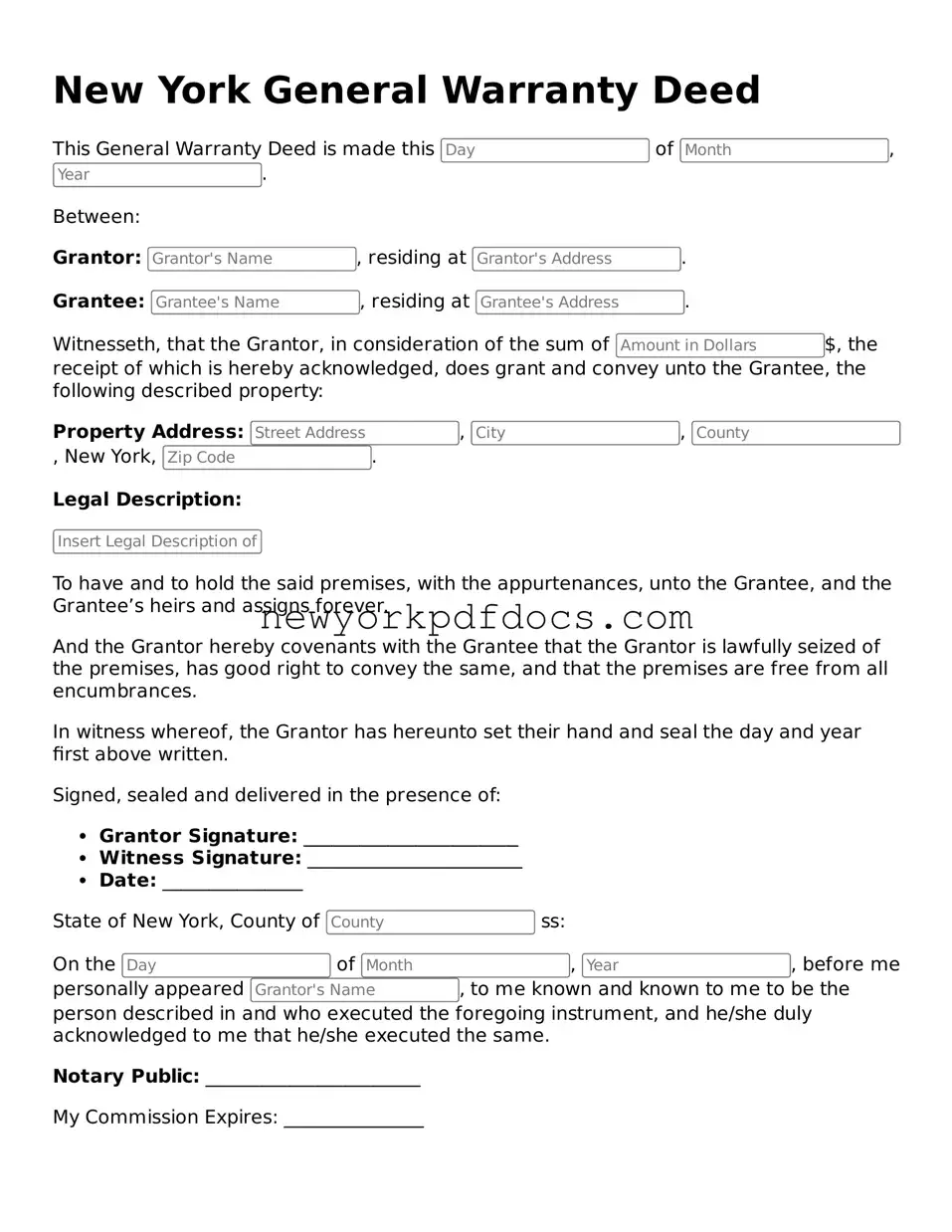

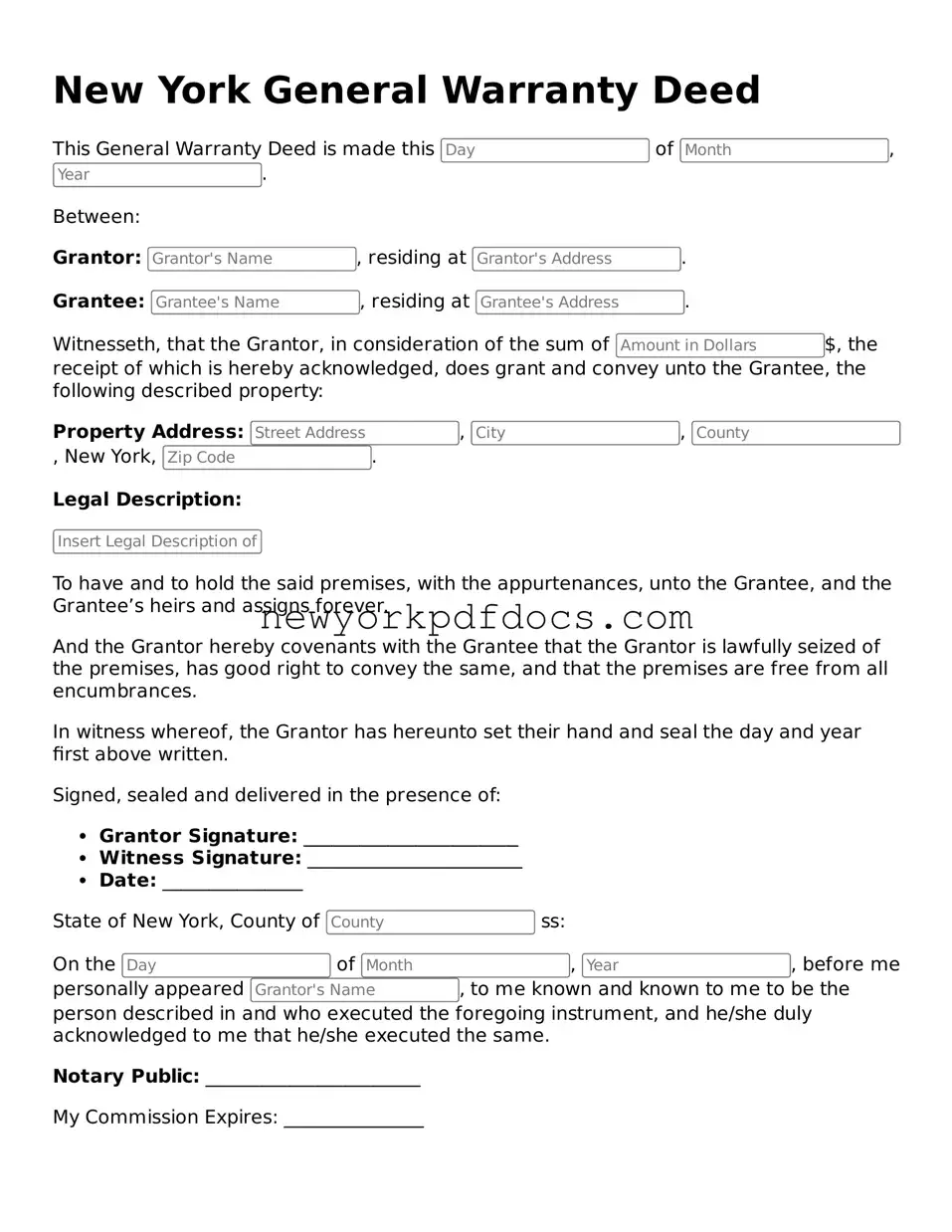

Valid Deed Document for New York

A New York Deed form is a legal document used to transfer ownership of real property from one party to another. This form ensures that the transfer is recorded and recognized by the state, providing a clear record of property ownership. Understanding the specifics of this form is essential for both buyers and sellers to ensure a smooth transaction.

Open My Document Now

Valid Deed Document for New York

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download Deed online with ease.

Open My Document Now

or

⇓ Deed PDF