|

CHAR500 |

Visit: |

www.CharitiesNYS.com |

2019 |

|

|

Need Assistance? |

|

|

Instructions for Completing Your NY Annual Filing |

Call: |

(212) 416-8401 |

Open to Public |

|

Email: Charities.Bureau@ag.ny.gov |

Inspection |

|

www.CharitiesNYS.com |

|

|

|

|

|

|

|

|

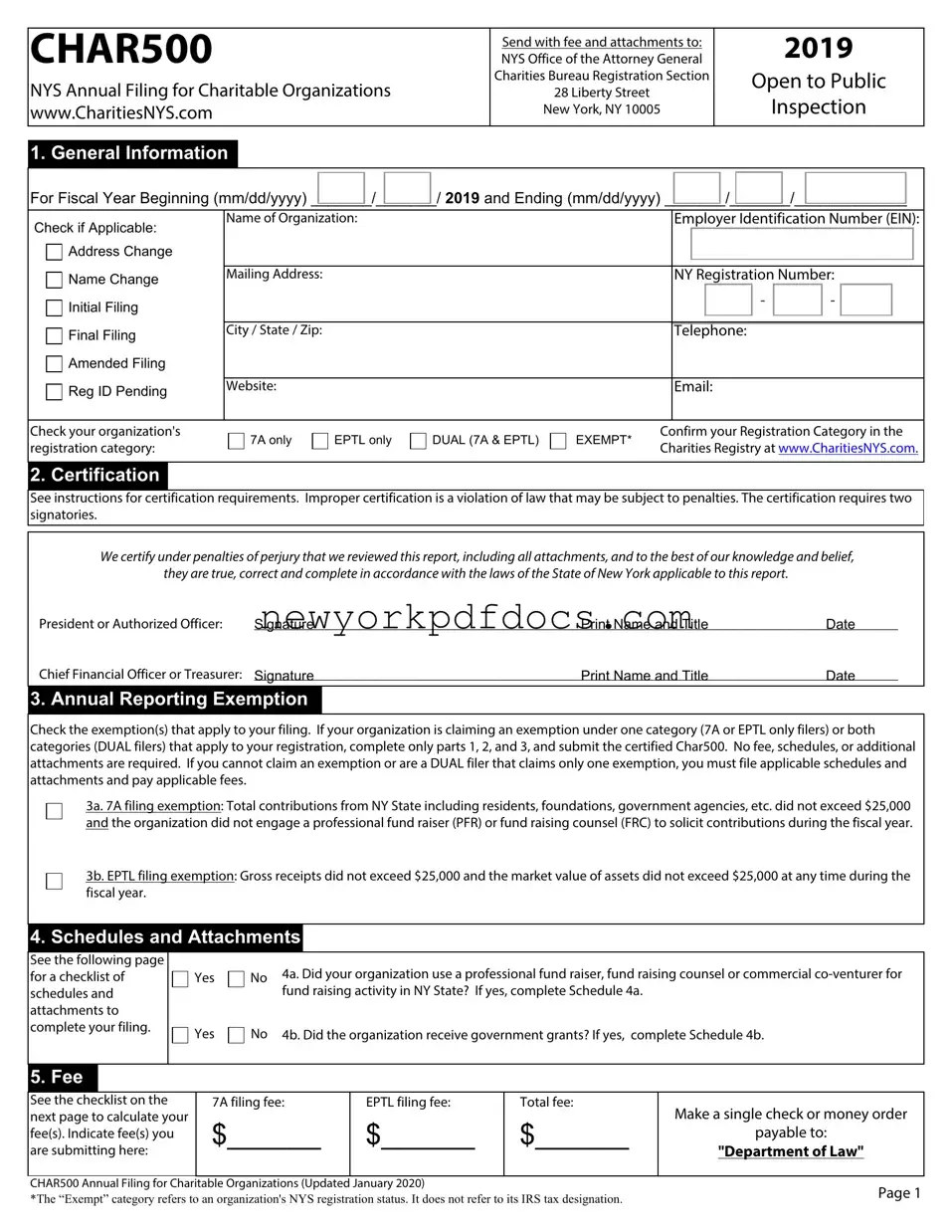

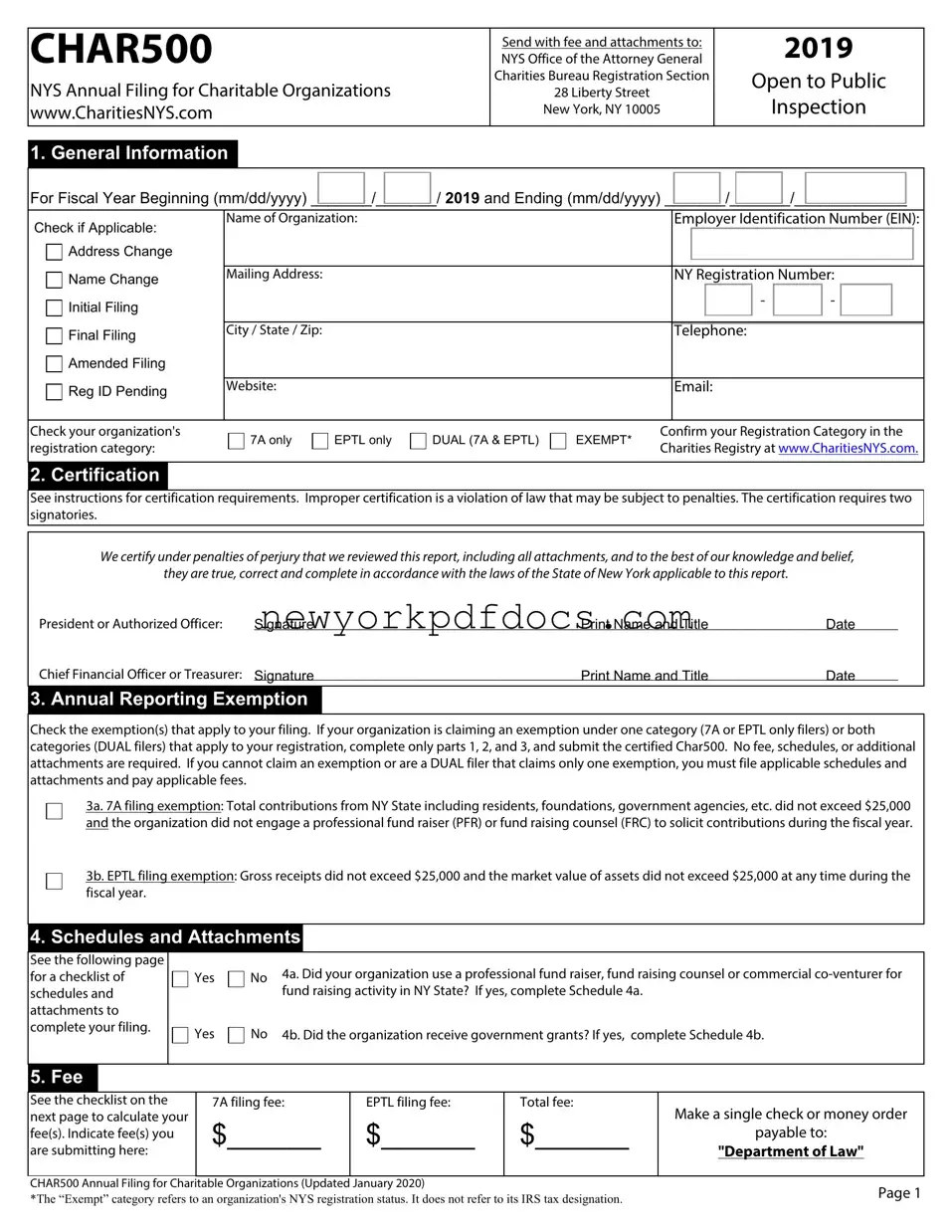

Before You Begin

Visit www.CharitiesNYS.com and search the Charities Registry to find your organization's NY State Registration Number (##-##-##) and Registration Category (7A, EPTL, DUAL, or EXEMPT). Knowing your organization's Registration Category will help you respond to Sections 1 and 3, determine the required attachments to the CHAR500 and calculate your filing fee. If your organization is not registered with the Charities Bureau, please complete CHAR410 "Registration Statement for Charitable Organizations".

