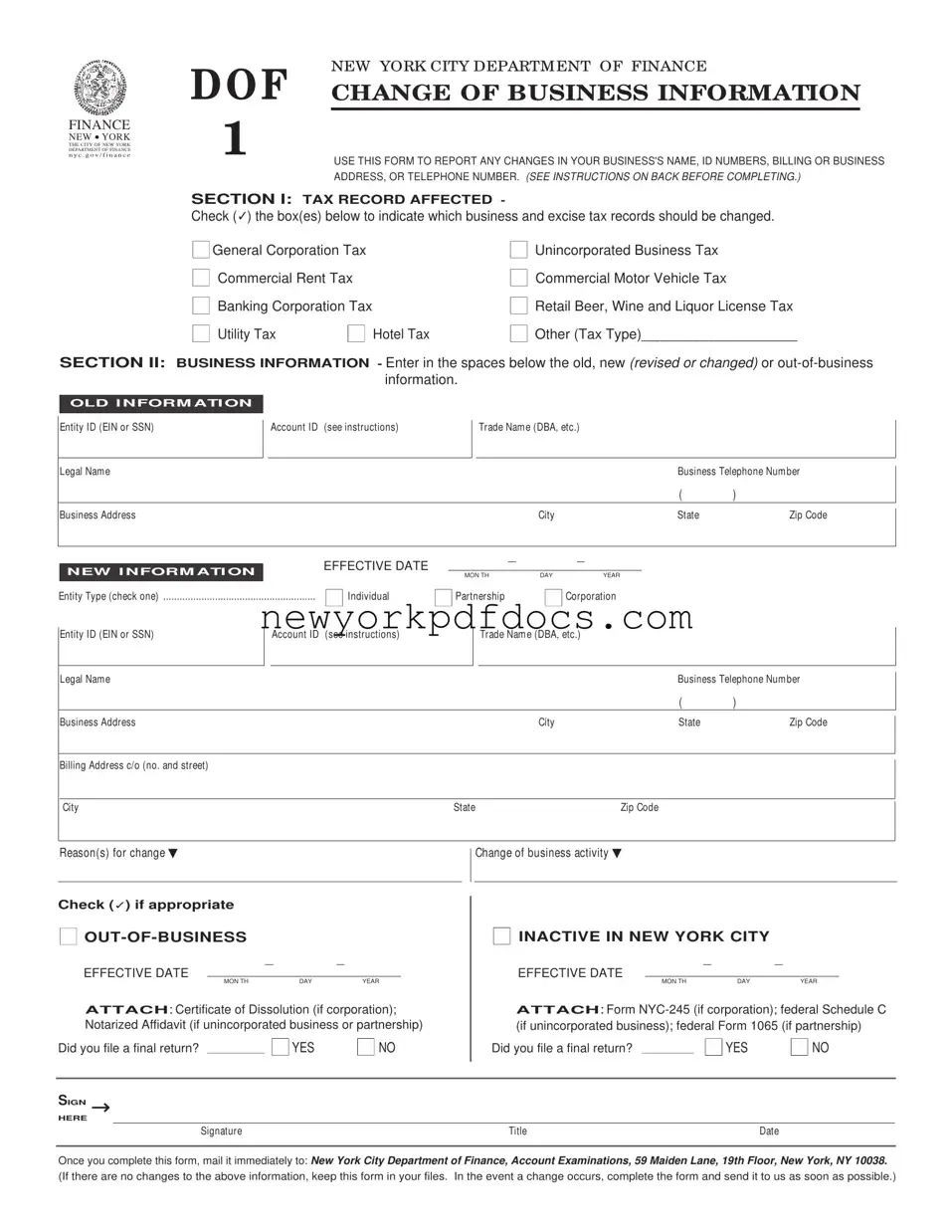

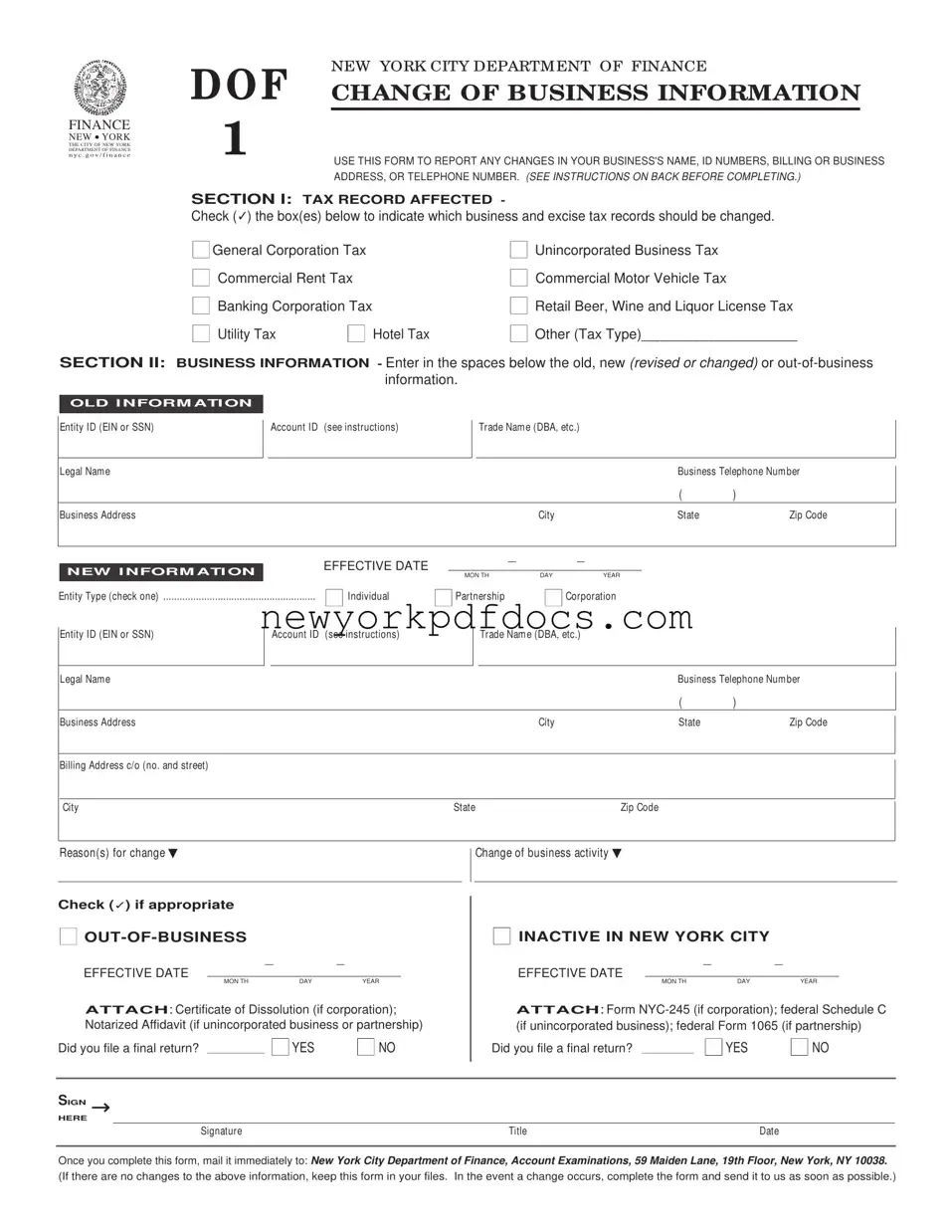

The purpose of Form DOF-1, Change of Business Information, is to provide a simple and convenient means for you to correct or update your business tax records. Please send us a completed Form DOF-1 whenever there is a change in your business's name, ID number, billing or business address, or telephone number.

If there are currently no changes to your business's information, keep this form in your files. In the event a change occurs, complete the form and send it to us as soon as possible. If you need addition- al forms, call Customer Assistance at ( 212) 504-4036.

SECTION I - TAX RECORD AFFECTED

Indicate which business tax record should be changed by marking

a✔ in the appropriate box( es) in this section. If your change affects a tax not listed, check the box labeled "Other" and enter in the space directly to the right of it the tax type.

SECTION II - BUSINESS INFORMATION

Enter in the spaces available all old and new information regarding your business's operation.

In the OLD INFORMATION area, enter your:

ENTITY ID NUMBER This is the number that is currently used to identify your business tax account. It is the number that either appears on all Department mailing labels you are presently receiv- ing, or it is the number that you entered when you last filed a tax return. This identifying number must be entered in order for us to make any account changes.

