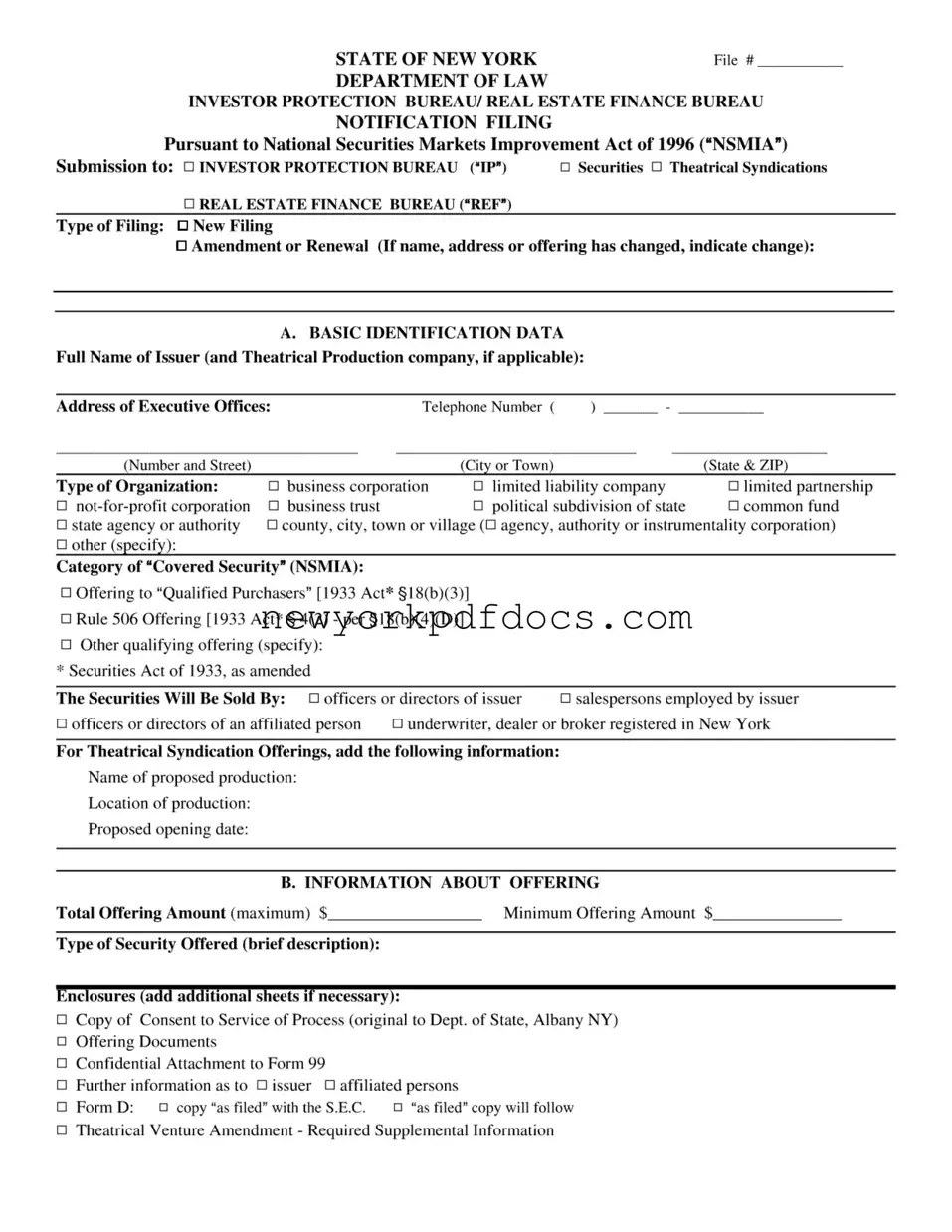

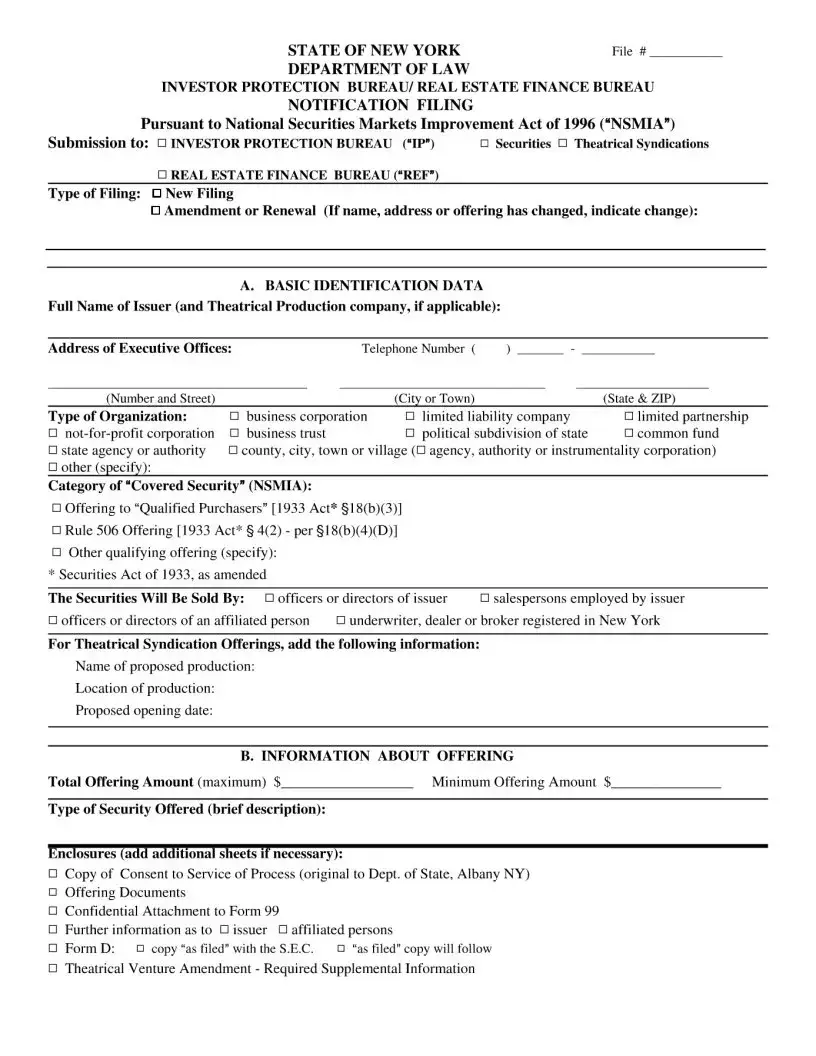

Free 99 Ny Form

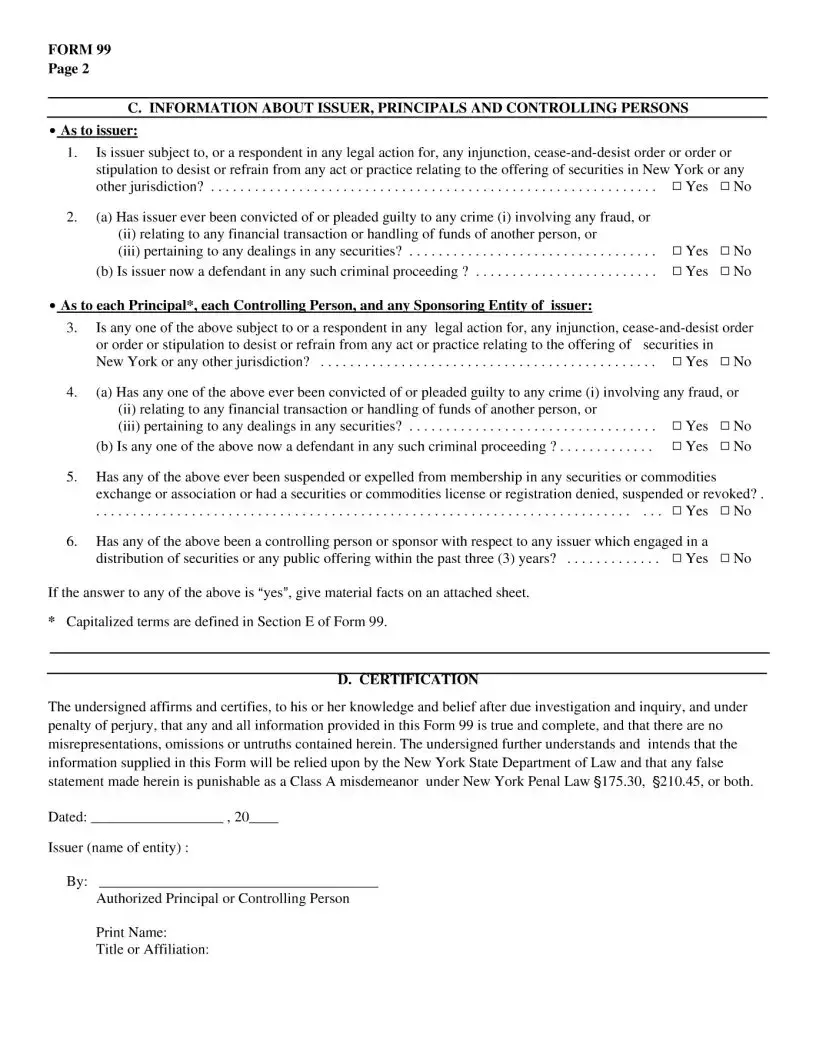

