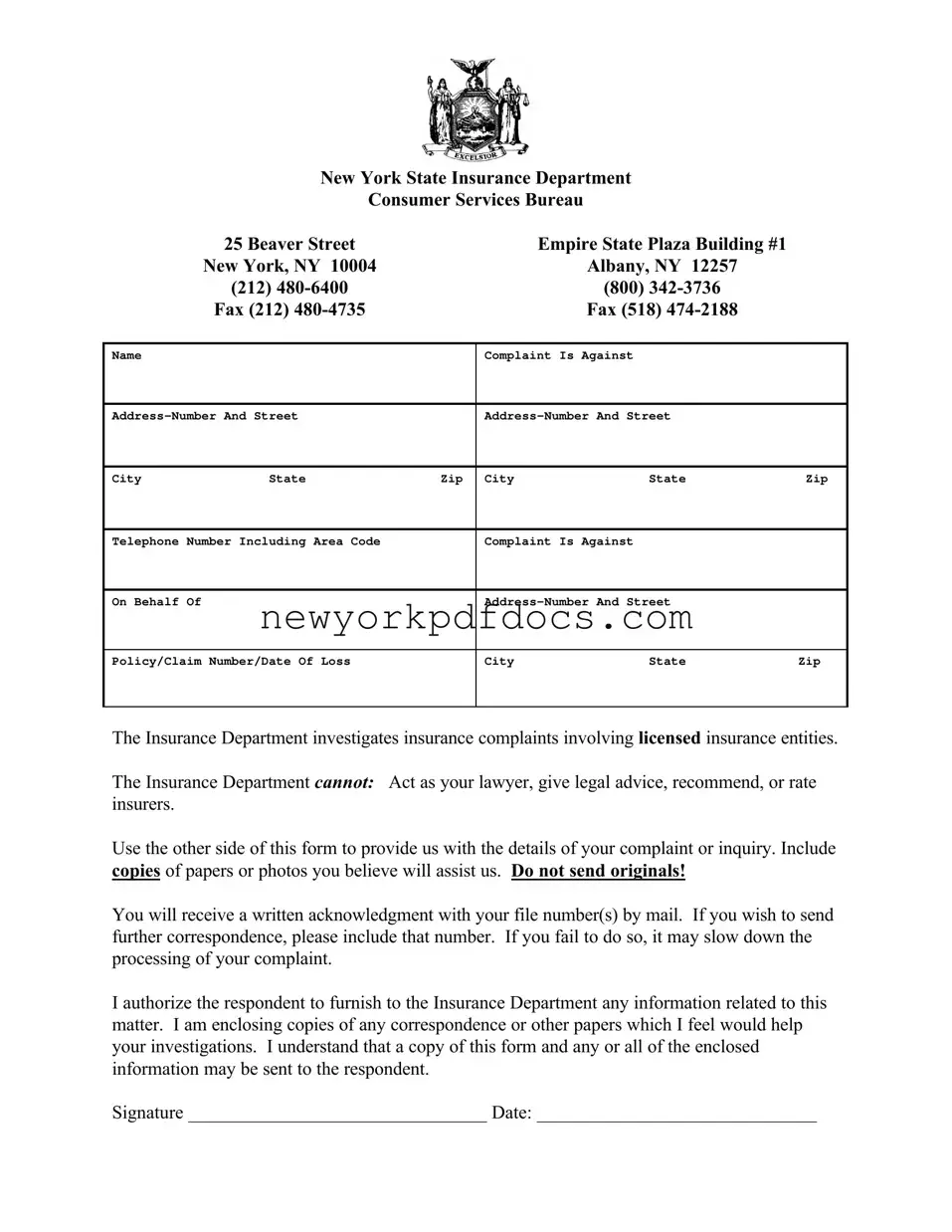

Filling out the New York Department of Insurance form can be a straightforward process, but mistakes can lead to delays in addressing your concerns. One common error is failing to provide complete contact information. Ensure that your name, address, and telephone number are filled out accurately. Missing or incorrect details can hinder the department's ability to reach you.

Another frequent mistake involves not specifying the complaint clearly. It is essential to articulate the issue you are facing in a concise manner. Avoid vague descriptions. Instead, provide specific details about your complaint, including relevant dates and events. This helps the department understand your situation better.

People often forget to include their policy or claim number. This information is crucial for the department to locate your records quickly. Without it, processing your complaint may take longer than necessary. Always double-check that this number is included in your submission.

Additionally, many individuals neglect to provide supporting documents. If you have any correspondence or evidence that supports your complaint, include copies with your form. These documents can significantly assist in the investigation. Remember, do not send original documents, as they will not be returned.

Another mistake is not signing and dating the form. A signature is necessary to authorize the department to investigate your complaint. Without it, your submission may be considered incomplete. Make sure to sign and date the form before sending it in.

Some people fail to keep a copy of their completed form. Retaining a copy is important for your records and can be helpful if you need to follow up on your complaint. It also provides you with a reference should any questions arise during the investigation process.

Moreover, not including a clear request for action can lead to confusion. Be explicit about what you hope to achieve with your complaint. Whether you seek a resolution, compensation, or clarification, stating your expectations can guide the department in addressing your concerns effectively.

Lastly, individuals sometimes forget to reference their file number in any subsequent correspondence. Once you receive your acknowledgment letter with the file number, always include it in future communications. This practice ensures that your correspondence is linked to your original complaint, facilitating a smoother process.