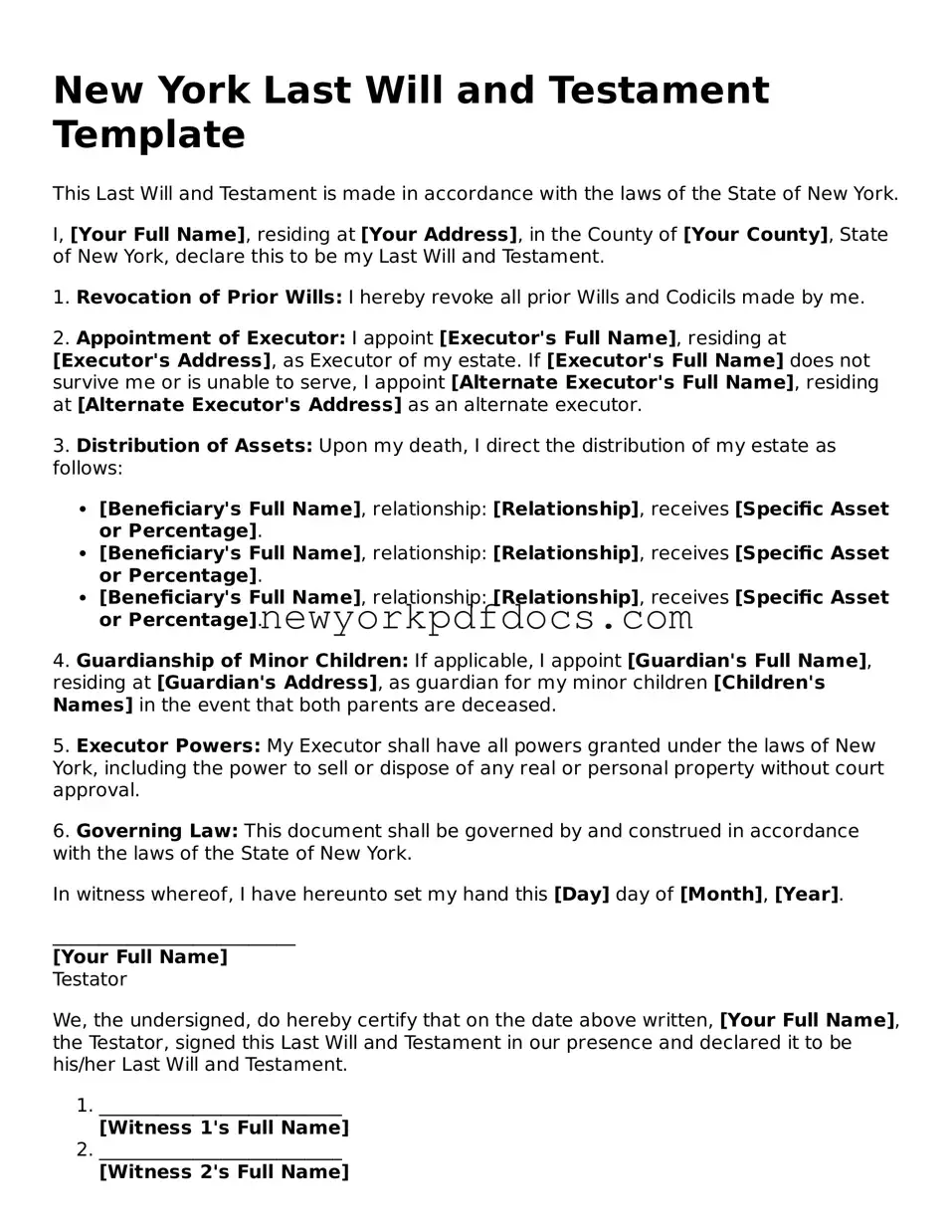

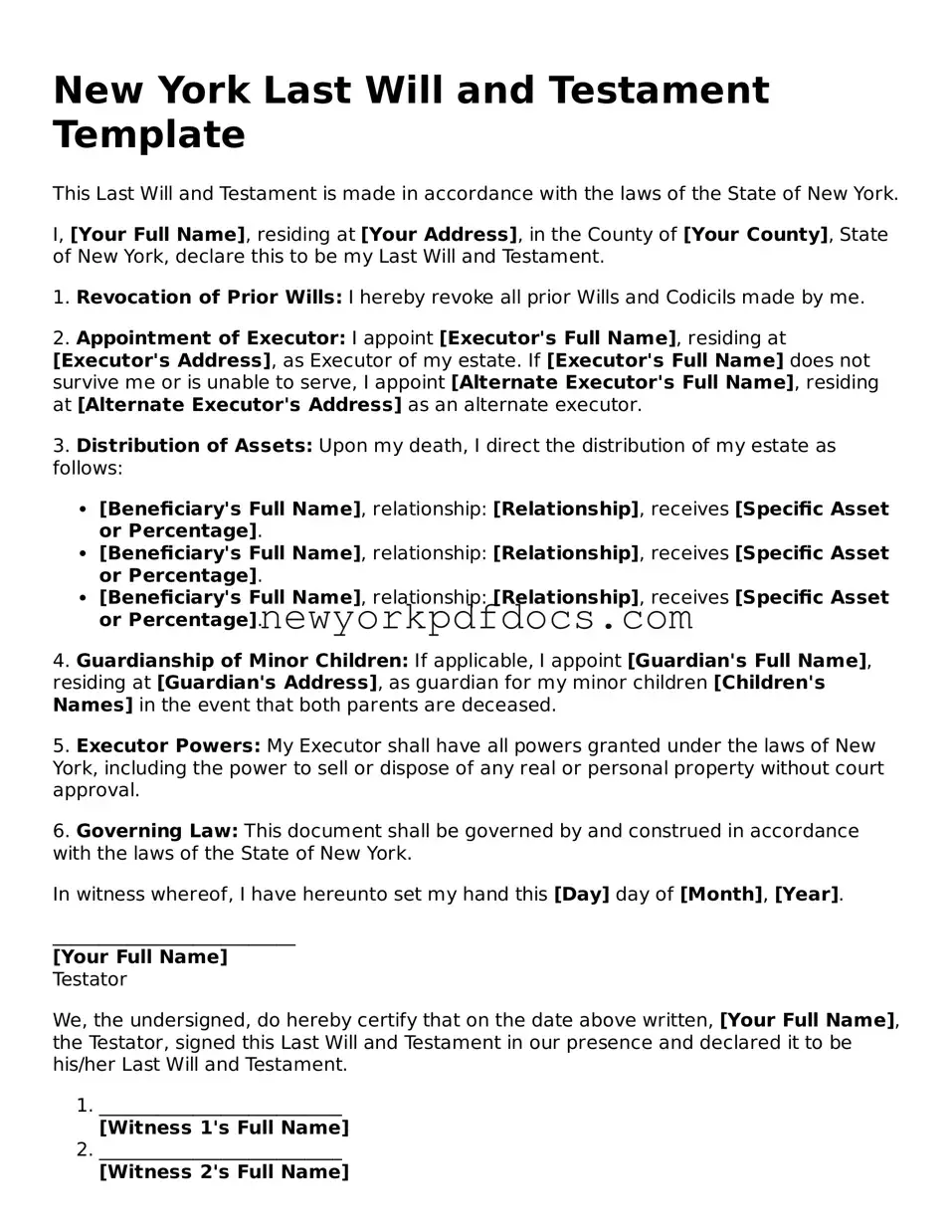

Valid Last Will and Testament Document for New York

A New York Last Will and Testament form is a legal document that outlines how a person's assets and affairs will be handled after their death. This form allows individuals to express their wishes regarding the distribution of their property, guardianship of minors, and other important matters. Understanding this document is essential for ensuring that your desires are honored and your loved ones are cared for according to your wishes.

Open My Document Now

Valid Last Will and Testament Document for New York

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Last Will and Testament online with ease.

Open My Document Now

or

⇓ Last Will and Testament PDF