State of New York, County of

ss.:

being duly sworn, deposes, and says; that deponent is not a party to the action, is over 18 years of age and resides at

That on

deponent served the within bill of costs and notice of taxation on

attorney(s) for

herein, at his/her office at

during his/her absence from said office. Strike out either (a) or (b).

(a) by then and there leaving a true copy of the same with

his/her clerk; partner; person having charge of said office.

(b)and said office being closed, by depositing a true copy of the same, enclosed in a sealed wrapper directed to said attorney(s), in the office letter drop or box.

Sworn to before me on

State of New York, County of |

ss.: |

being duly sworn, deposes and says; that deponent is not a party to the action, is over 18 years of age and resides at

That on

deponent served the within bill of costs and notice of taxation on

attorney(s) for at

the address designated by said attorney(s) for that purpose by depositing a true copy of same enclosed in a post paid properly addressed wrapper, in--a post office--official depository under the exclusive care and custody of the United Sates Post Service within New York State.

Sworn to before me on

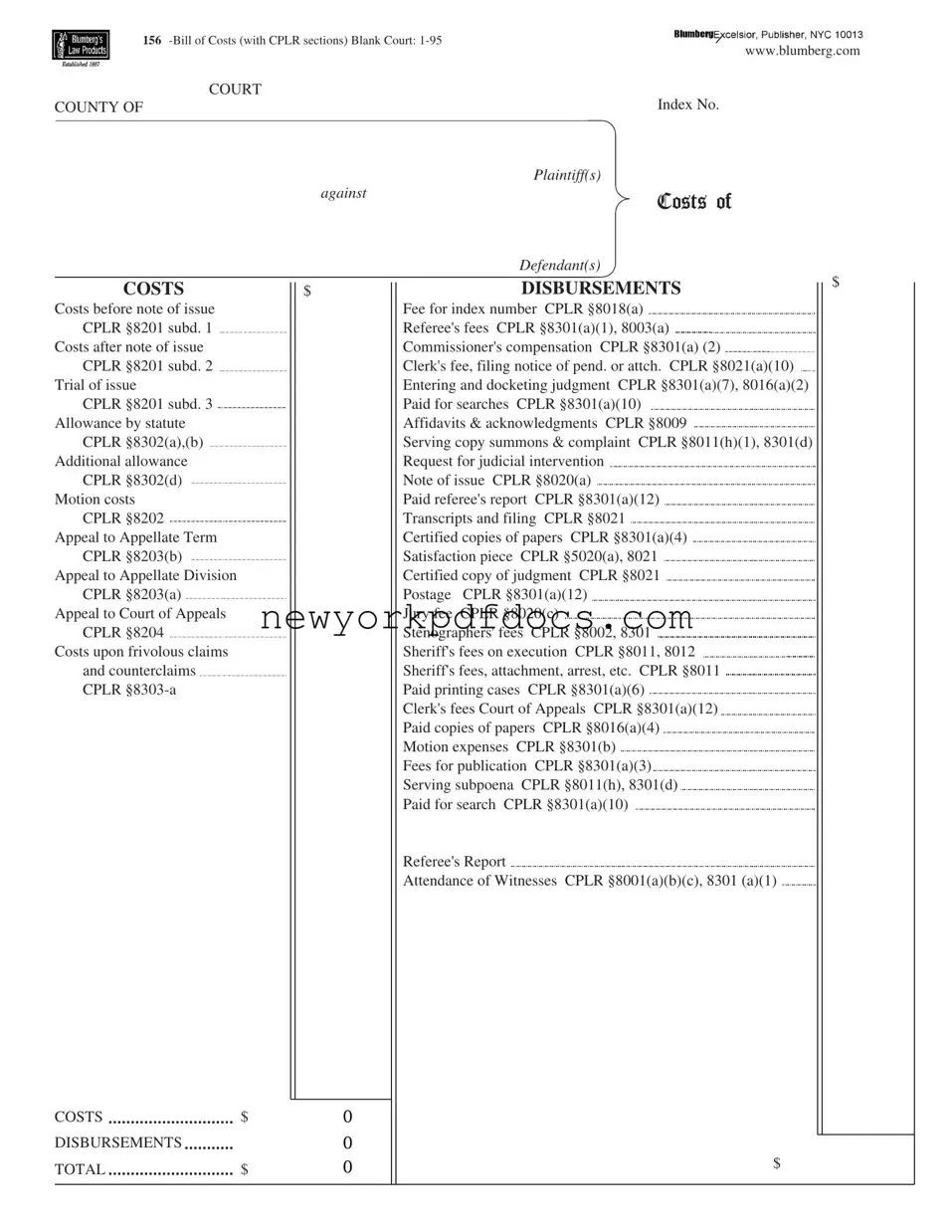

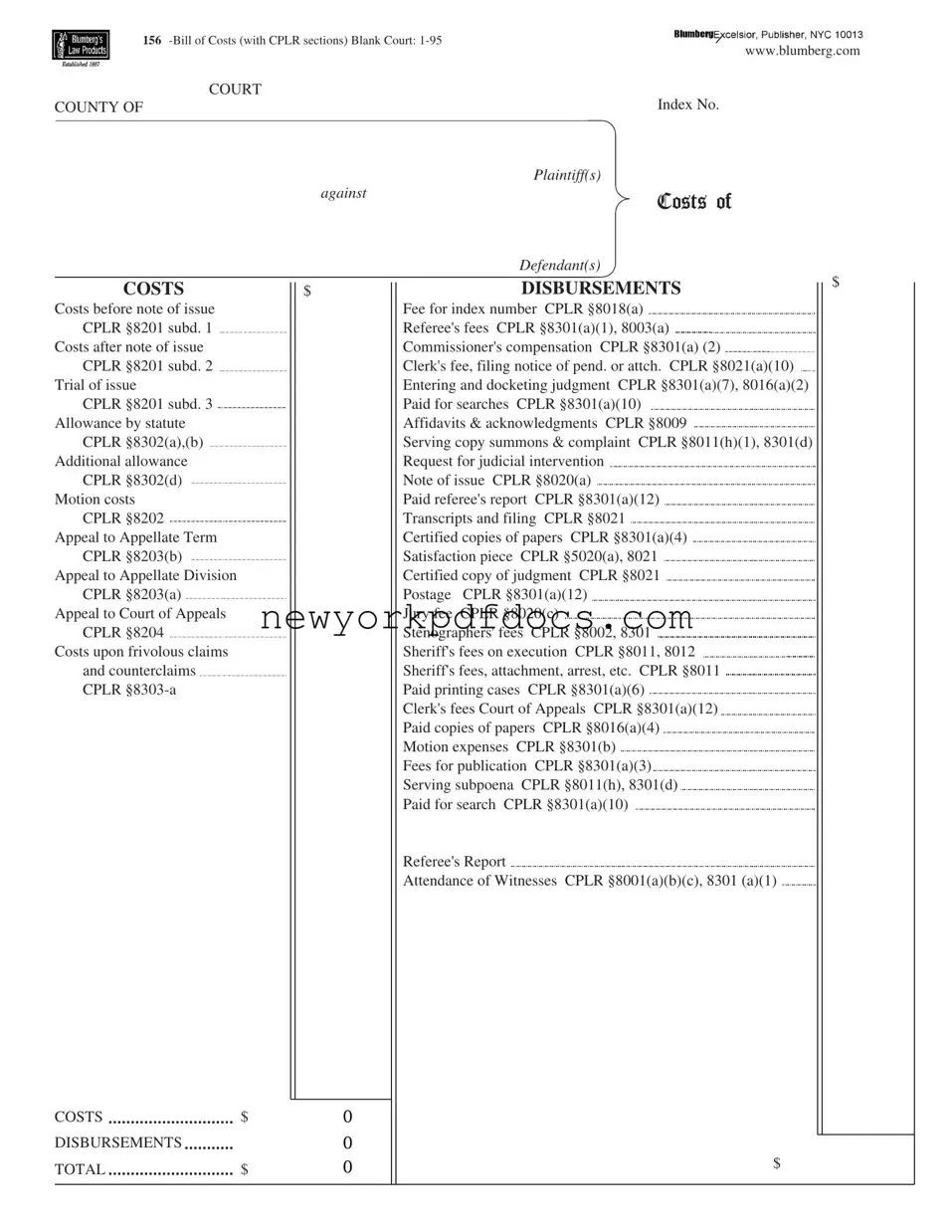

Index No.

COURT

COUNTY OF

Plaintiff(s)

against

Defendant(s)

Bill of Costs

Please Take Notice that the within is a true copy of the items of costs and disbursements in the within action

taxed *

and the same will be taxed *

by the clerk of

Court, at his/her office in the courthouse thereof on

atM.

of that day--and the amount inserted in the judgment.

Yours, etc.

Attorney(s) for

To

Attorney(s) for

Service of the within bill of costs and notice of taxation is hereby admitted on

Attorney(s) for

ATTORNEY'S AFFIRMATION

STATE OF NEW YORK, COUNTY OF

ss.

The undersigned, an attorney admitted to practice in the courts of this state, affirms: that I am

the attorney(s) of record for the

in the above entitled action; that the foregoing disbursements have been or will be necessarily be made or incurred in this action and are reasonable in amount and that each of the persons named as witnessses attended as such witness on the trial, hearing or examination before trial herein the number of days set opposite their names; that each of said persons resided the number of miles set opposite their names, from the place of said trial, hearing or examination; and each of said persons, as such witness as aforesaid, necessarily traveled the number of miles to set opposite their names in traveling to, and the same distance in returning from, the same place of trial, hearing or examination; and that copies of documents or papers as charged herein were actually and necessarily obtained for use.

The undersigned affirms that the foregoing statements are true, under the penalties of perjury.

Dated:

The name signed must be printed beneath