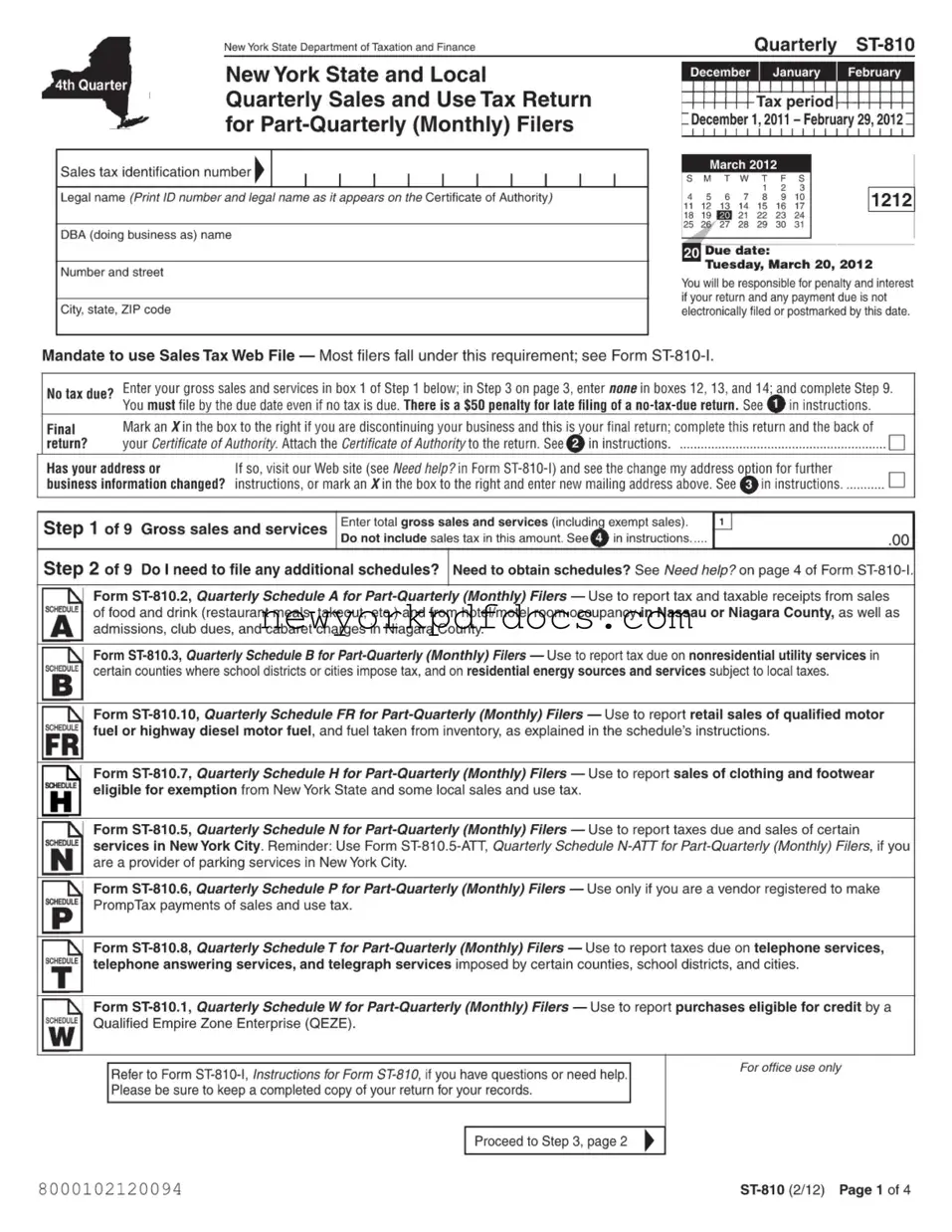

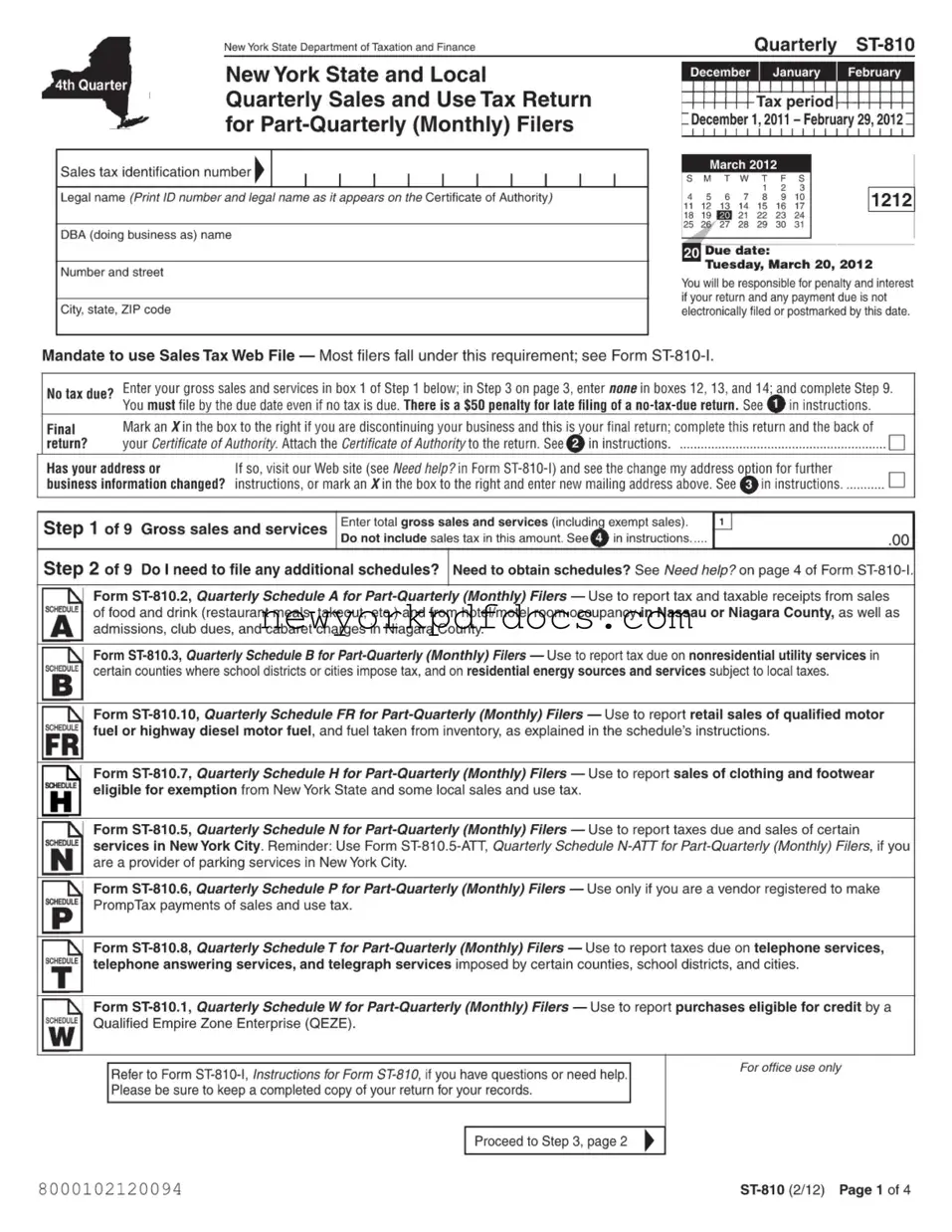

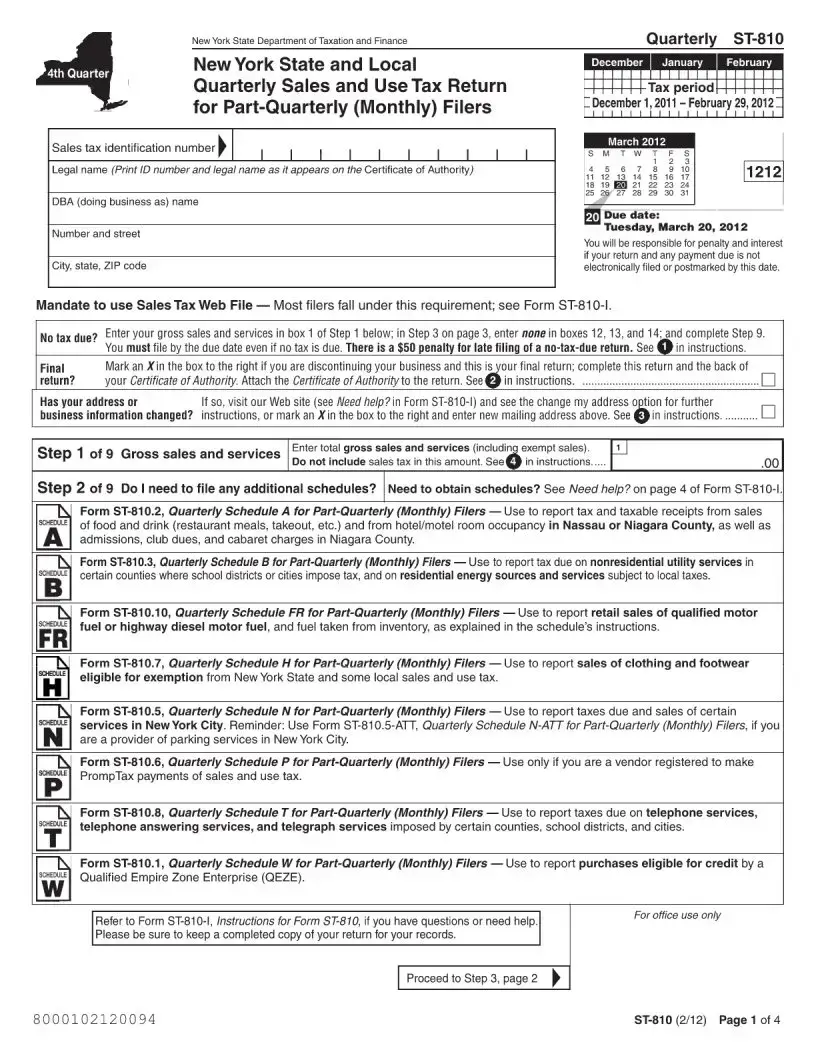

Filling out the New York ST-810 form can be a straightforward process, but there are common mistakes that individuals and businesses often make. One significant error is failing to include the correct sales tax identification number. This number is essential for processing the return accurately. If this number is missing or incorrect, it can lead to delays or penalties.

Another frequent mistake is neglecting to report all gross sales and services. It is crucial to enter the total gross sales accurately in the designated box. Omitting certain sales, whether they are exempt or not, can result in discrepancies and potential audits.

Many filers also overlook the importance of marking the correct box if they are discontinuing their business. If this is the final return, it is vital to indicate that clearly. Failure to do so can complicate future filings and may lead to unnecessary penalties.

Address changes are often a source of confusion. When a business's address or information changes, it is important to update this on the form. Many individuals forget to mark the box indicating a change, which can lead to miscommunication and delays in receiving important documents from the tax department.

