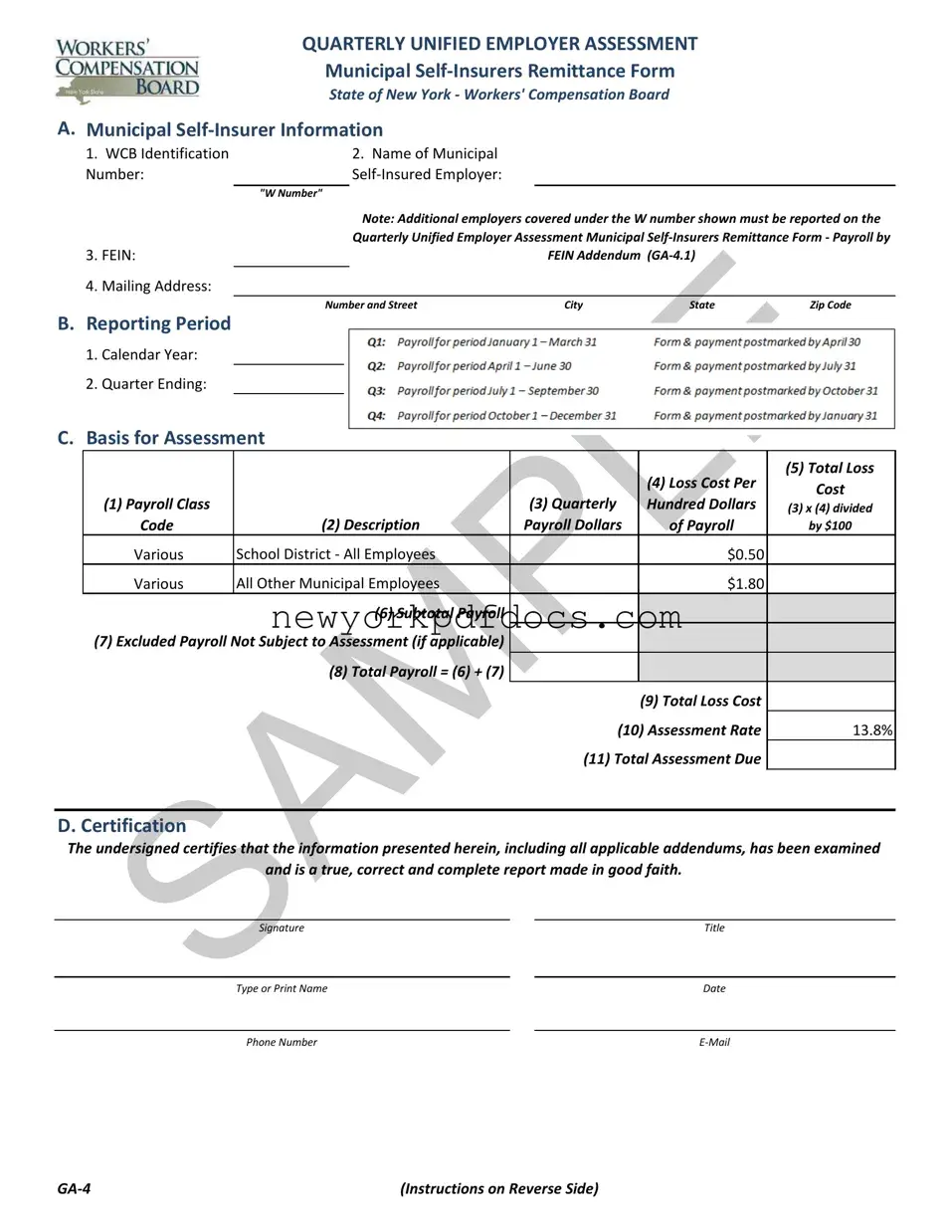

Instructions for Completing Quarterly Unified Employer Assessment

Municipal Self-Insurers Remittance Form

General Instructions

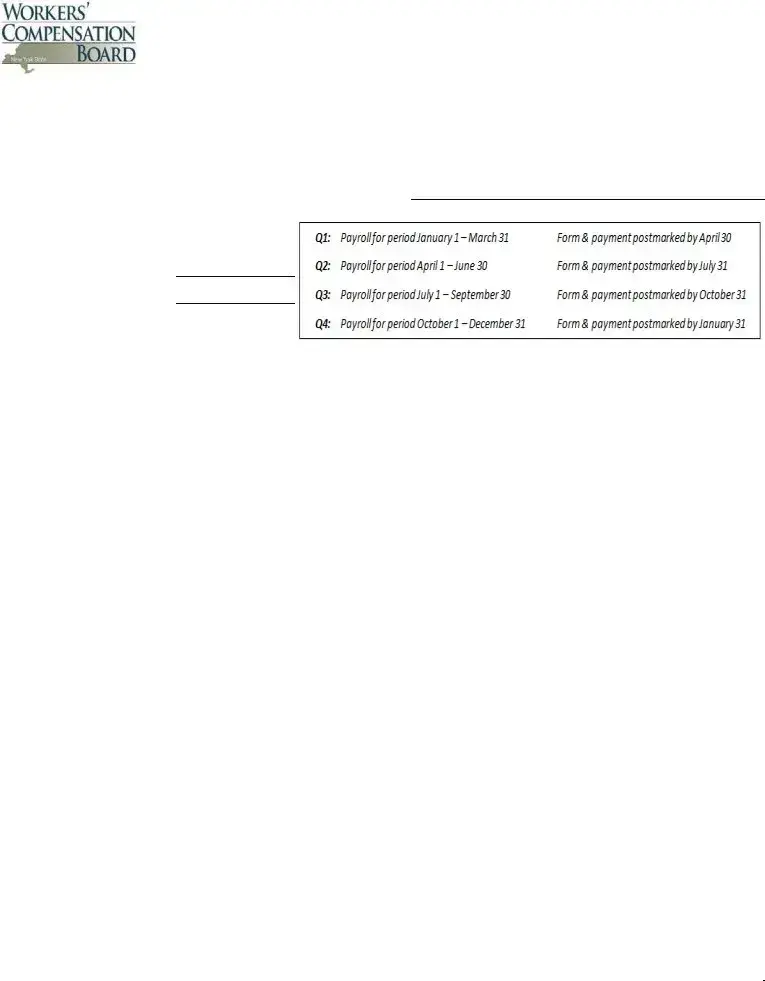

1.The Quarterly Unified Employer Assessment Municipal Self-Insurers Remittance Form (GA-4) must be completed each quarter on a calendar year basis by every active municipal self-insured employer and submitted, with payment, within thirty days of the end of the quarter.

2.Additional municipal employers covered under the W number shown must be reported on the Quarterly Unified Employer Assessment Municipal Self- Insurers Remittance Form - Payroll by FEIN Addendum (GA-4.1) such as those covered under a county plan or municipal group.

3.Questions about the form or process should be directed to WCBFinanceOffice@wcb.ny.gov.

4.Checks are to be made payable to the Chair, NYS Workers' Compensation Board.

5.To ensure the proper application of payment please include W Number and applicable quarter on check.

6.This report and corresponding payment, along with applicable addendum, must be submitted quarterly by every municipal employer actively self- insured for workers' compensation. Employers that discontinued their self-insurance program (i.e., inactive self-insurers) and employers actively or inactively self-insured for disability benefits do not have to submit.

Submit completed form via e-mail to:

WCBFinanceOffice@wcb.ny.gov

and mail check to address below

Or mail completed form and check to:

New York State Workers’ Compensation Board

328 State Street

Finance Unit, Room 331

Schenectady, NY 12305-2318

Municipal Self-Insurer Information

1.The WCB Identification Number or "W Number" as assigned to the municipal self-insurer when approved to self-insure.

2.The Name of the Municipal Self-Insured Employer must be the full legal name of the employer approved to self-insure.

3.The FEIN, or Federal Employer Identification Number, must be reported for the municipal self-insurer. Additional municipal employers covered under the W number shown must be reported on the Quarterly Unified Employer Assessment Municipal Self-Insurers Remittance Form - Payroll by FEIN Addendum (GA-4.1) such as those covered under a county plan or municipal group.

4.The full mailing address of the municipal self-insurer to be used for all correspondence related to the unified assessment must be provided.

