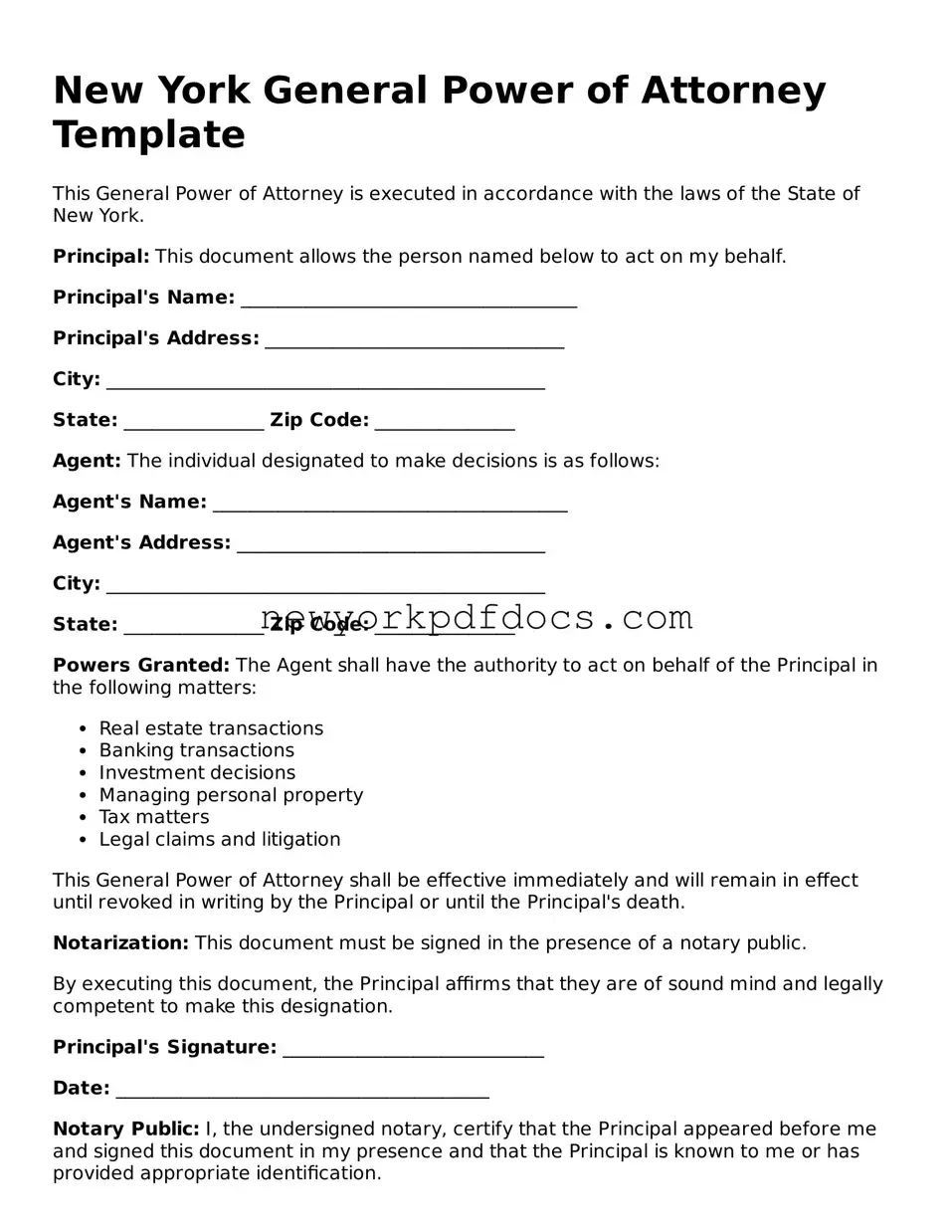

Valid General Power of Attorney Document for New York

A New York General Power of Attorney form is a legal document that allows one person to grant another the authority to act on their behalf in financial and legal matters. This form is essential for individuals who wish to ensure their affairs are managed by a trusted person when they are unable to do so themselves. Understanding its purpose and implications can help in making informed decisions for future planning.

