Filling out the Access NY Supplement A form can be a complex process, and many individuals make mistakes that can delay their application or lead to denial of benefits. One common mistake is failing to provide accurate personal information. Applicants must ensure that their name, address, and contact information are correct. Inaccuracies can lead to confusion and miscommunication, which may hinder the processing of the application.

Another frequent error is incomplete income reporting. It is essential to report all sources of income, including wages, benefits, and any other financial support. Omitting income can result in an inaccurate assessment of eligibility, potentially disqualifying the applicant from receiving assistance. Additionally, applicants should be aware of the specific income limits applicable to their situation.

Many individuals also struggle with not understanding the documentation requirements. The form often requires supporting documents to verify income, residency, and other factors. Failing to include necessary documentation can lead to delays in processing or outright denial of the application. It is advisable to carefully review the checklist provided with the form and ensure all required documents are included.

Another mistake is not signing the application. A signature is a critical part of the application process, as it certifies that the information provided is true and complete. Without a signature, the application may be considered invalid and could be returned to the applicant for correction.

Furthermore, applicants sometimes overlook the importance of reviewing their application before submission. Taking the time to double-check for errors or omissions can save significant time and effort later. A thorough review can help catch mistakes that might otherwise lead to complications in the application process.

Lastly, not seeking assistance when needed is a mistake that many make. The application process can be daunting, and individuals should not hesitate to reach out for help. Whether it’s contacting a local assistance office or seeking guidance from a trusted friend or family member, support can make the process smoother and increase the likelihood of a successful application.