1. General Information

Enter the accounting period covered by the report. Provide the best contact information for your organization. This information will be publicly available in the Charities Registry and will be used for communication to your organization. If your organization is registered and this is your regular annual filing, check Initial Filing. If your contact information needs to be updated, check Address Change and/or Name Change. Check Amended Filing if you are making a change to a previous filing. If you have submitted a CHAR410 - Registration Statement for Charitable Organizations - but do not yet have a NY State Registration Number, check NY Reg Pending. If this is a final filing and the organization is seeking dissolution or ceasing operations, check Final Filing and submit all applicable IRS schedules and attachments. If your organization is a NY corporation, visit www.CharitiesNYS.com for information on how to dissolve. Check the Charities Bureau Registration Category of your organization (7A, EPTL, DUAL, or EXEMPT). EXEMPT organizations are those that have registered with the NY Charities Bureau and meet conditions in Schedule E - Registration Exemption for Charitable Organizations - but have registered and file voluntarily.

2. Certification

When you have completed the form, sign and print the name, title and date. For 7A and DUAL filers, the CHAR500 must be signed by both the president or another authorized officer and the chief financial officer or treasurer. These must be different individuals. EPTL filers have the option of a single signature if the certification is by a banking institution or a trustee of a trust. Clearly state the title of the representative (e.g. "President," "CEO", Treasurer," "CFO," "Bank Vice President" or "Trustee").

3. Annual Reporting Exemption

You may claim an exemption from the reporting and fee requirements if you meet the filing exemptions applicable to your organization. If claiming an exemption under one statute (7A and EPTL only filers) or both statutes (DUAL filers) that apply to your registration, complete only parts 1, 2, and 3, and submit the certified Char500. No fee, schedule, or additional attachments are required. Otherwise, file all required schedules and attachments and pay applicable fees.

Note: A 7A or DUAL filer with contributions over $25,000 that did not contract with a professional fund raiser may check the 7A filing exemption in Part 3 if it (i) received all or substantially all of its contributions from a single government agency to which it submitted an annual report similar to that required by Executive Law Article 7A, or (ii) it received an allocation from a federated fund, United Way or incorporated community appeal and contributions from all other sources did not exceed $25,000.

4. Schedules and Attachments

If you do not qualify for the reporting exemptions as described in Part 3, review the checklist of schedules and attachments required to complete your filing. If your organization qualified for and submitted an IRS 990-N "e-Postcard", you must complete and submit an IRS Form 990-EZ to the NY Charities Bureau for reporting purposes. The NY Charities Bureau will not accept an IRS 990-N "e-postcard" because it does not contain sufficient financial information.

5. Fee

Your total fee is based on your registration category (7A, EPTL or DUAL). 7A or EPTL filers only pay the fee that applies to the statute under which they have registered unless they have claimed an exemption in Part 3. DUAL filers must pay both fees, unless they have claimed an exemption in Part 3. Consult the CHAR500 to calculate your fee or contact the NY Charities Bureau if you have additional questions.

When to Submit Your Filing

7A and DUAL filers: postmarked within 4 1/2 months after the organization's accounting period ends. For example, fiscal year end December 31 reports

are due by May 15th of the following year. EPTL filers: postmarked within 6 months after the organization's accounting period ends. An additional 180 day extension is automatically granted. Information regarding extensions is available at www.CharitiesNYS.com.

Where to Submit Your Filing

Payment must be made to the "Department of Law". Send the complete filing with payment to:

NYS Office of the Attorney General, Charities Bureau Registration Section, 28 Liberty Street, New York, NY 10005.

Penalties

The Attorney General may cancel the registration of or seek civil penalties from an organization that fails to comply with the filing requirements.

Address Change

Address Change

Name Change

Name Change

Initial Filing

Initial Filing

Final Filing

Final Filing

Amended Filing

Amended Filing

Reg ID Pending

Reg ID Pending