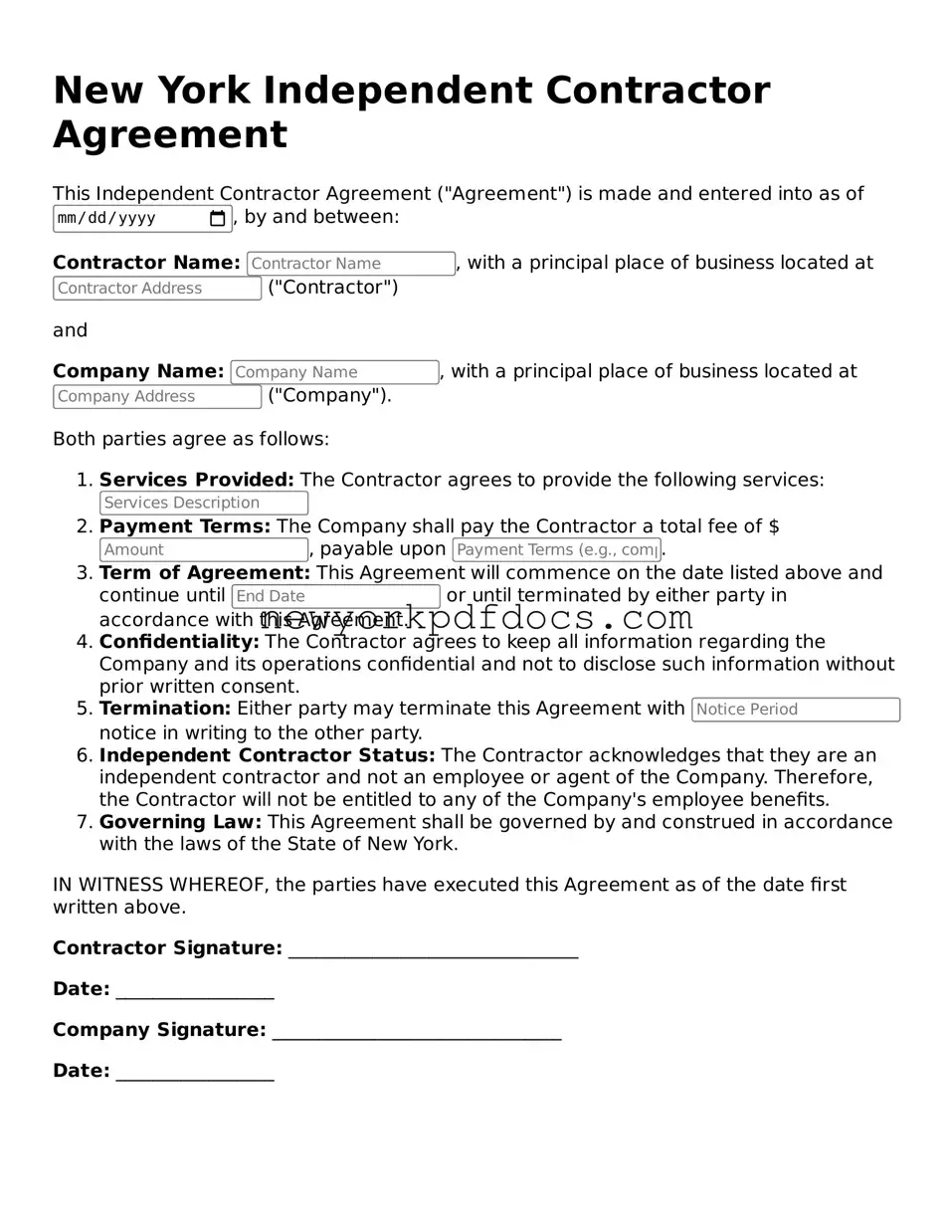

Valid Independent Contractor Agreement Document for New York

The New York Independent Contractor Agreement is a legal document that outlines the terms and conditions between a business and an independent contractor. This agreement defines the scope of work, payment terms, and responsibilities of both parties. Understanding this form is essential for ensuring a clear and professional working relationship.

