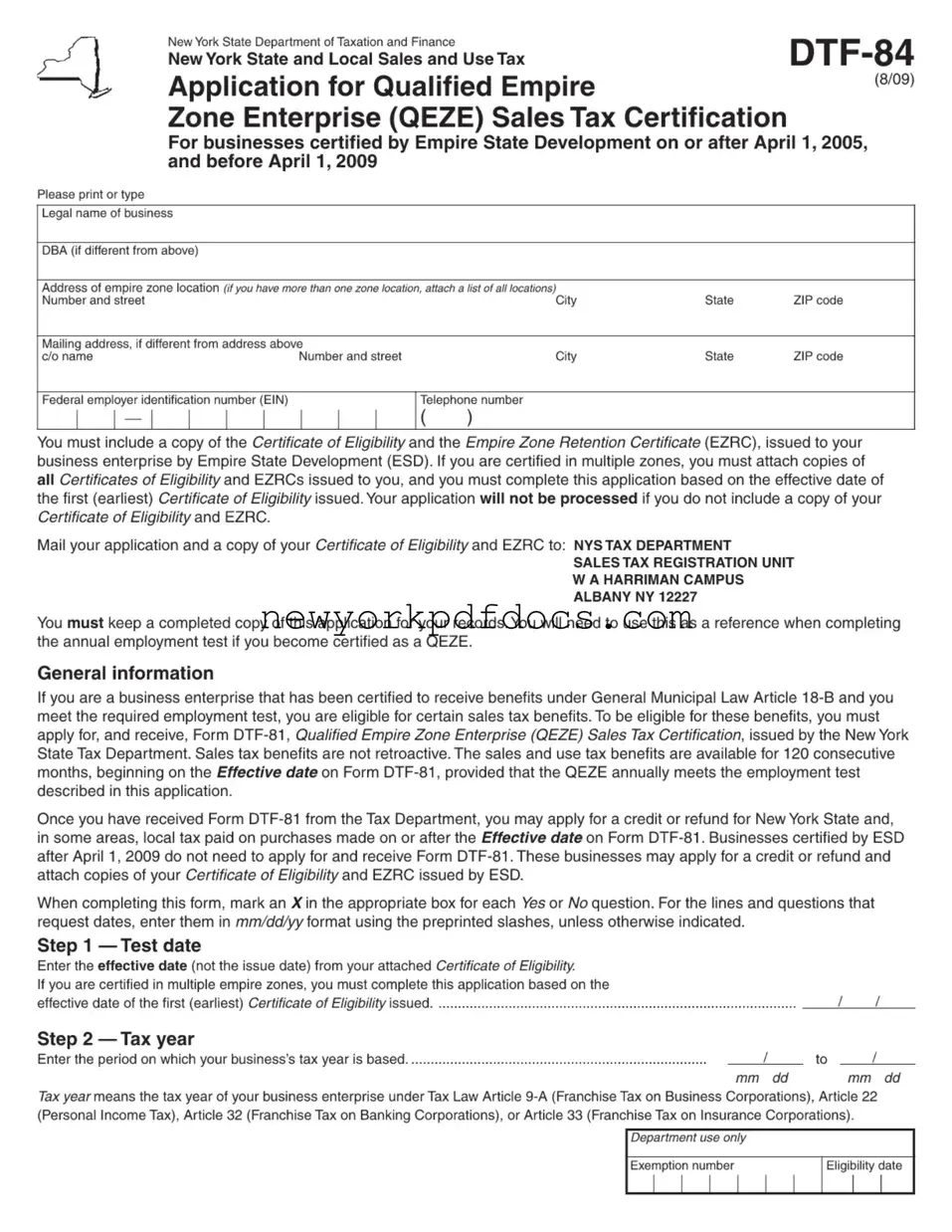

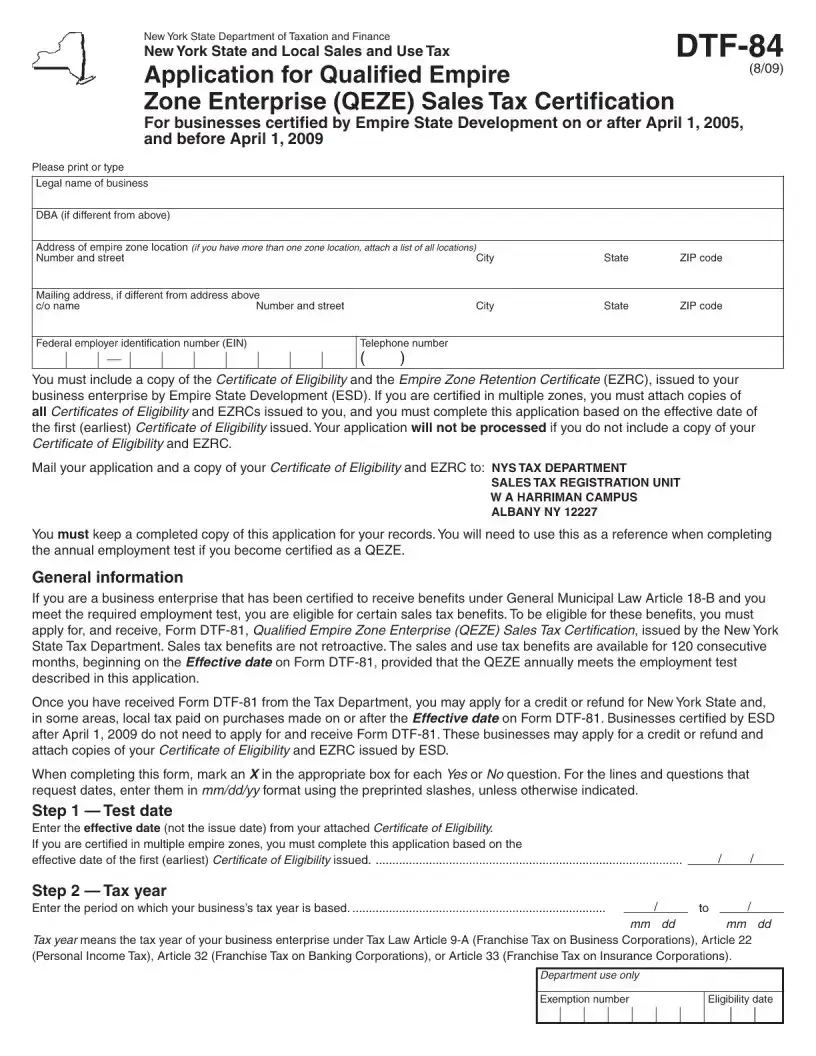

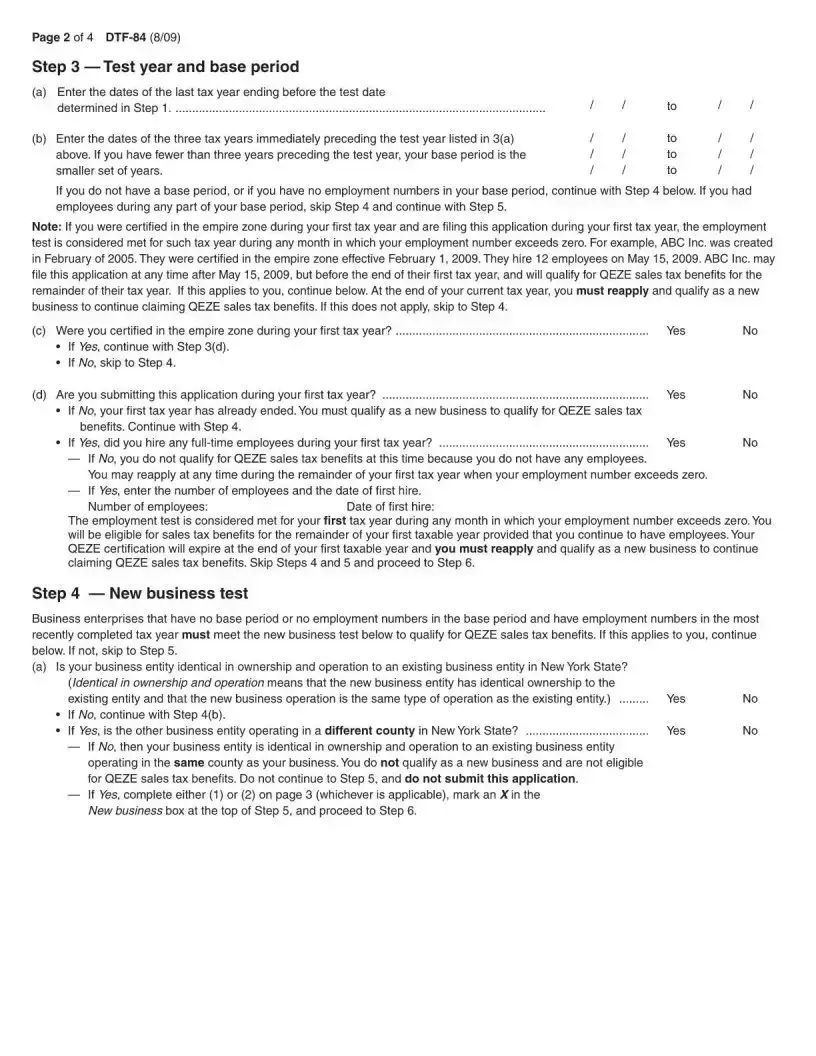

Filling out the New York DTF-84 form can be a straightforward process, but many applicants make common mistakes that can lead to delays or rejection of their applications. One frequent error is failing to include the necessary documentation. Applicants must attach a copy of the Certificate of Eligibility and the Empire Zone Retention Certificate (EZRC). Without these documents, the application cannot be processed. It is crucial to double-check that all required paperwork is included before submission.

Another mistake often seen is incorrect entry of dates. The form requires dates to be entered in a specific format: mm/dd/yy. This requirement can be easily overlooked, leading to confusion and potential rejection. Applicants should ensure they follow the format precisely, using the preprinted slashes provided on the form.

Many individuals also misinterpret the effective date versus the issue date. The form explicitly requests the effective date from the attached Certificate of Eligibility, not the date the certificate was issued. Confusion between these two dates can result in incorrect information being submitted, which can complicate the application process.

Additionally, some applicants neglect to mark an "X" in the appropriate boxes for Yes or No questions. This oversight can lead to incomplete applications, prompting further inquiries from the tax department. It is essential to carefully review each question and ensure that every applicable box is checked.

Another common error is failing to provide a complete mailing address. If the mailing address differs from the business address, it must be clearly stated. Incomplete or unclear addresses can cause delays in communication and processing, making it vital to provide accurate information.

Some applicants mistakenly believe that they can apply for retroactive benefits. However, the sales tax benefits are not retroactive, and this misunderstanding can lead to frustration. It is important for applicants to be aware that benefits are only available for purchases made on or after the effective date on Form DTF-81.

Moreover, businesses certified in multiple zones often make the mistake of not attaching copies of all Certificates of Eligibility and EZRCs. The application must be based on the earliest certificate, and failing to include all relevant documents can hinder the processing of the application.

Finally, applicants may overlook the requirement to keep a completed copy of the application for their records. This document serves as a reference for the annual employment test if the business becomes certified as a Qualified Empire Zone Enterprise (QEZE). Keeping this record is not just a good practice; it is essential for future compliance.