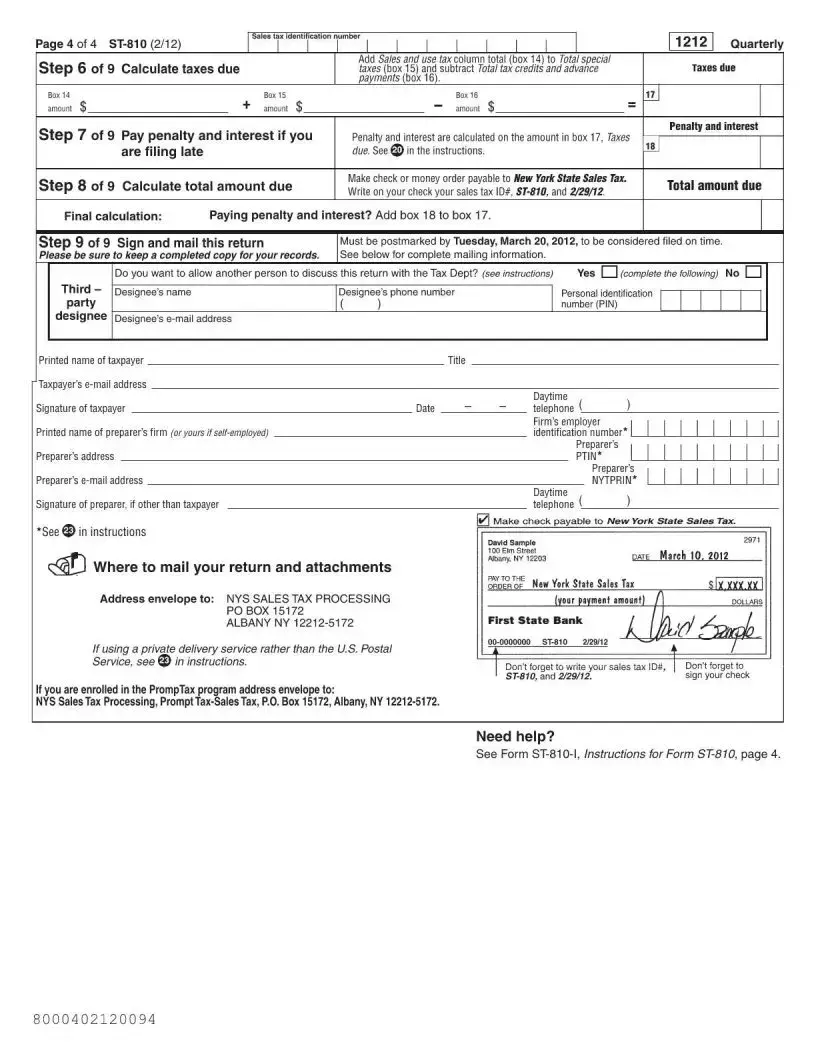

In addition, some filers mistakenly assume that they do not need to file if no tax is due. This is incorrect; even if there is no tax due, the form must still be submitted by the due date to avoid a penalty. A late filing fee of $50 can be incurred for failing to submit a no-tax-due return.