Basis for Assessment

1.A blended rate for municipal payroll will be used and there is no need to breakout by class.

2.Payroll must be broken out between employers which are school districts and all other municipal employers.

3.Total quarterly payroll associated with either the school district and/or all other types of municipal self-insurers.

4.The loss cost per hundred dollars of payroll for municipal employers and school districts is set annually by the Chair. The rates are shown on the Quarterly Unified Employer Assessment Municipal Self-Insurers Remittance Form (GA-4) .

5.The total loss cost is determined by multiplying the payroll by the loss cost shown and dividing by $100.

6.Subtotal of payroll reported on the Quarterly Unified Employer Assessment Municipal Self-Insurers Remittance Form (GA-4) .

7.Excluded payroll not subject to assessment.

8.With limited exception, total payroll should agree with that reported on the Quarterly Combined Withholding, Wage Reporting and Unemployment

|

Insurance Return (NYS-45) ; specifically, Part Line 1 Total Remuneration Paid This Quarter. If total quarterly payroll does not agree with NYS-45, |

|

please provide reconciliation. No payroll caps are to be applied. |

9. |

Equal to the sum of all of the loss cost by payroll class shown. |

10. |

The assessment rate for the rating period established by the Chair pursuant to WCL Section 151. This can be found on the WCB's website -- |

|

www.wcb.ny.gov. |

11. |

The total assessment due is equal to the total loss cost multipled by the assessment rate. |

Certification

In accordance with WCL Section 151 the Chair may conduct periodic audits of any self-insurer on any information relevant to the payment or calculation of assessments. If a self-insurer underpays an assessment as a result of inaccurate reporting the self-insurer shall pay the full amount of the underpaid assessment along with interest at the rate of 9% per annum. Further, in the event that it is determined that the payer knew or should have known that the reported information was inaccurate an additional penalty of up to 20% may be imposed. The failure of a self-insurer to timely remit assessment payments and required reports shall constitute good cause for revocation of self-insured status. An employer that knowingly makes a material misrepresentation of information required for the purposes of assessments shall be guilty of a class E felony.