Open My Document Now

Valid General Power of Attorney Document for New York

Open My Document Now

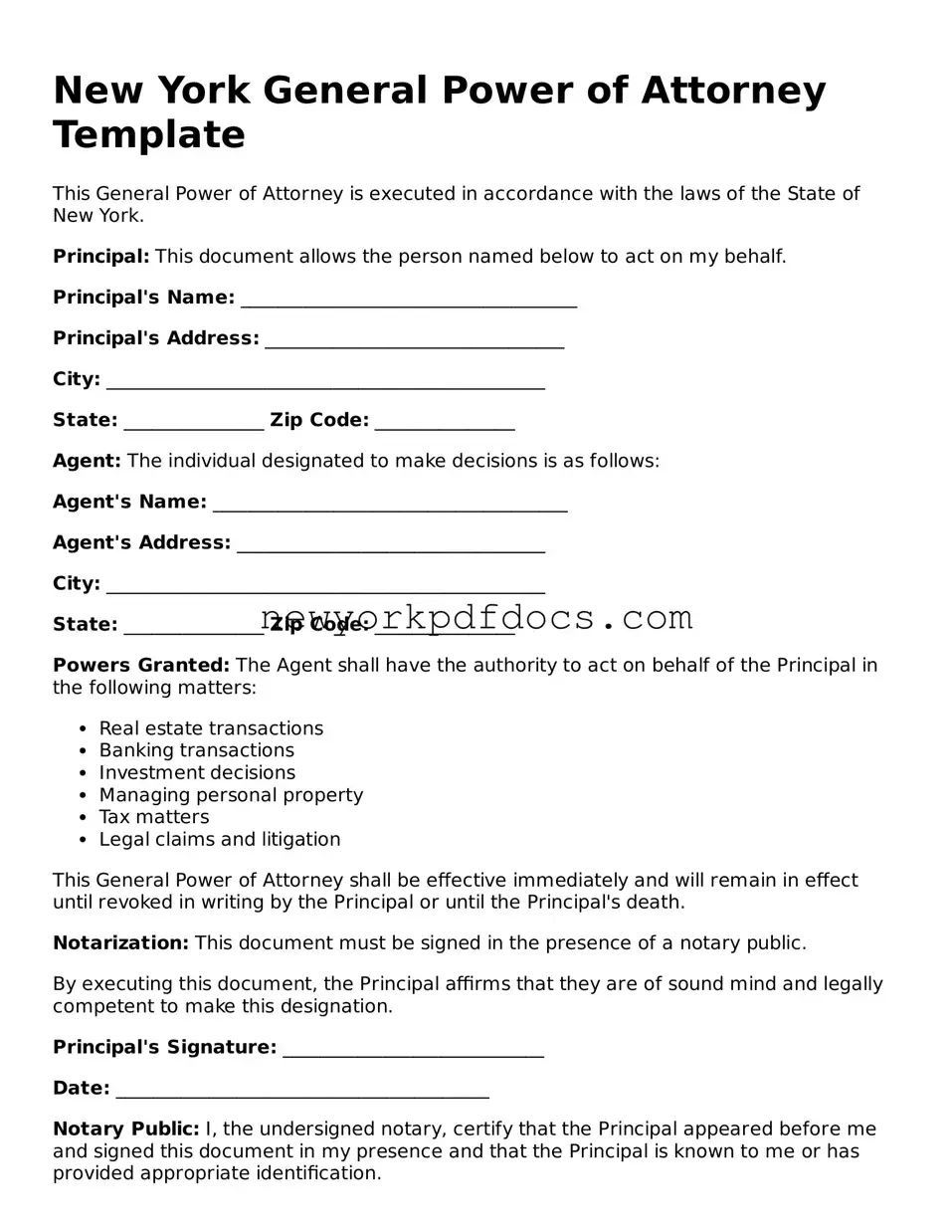

Your form isn’t finalized yet

Edit, save, and download General Power of Attorney online with ease.

Open My Document Now

or

⇓ General Power of Attorney PDF