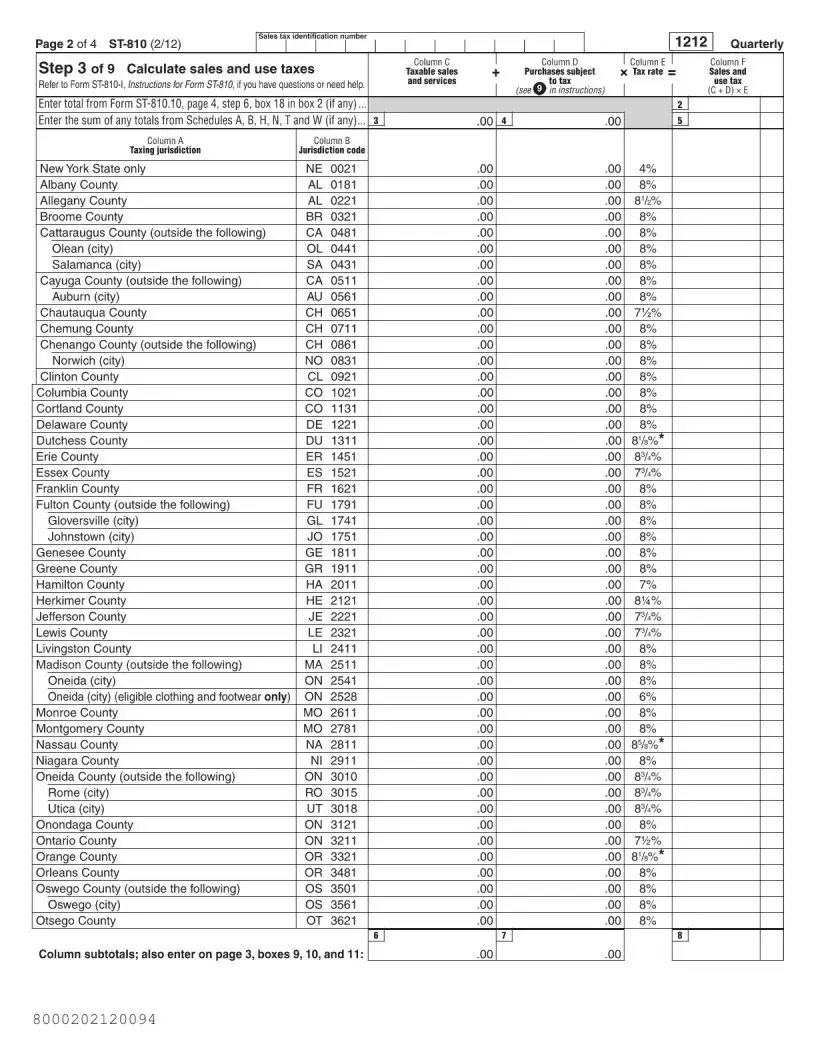

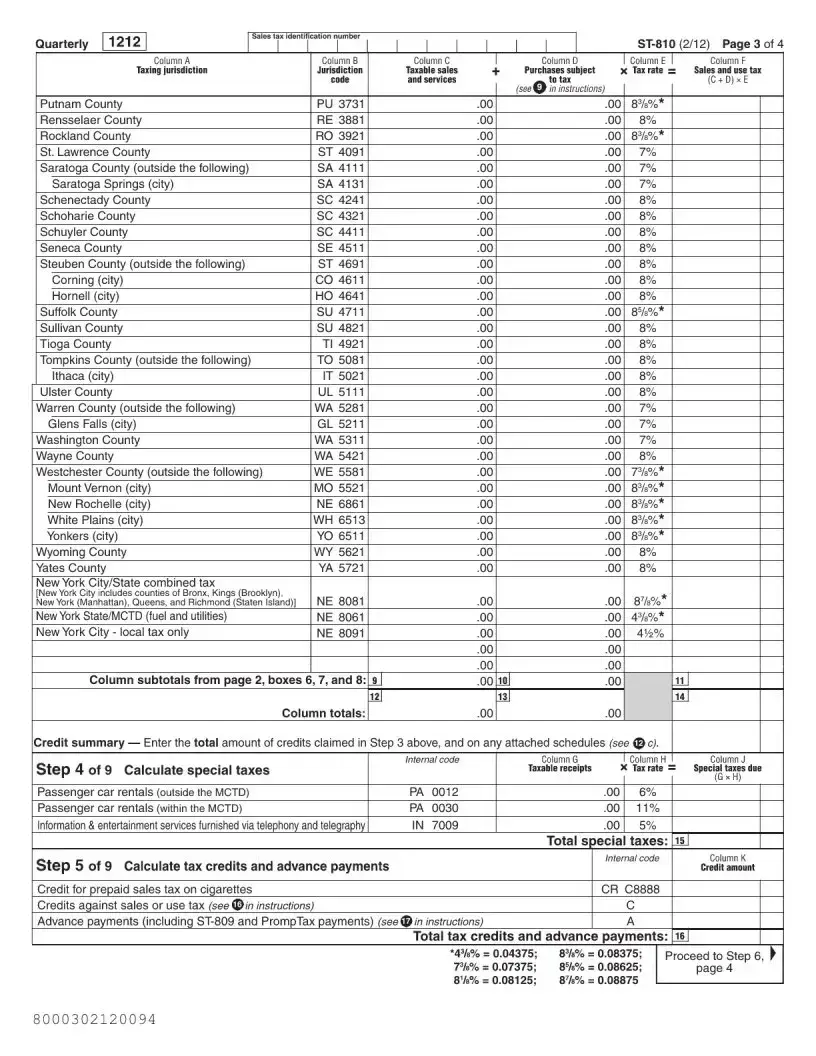

Calculating taxes can also be a source of errors. Some individuals may miscalculate the taxable sales and purchases. It is essential to follow the instructions carefully and ensure that the calculations are accurate. Errors in this area can lead to underpayment or overpayment of taxes.

Another common oversight is neglecting to keep a copy of the completed return. Retaining a copy is important for future reference and can be helpful in case of any discrepancies or audits. Without this documentation, it can be challenging to resolve issues that may arise later.

Additionally, failing to use the appropriate schedules can complicate the filing process. Each schedule serves a specific purpose, and not utilizing them correctly can lead to incomplete information being submitted. Filers should review the instructions to determine which schedules are necessary for their situation.

Lastly, some individuals do not take advantage of the resources available for assistance. The New York State Department of Taxation and Finance provides guidance and help for those who may have questions. Ignoring these resources can lead to avoidable mistakes and complications.