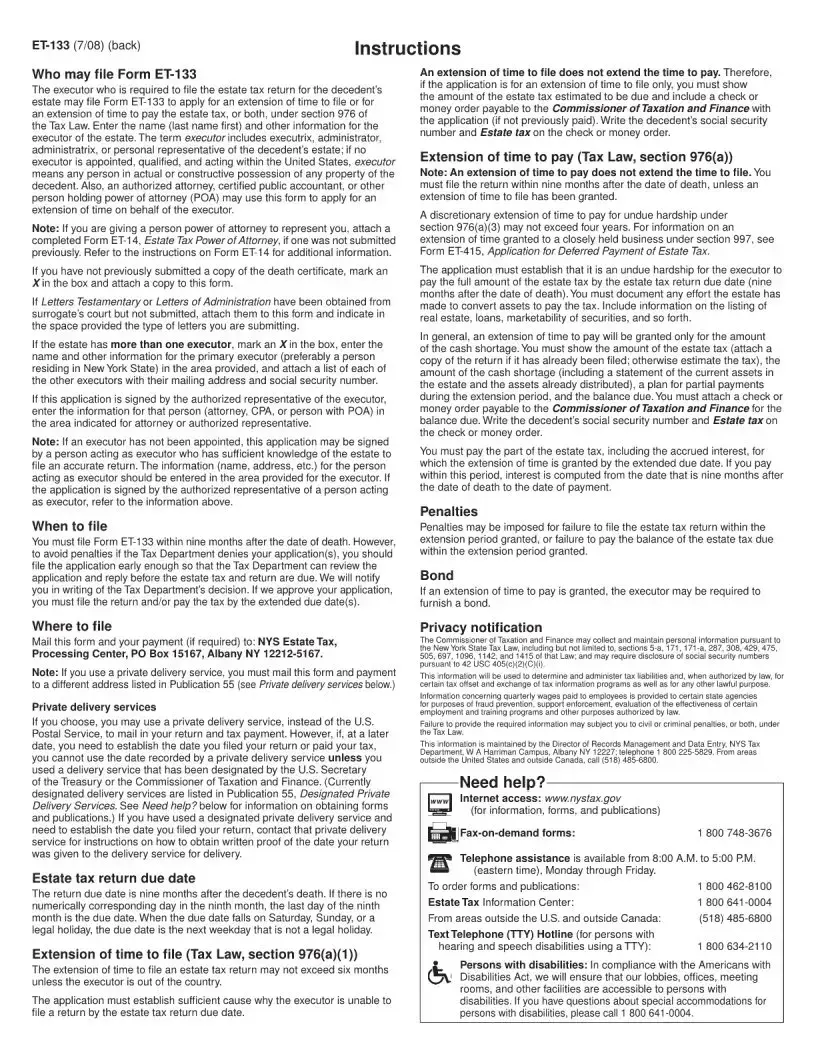

The New York ET-133 form is an application for an extension of time to file and/or pay estate tax in New York State. Executors or authorized representatives can use this form to request additional time when facing challenges in meeting the original deadline. Understanding the requirements and process for this form can ease the burden during a difficult time of loss.

Open My Document Now

Free New York Et 133 Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download New York Et 133 online with ease.

Open My Document Now

or

⇓ New York Et 133 PDF