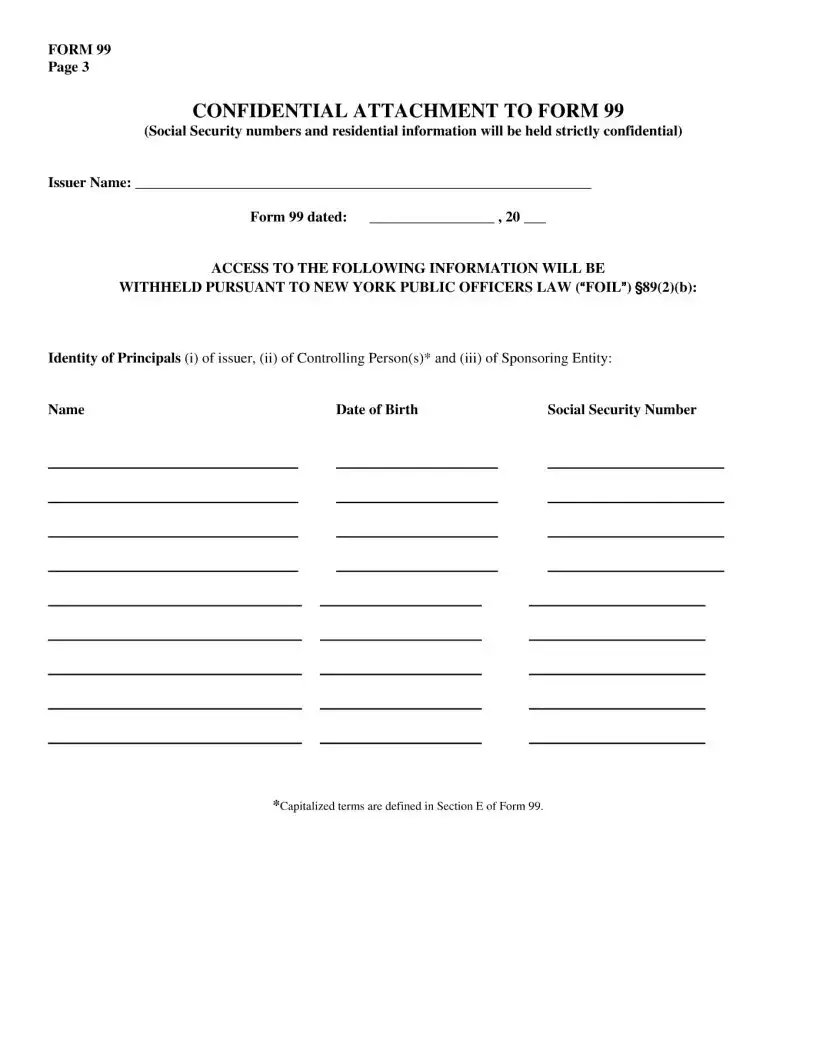

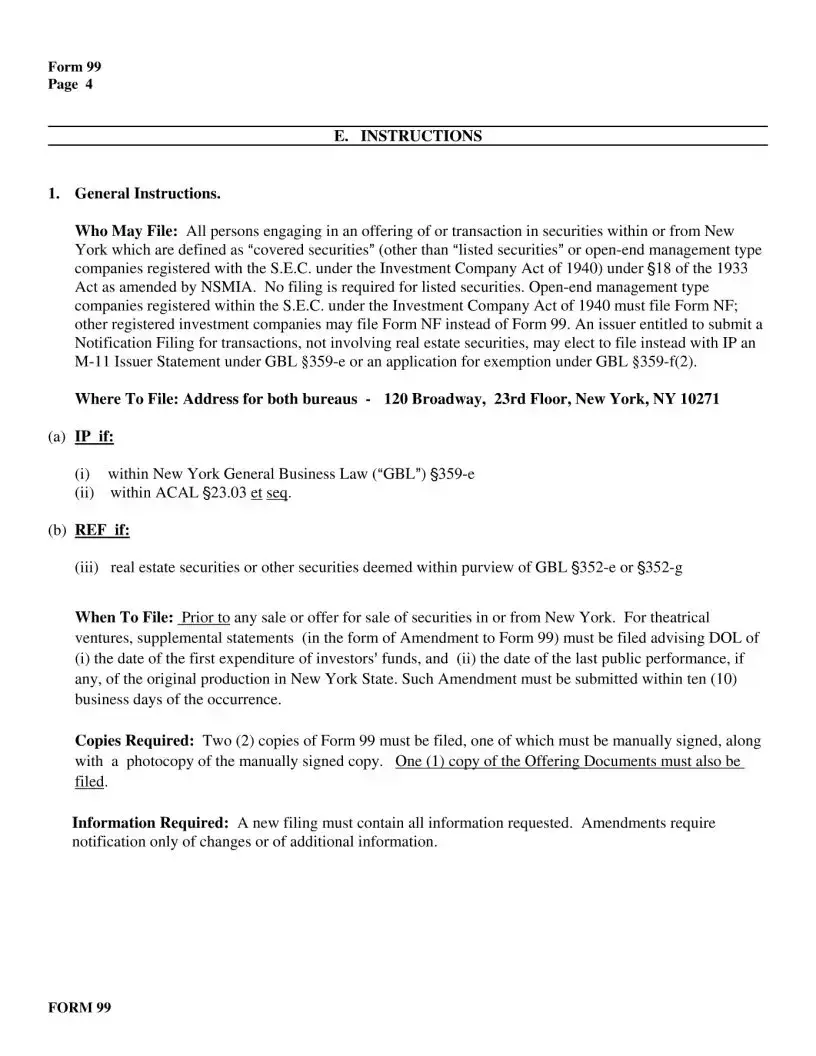

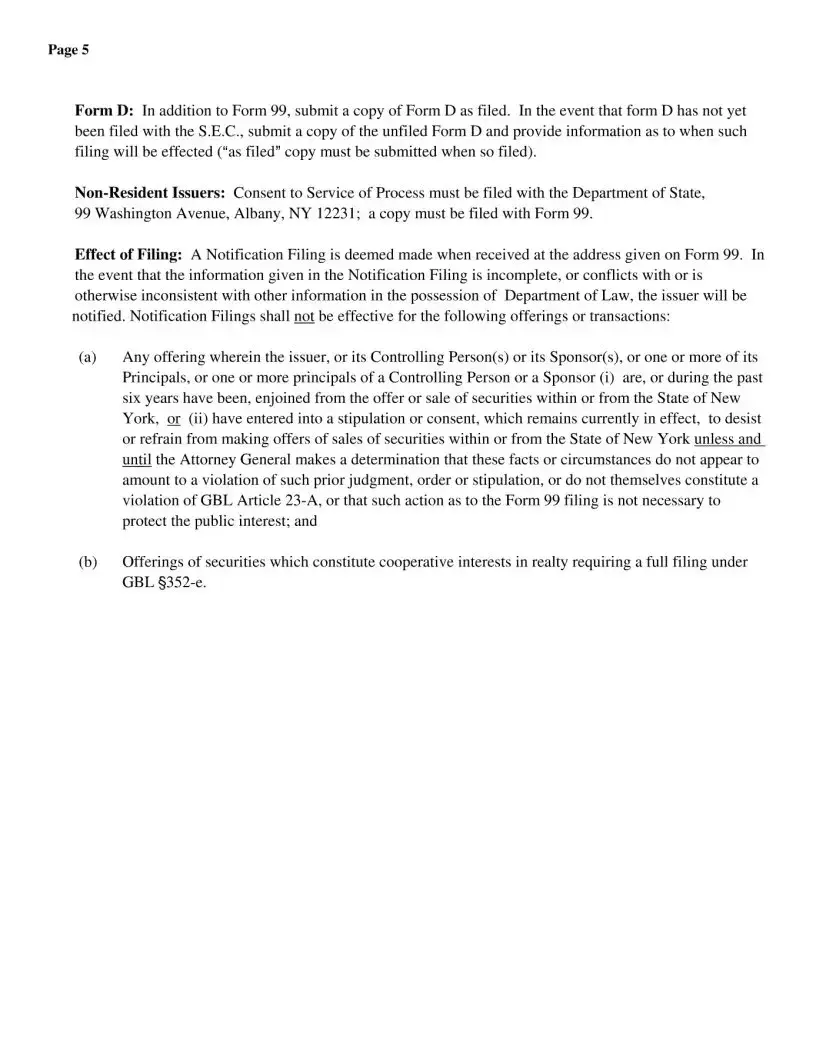

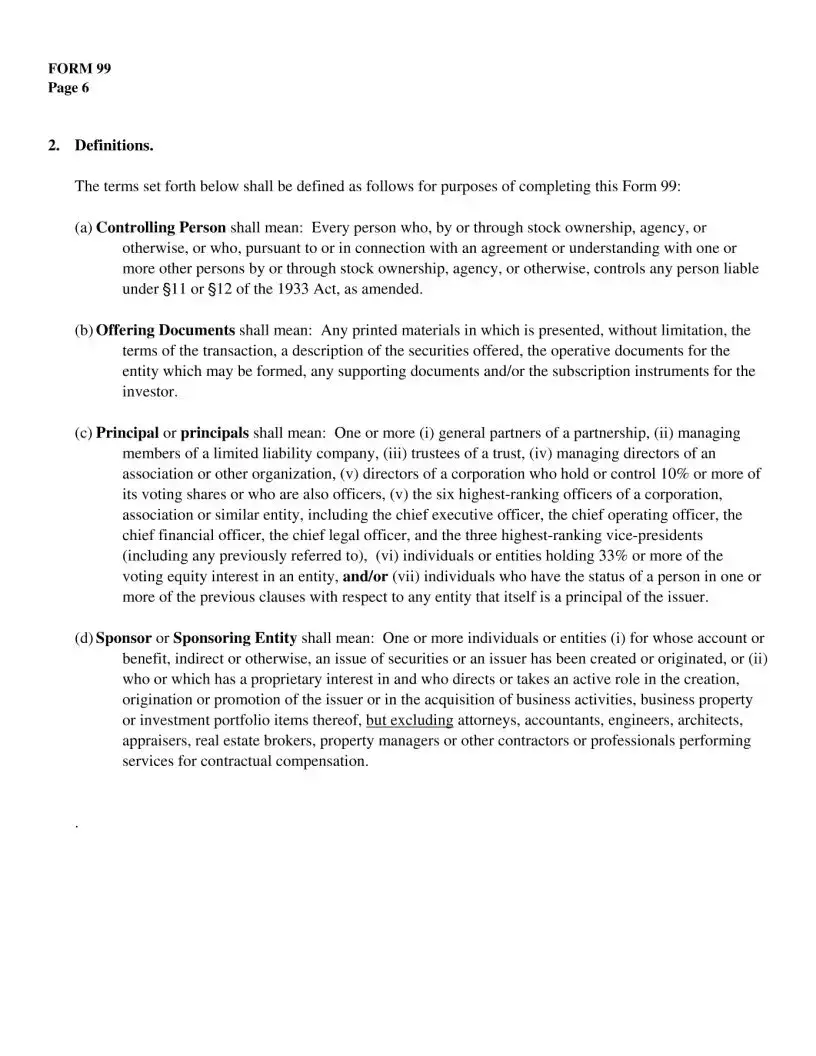