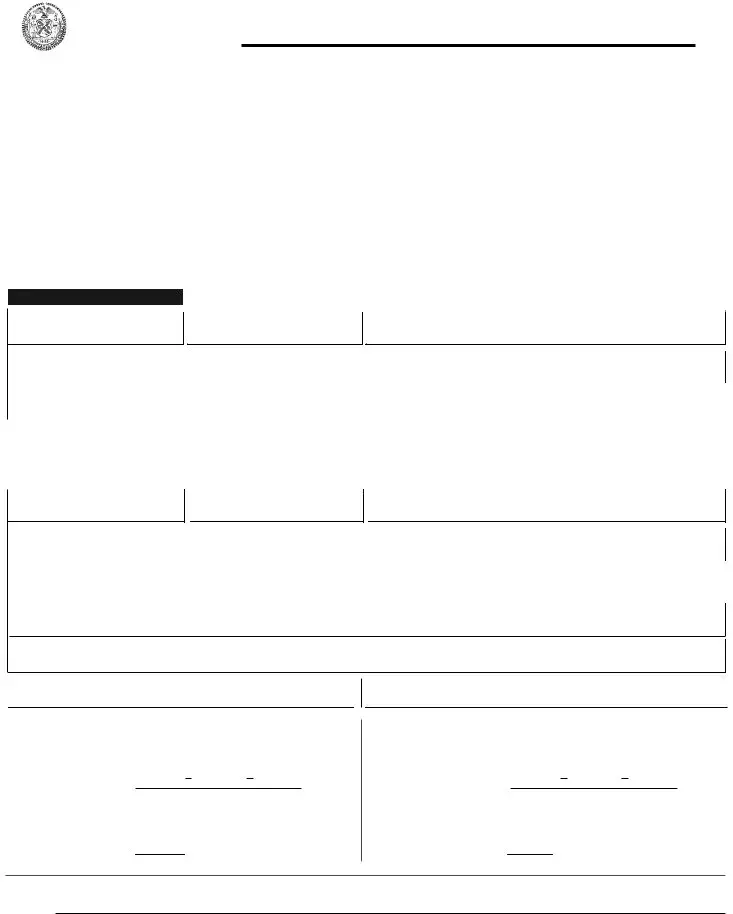

Leave this area blank unless you are changing the tax records listed below. If you have more than one account ID number, list the account ID number in the appropriate line in the chart below.

IF THE BUSINESS |

THE ACCOUNT ID NUMBER |

TAX IS.... |

TO ENTER IS... |

|

|

➧ Commercial Rent Tax |

➧ Commercial Rent Tax Registration |

|

● Number------------------------------------------------------------------------------- |

____________________________________________________________ |

➧ Commercial Motor Vehicle |

➧ Commercial License Plate |

|

● Number------------------------------------------------------------------------------- |

____________________________________________________________ |

➧ Retail Beer, Wine and |

➧ License Number |

Liquor License Tax |

● --------------------------------------------------------------------------------------------------------- |

____________________________________________________________ |

➧ Utility Tax |

➧ Utility Tax Registration |

|

● Number------------------------------------------------------------------------------- |

____________________________________________________________ |

➧ Hotel Tax |

➧ New York City Certificate |

● Number-------------------------------------------------------------------------------

____________________________________________________________

TRADE NAME This is the name that you use in conducting your normal day-to-day business operation.

Your legal name is the name under which your business owns assets or incurs debts. For sole proprietorships, it is the name of the sole proprietor; for corporations, it is the name filed with the New York Secretary of State; and for partnerships, it is the legal name used in the partnership agreement.

The address where your major business activity is physically located.

The number where you can

usually be reached during normal business hours.

In the NEW INFORMATION area, enter the date the new information became effective. Enter your new or revised:

ENTITY TYPE This is the legal form of the taxpayer. Check either individual ( e.g., sole proprietor or self-employed profession- al) , partnership or corporation. If the taxpayer is a limited liability partnership or limited liability company treated as partnership for federal income tax purposes, check partnership. If the taxpayer is a limited liability company treated as a corporation for federal income tax purposes, check corporation. If the taxpayer is a single member limited liability company owned by an individual and disregarded for federal income tax purposes, check individual. See Finance M emorandum 99-1 for additional information about disregarded entities for federal income tax purposes. Finance Memorandum 99- 1 is available on the Department website at nyc.gov/ finance.

ENTITY ID NUMBER If yo u have rec ently rec eived an EIN ( Employer Identification Number) or have otherwise changed your identification number, enter the new number here. ( If there is no change, leave this space blank.)

ACCOUNT ID NUMBER ( SEE ABOVE)

TRADE NAME ( SEE ABOVE)

LEGAL NAME ( SEE ABOVE)

BUSINESS ADDRESS AND TELEPHONE NUMBER ( SEE ABOVE)

The address where you now want us to send all of your tax returns and notices. Be sure to include your street name and number, city and post office box number, if any. ( If there is no change, leave this space blank.)

Enter the specific reaso n( s) fo r sending us this form ( i.e., change of name, change of ID number, change of entity, change of address, etc.) .

Enter any other pertinent information that will help us to properly change information about your tax records. ( If you need more space, attach a sheet to this form.)

SIGNATURE Sign your name and enter your title and the date in the spaces provided. Send your completed form to:

NYC DEPARTMENT OF FINANCE ACCOUNT EXAMINATIONS

5 9 MAIDEN LANE, 1 9 TH FLOOR NEW YORK, NY 1 0 0 3 8

PRIVACY ACT NOTIFICATION

The Federal Privacy Act of 1974, as amended, requires agencies requesting Social Security Numbers to inform individuals from whom they seek this information as to whether compliance with the request is voluntary or mandatory, why the request is being made and how the information will be used. The disclosure of Social Security Numbers for taxpayers is mandatory and is required by sec- tion 11-102.1 of the Administrative Code of the City of New York. Such numbers disclosed on any report or return are requested for tax administration purposes and will be used to facilitate the pro- cessing of tax returns and to establish and maintain a uniform system for identifying taxpayers who are or may be subject to taxes administered and collected by the Department of Finance, and, as may be required by law, or when the taxpayer gives written authorization to the Department of Finance for another department, person, agency or entity to have access ( limited or otherwise) to the information contained in his or her return.

DOF-1 2006