Open My Document Now

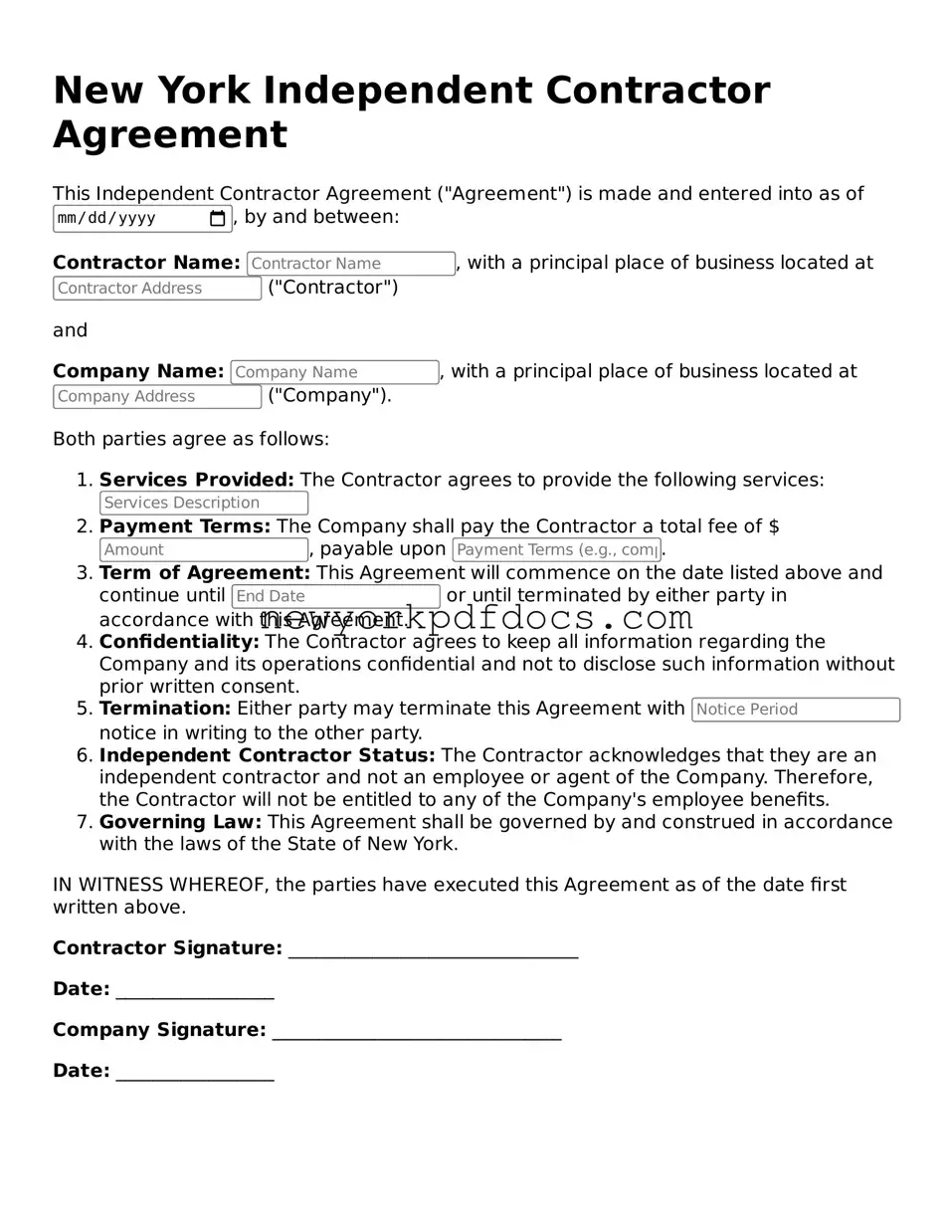

Valid Independent Contractor Agreement Document for New York

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Independent Contractor Agreement online with ease.

Open My Document Now

or

⇓ Independent Contractor Agreement PDF