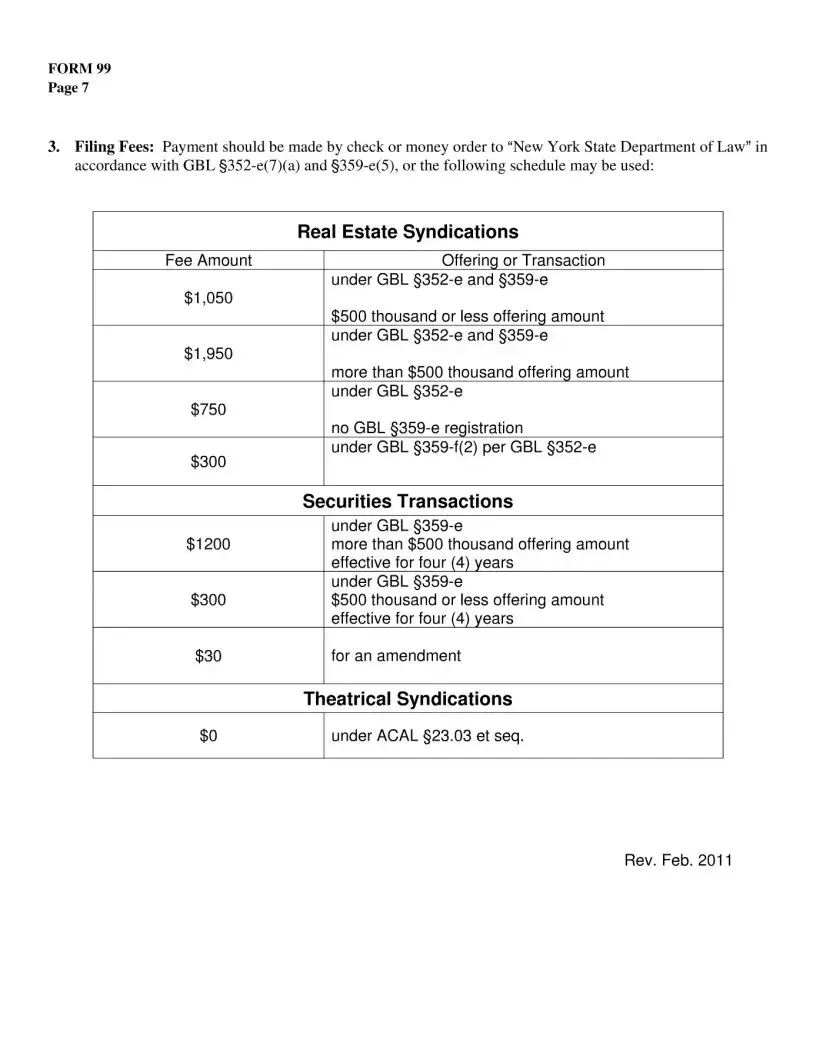

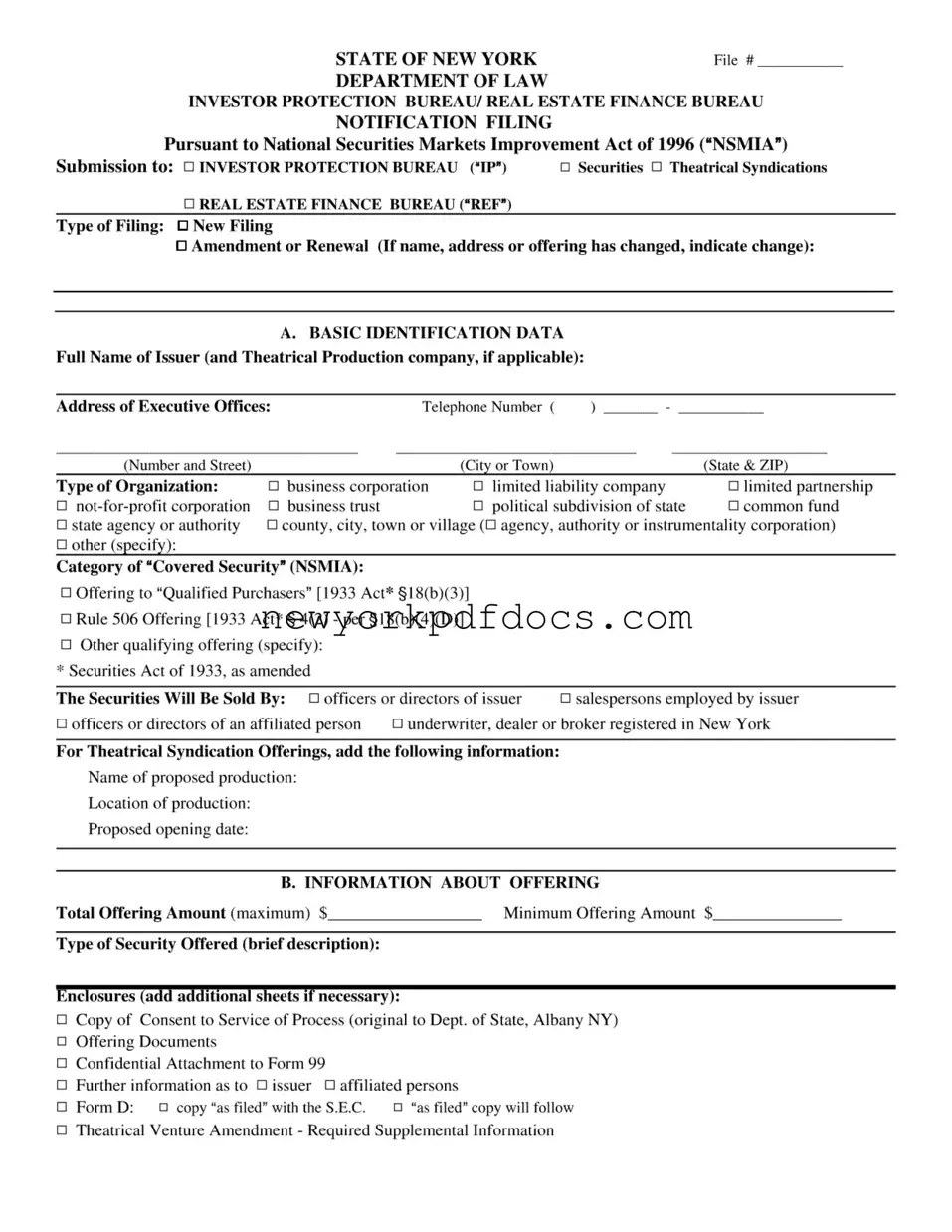

The 99 NY form is a notification filing required by the New York Department of Law for entities looking to offer securities, particularly in the realm of real estate finance and theatrical syndications. This form helps ensure compliance with the National Securities Markets Improvement Act of 1996, providing essential information about the issuer and the offering. Completing this form accurately is crucial for maintaining transparency and protecting investors in New York.

Open My Document Now

Free 99 Ny Form

Open My Document Now

Your form isn’t finalized yet

Edit, save, and download 99 Ny online with ease.

Open My Document Now

or

⇓ 99 Ny PDF