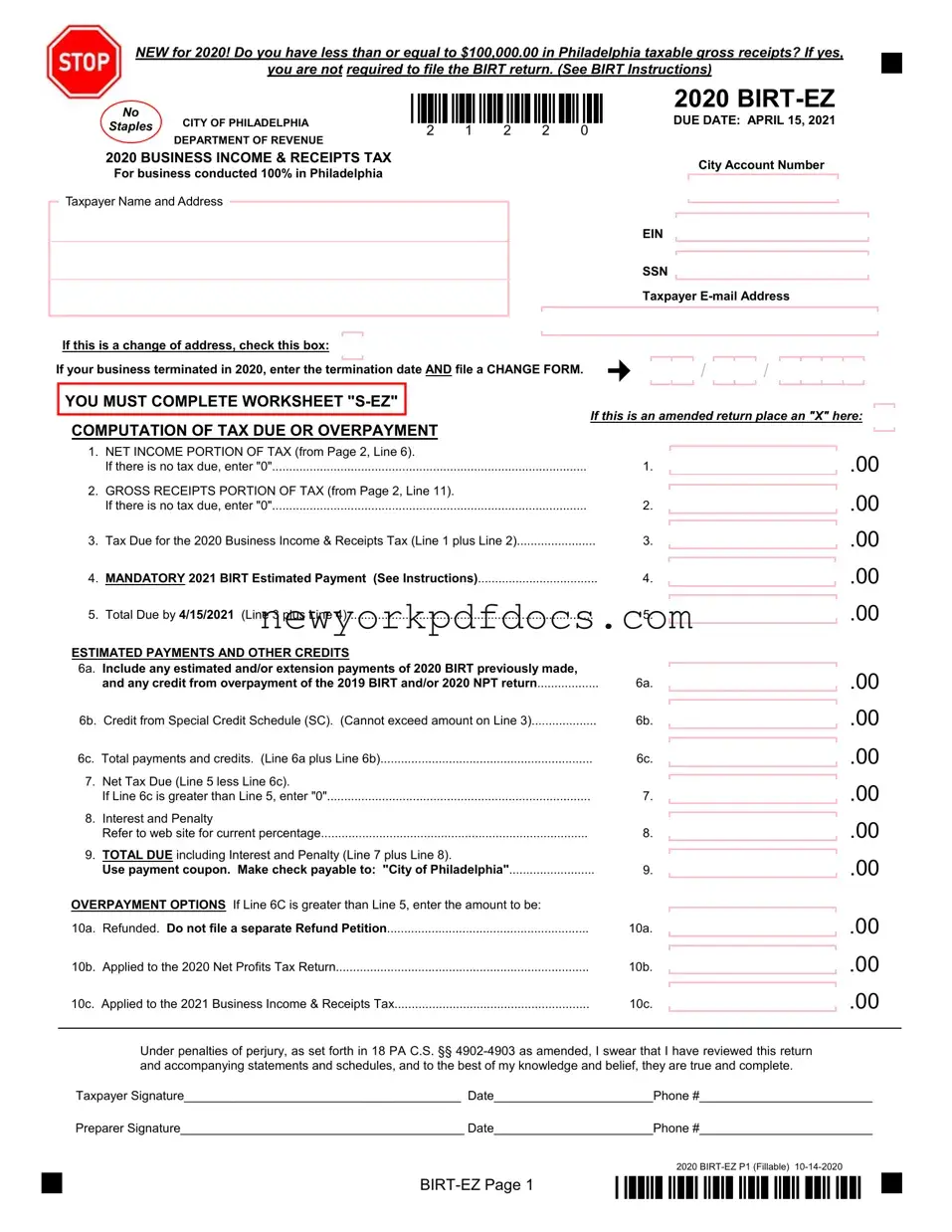

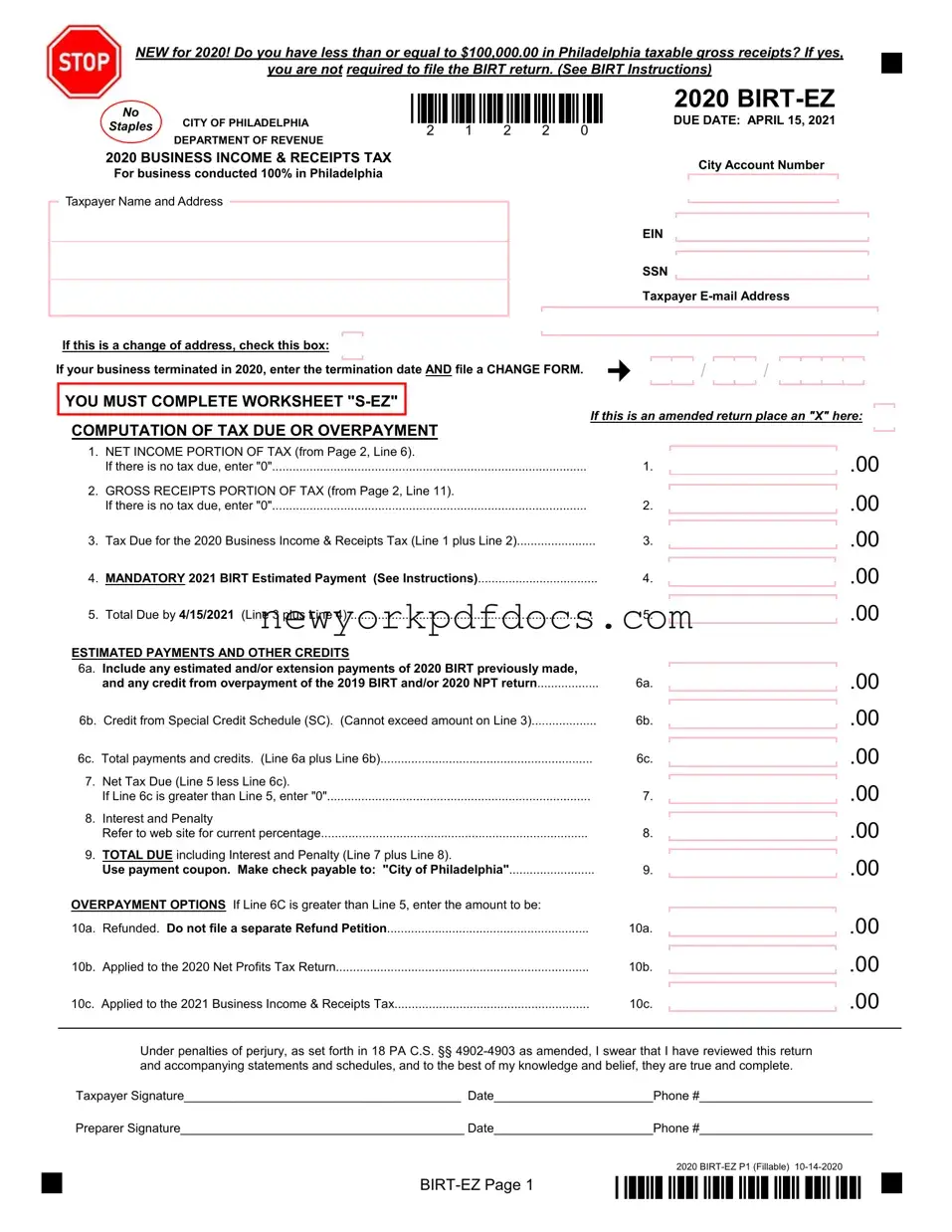

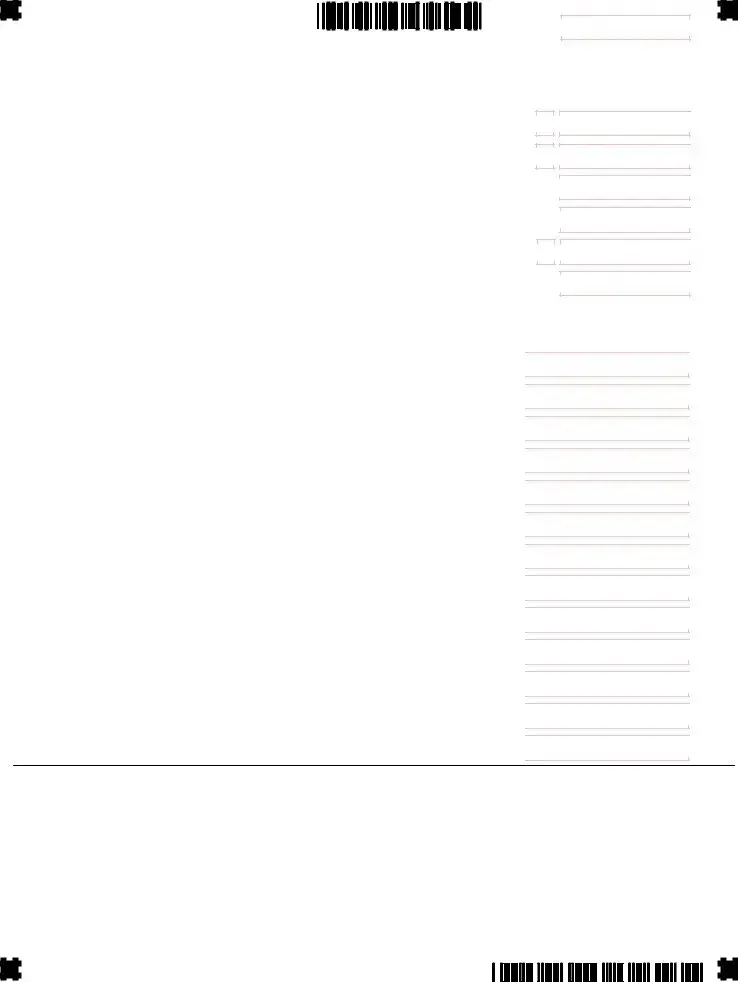

Taxpayer

Taxpayer

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00 .00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00 .00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

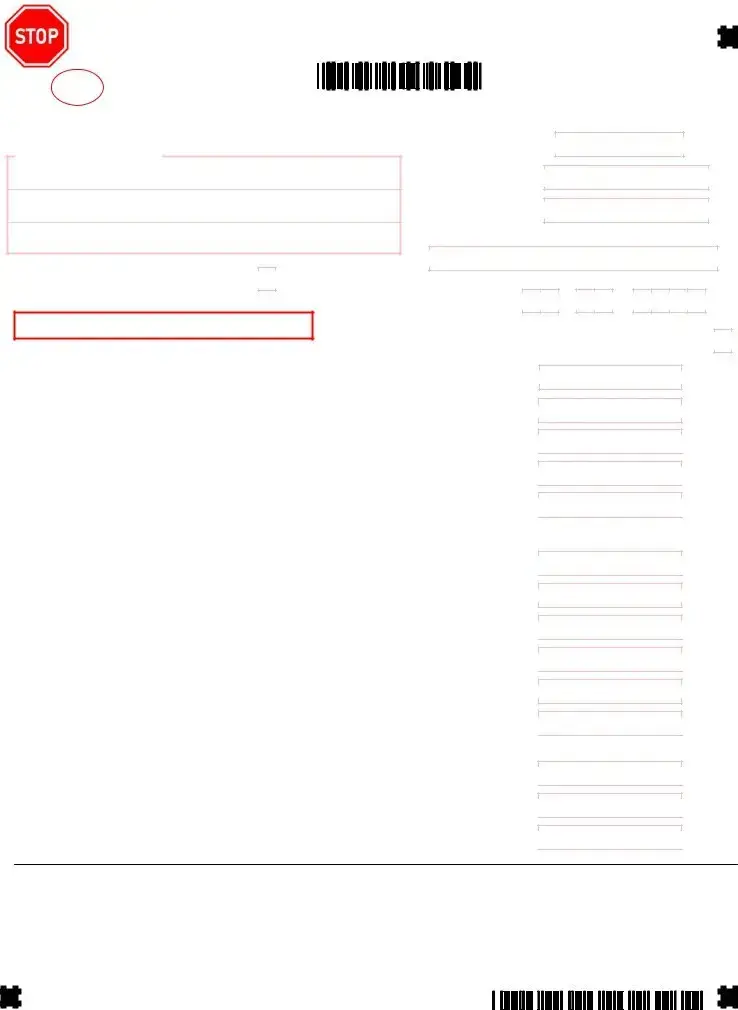

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00

.00